I was drawing up some scenarios using the American Express Gift Card + Cashback from either TopCashBack or BigCrumbs for a minimum of 2% back and the more steps added, the less profit margin there is.

The thought applied to this is part of the broader bill pay in Manhattan to keep the costs down discussed here and here

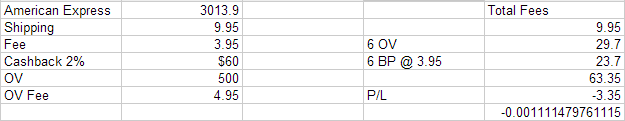

Assuming this works (haven’t tested it yet) here is the scenario: Buy AMEX gift card with Cashback, buy OneVanillas, and use with PIN at the bill pay locations.

If the above scenario works, then you would be manufactured spending a $.0011/point, which is phenomenal considering the amount of fees and each time a transaction occurs. As you can see, because of the small cost per point, anything over 2% with the American Express gift card you would profit.

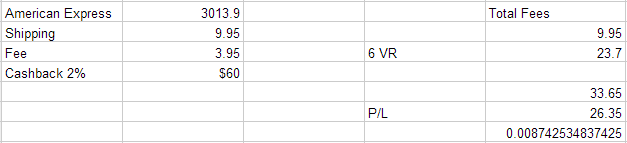

When there are less transactions and fees, there is profit to be made: Buy AMEX gift card with Cashback and buy Vanilla Reload.

In fact, you will be profiting $.0087/point that you generate. Notice, less transactions means less fees and less work.

How far do you go to manufacture spend? I like to pick the low hanging fruit when I can, like Amazon Payments (when I was able to use it), then go greater lengths to MS like gift card churning because these are the avenues that take longer before a deal gets shut down.

The only problem comes when trying to cash out the Amex to Visa/MC gcs – if you haven’t trained your local gc suppliers that you are “legit” and they accept you telling them the last 4 digits, you could run into the ubiquitous “you can’t use gc to buy gc” denial.

I suggest this is an intermediate technique for established MSers on good terms with local suppliers. If you’re a beginner, or an infrequent MSer, probably not a route I’d choose.

Id offer a better approach yet takes longer (but less time commitment) would be to go thru TCB or better yet the Barclay portal. Then withthe AMEX GCs you can go back thru TCB for .5% and buy Visa GCs from GiftCardMall. Your value from the first transaction partially subsidizes the second but for Barclay for example, youre getting 6.6% back.

Of course then you can liquidate the GCs as you see fit.

Thanks Trevor, I like it!

The ultimate would be to bribe an IT worker at Office Depot to reprogram the computers to let us buy VR with a Chase Ink card. I would not go that far, but I can dream that far.

That would be pretty awesome!

As FM highlighted a while back, you need to factor in opportunity cost. Re-do the math assuming you went thru the highest cash back portal and used the highest cash back card. Currently that would be the Arrival mall (4x) and Arrival card (2x) which translates to 6.67% cash back assuming you cash out via refundable travel. However, that takes some extra effort to cash out so haircut it to 6%. Now manufacture spend using whatever portal you want and whatever card you want. Your true cost of the manufacture the points is the differential. It’s actually much more expensive than you portray above. For example, if you used the Alaska portal (3x) and Alaska card (1x) you would net 4x Alaska miles instead of 6% cash back, so you are paying 6% / 4x = 1.33 cents for the Alaska miles in opportunity cost. If you used the Alaksa portal (3x) and Arrival card you are paying 4% / 3x = 1.48 cents for the Alaska miles in opportunity cost. If you used the Arrival portal and a 1x card you would be paying 2% / 1x = 2 cents for the 1x points. If you used a 2% cash back portal instead of Arrival you would be paying even more! 😉

Oops, typo for the 1.48. Should have been 4% / 3x = 1.33. This is roughly where I account for the cost of miles for personal use. A little lower for some currencies, a little higher for others. But nowhere near the 2 cent valuations or conversely fraction of a cent values that don’t adequately reflect opportunity cost in the acquisition.

Thanks for the feedback! I definitely need to put more thought when compiling the math the opportunity costs for the real costs. That part of the equation is tough for me to calculate I’ll have to incorporate them into the posts

and 1 more thing in the equation…

when you cash out the arrival for travel, you will be earning airline or hotel point/miles and status. a couple of arrival funded high return intl mileage runs/year (for me, a MR is different in that it’s somewhere i’m going anyway, but paying vs award travel to take advantage of a great deal) and you’ll have mid tier status

i wish i could get the arrival card but my fico in only 670, so no way (tip: don’t leave the country for 2 years without someone reliable checking your mail. bad things can happen and your hard earned 820 fico can get slaughtered and unrecoverable). 🙁

Ouch! If you book that much flights, have you considered the US Bank Flexperks? Your points could be worth up to $.02 and if you exclusively buy in the double points category you could earn 4% back or if you do Kiva loans then that’s 3x and then it’ll become a 6% card.