A couple of weeks ago a representative from Plastiq reached out to me about the service and see if I would be interested in blogging about it. The timing was good as I haven’t MS’d in a very long time as I have had my head down reselling. The closest to manufactured spending that I have done would be purchasing inventory using my personal credit cards and using expense reports with Expensify to pay myself back. One of the things that I’ve done with the reselling business is to create systems and processes. In the event of selling the business, I could give a week’s session to the new owner and have a successful exit.

What Makes Plastiq Interesting

Some readers may know that I previously worked in New York City, then about 3 years ago started a new job in New Jersey. What many readers didn’t know last year around this time, I was laid off. It was the best thing for the company and myself. I couldn’t have been more pleased. I recently started working in NYC again with the commute eating up most of my free time. The office location is near the Holland Tunnel which is a little bit of a desert. With all that said, there’s little to no chance I would be doing any kind of manufactured spending.

Having a direct connection with someone at Plastiq I was able to ask various questions that others might not cover because it’s not something they would ask.

Working Capital

I’ve talked about working capital a few times and the premise is leverage. Use other people’s money for as long as you can. The best part about Plastiq is putting charges that you couldn’t on a credit card. I had a vendor where I negotiated two third’s payment up front then the last third net 30 after delivery. Had I signed up for Plastiq, I would have been able to extend the final payment into almost 60 days before the payment would have been due. Plus, the 2.5% is a business expense that could be written off.

Advanced Techniques With Plastiq

For the reselling, my primary bank is Bank of America and they have the biggest crock of crap for a Bank of America to Bank of America account charging $30. How ridiculous is that?

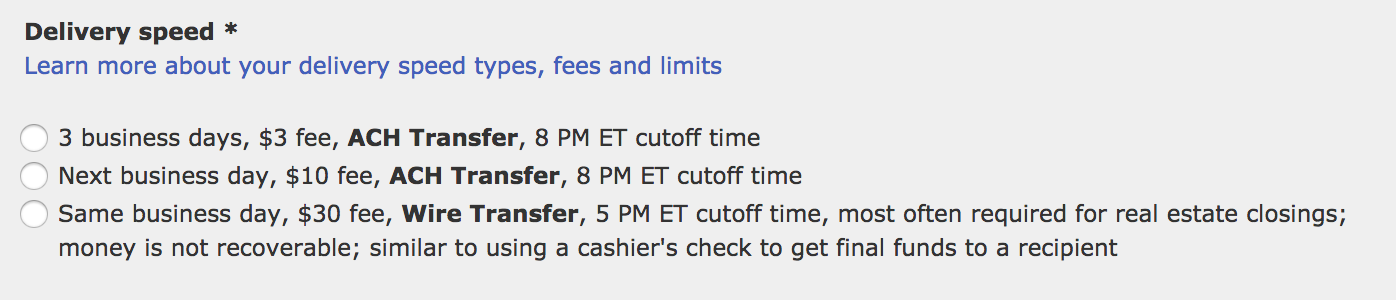

A regular ACH is $3 or $10.

Plastiq’s ACH takes 2 to 3 business days if ACH. This still goes along with working capital If a vendor offered something like 1%/10 net 30. Generally, if you pay within 10 business days of invoice you would save 1% , but you have to use cash. Using Plastiq, yes, a fee applies, but you could leverage the 1% discount.

More Advanced Techniques With Plastiq

Granted, this is only applies to a smaller subset of readers. Many of the bloggers talk about paying bills and mortgages with Plastiq, here is something that I haven’t seen covered.

When managing procurement, remember that everything is negotiable. You can do all kinds of fancy things like asking your vendor in California what the price is FOB and you find a 3PL nearby using their free shipping. There’s many things that you can try, but one of the things that makes Plastiq very unique for someone who resells is to negotiate the price as low as you can. Think of it like negotiating a car and then you spring it on the dealer that you have a trade in. In the negotiations you want everything taken out, especially if the supplier takes credit card. The 2.5% fee that Plastiq charges is better than the 3.5% that many businesses charge. Worse, you show your cards to the supplier that you want to pay with a credit card, they’ll bake the price with the credit card fee and would probably be more than the 2.5% from Plastiq.

Drawback of Plastiq

International payments of Plastiq are only in US dollars. If you had a vendor that would only accept their local currency, you wouldn’t be able to use Plastiq. I wouldn’t mind seeing Plastiq one day add local currency and charge the credit card in the local currency. Then we could avoid the foreign transaction fees and get a more favorable local currency foreign exchange rate.

Wrapping Up

If you haven’t signed up for Plastiq, you need to think if it works out for you. The 2.5% fee will add up. For every $10000 charged, that would be $250 extra spent. Would you be able to redeem the points worth more than $250 cash?

If you signed up for Plastiq using my referral code at signup, I earn 1,000 fee free dollars (FFD) when you make payments totaling $500. You would also receive 500 FFDs for having made $500 in payments.

Wonderful post, thank you for piquing my interest in other ways to use Plastiq (and expensify for that matter).

Pay any bill by credit card with Plastiq. Use my referral code & pay $500 worth of bills to get 500 fee-free dollars:

Great way to meet minimum spend requirement on credit cards by paying the rent or the mortgage.

You would get $500 Fee Free Dollars after minimum $500 spend of paying your bills.

Click here to sign up

https://try.plastiq.com/1133005

What are fee free dollars?

I’ve been thinking of doing this tor car payment, what’s the $500 fee free dollars?