The general rule of thumb when submitting an app-o-rama, applying for multiple cards at one time, is to not apply with the same issuing bank because it would increase your chance of denial. I would have to agree as this recently happened to me for Barclay’s UPromise card.

However, I believe that you could apply for both a personal Bank of America card and business credit card and be approved on the same day.

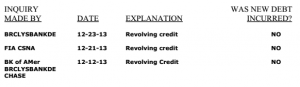

Below is a screenshot of a recent credit inquiry report for a refinance that I am taking part of.

Notice “BK of AMer” was for the Alaska Airlines personal card and then I applied for the Alaska Business which is the “FIA CSNA” line. While both accounts are serviced by Bank of America, the inquires are made by different business units.

This report was run in January and appears to extend only for the last six months because I had applied for a few cards in July and did not show up in the report.

Does that mean other banks like Chase, Citi, or even Barclay’s would be the same? It’s possible, but at least with Bank of America you can clearly see the differences and that is why I believe you could be approved for a business card and personal card within the same app-o-rama.

FIA is legacy MBNA and apparently those systems still aren’t integrated. So maybe it’s apply for one BAC card and one FIA card? Though it’s puzzling as to why the biz card is FIA, maybe BAC does all biz cards on that platform?

It surprised me too when I saw the credit report and why it wasn’t all BAC.

You’re correct that FIA Card Services handles all BoA business cards. I called that recon number once by accident and they couldn’t even pull up my personal app.

“The general rule of thumb when submitting an app-o-rama, applying for multiple cards at one time, is to not apply with the same issuing bank because it would increase your chance of denial.”

I would have to disagree. Unless you’re applying for Barclays or Citi, you can usually get at least 2-3 cards. With Bofa the sky’s the limit (as long as it’s done same second), amex I’ve been approved 3 at a time, while my friend has gotten 6 last month, and Dan has gotten 12.

Chase has gotten harder, yet it’s usually much easier to get 2 than 3-4.

Agreed. The whole point of app-o-ramas is to get 2-3 cards from one bank for only 1 hard pull while “hiding” these pulls from other banks.

Agree with yuneeq there is no requirement not to apply for more than one card from more than one issuer. Sometimes from a practical perspective it can make sense to only do 1 per issuer if you are applying for like 8 or 9 different issuers, but I have had plenty of app-o-ramas with many cards from the same bank. The only exception now is Citi with it’s “rules” though those “rules” change all the time

As a churner, it rarely if ever makes sense to apply for 8-9 issuers at a time. You’re looking at 8-9 credit pulls at the minimum and more likely getting 2-3 from some of them. Try applying for more cards after 3 months with that many pulls, it’ll be pretty damn hard to get approved, not to mention the short term hit your credit takes.

However, when doing 2/3/4 cards at a time from each bank, and limiting it to 2-3 banks, you can do AORs every 3 months with much greater chance of approval.

In conclusion, unless you invest serious time and money into B*, it dies not usually make sense to apply from more than a few issuers.

Thanks MA and yuneeq for the feedback, I have not churned that many cards before – don’t really plan on doing it. Although, I’ve now amassed around 13 active cards for all the bonus categories and different avenues to MS.

When I applied on my husband’s behalf for a B of A Alaska Air personal credit card, he got approved immediately, and up popped an invitation to apply right then for a Bus card. I had not planned to, but did, and it was sent for review. I did nothing more and a few days after he got that one too.

The only thing I would add is that I hate the B of A online website. I also have gotten awful assistance from them whenever I call – technical assistance, I mean. Setting up autopay was a huge pain. I see that as a huge drawback to dealing with that bank, enough that I will factor it in when choosing cards for future aors.

Agreed, their website isn’t that great. I don’t like how I can’t see what the balance is to the credit card at the same time when trying to pay the card. Not quite intuitive

The old rule of them we have used for years is one personal and one business card per issuer every 91 days. Still works except Barclays. You may need to call on the second card with each issuer but should be OK

Do them all the same day to decrease the chance your inquiries will show with the other card issuers