I made a public service announcement about in branch offers being better than online on Twitter, and many folks don’t seem to fully grasp that fact. Yes, I love doing things online and at home just like many people, but you need to go to the branch and speak to a banker to see what’s available. Despite some of the news you may see online, like Chase laying off 5,000 people from the branches, which targets mostly tellers as ATMs are now so sophisticated it does many of the functions the tellers do like dispensing change! Speaking of Chase, last time I mentioned the in branch offers, it was for the National Small Business week where Chase was upping the bonus AND waiving the annual fee if you signed up.

This time, we are looking at Bank of America and you must apply in branch.

The Offer:

Let’s start with the crappy offer.

The online offer says if you open either of the two small business checking accounts above and you will receive $100. Not very interesting.

In Branch

If you visit your local branch and speak with the Small Business Banker they will tell you about this amazing offer that’s up to 20 times higher than the online offer. Below with their emphasis

Here’s how

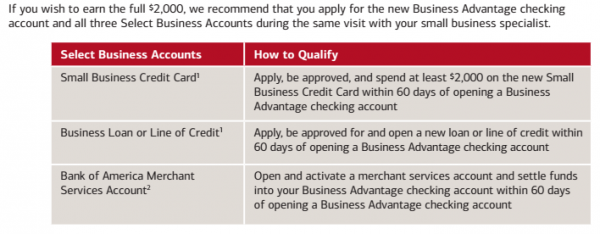

- Open a Business Advantage checking account by 10/30/2015 AND be approved for one of the following Select Business Accounts listed below within 60 days of opening the Business Advantage checking account to earn $1,000, provided you meet the related qualifier as defined below.

- For each additional Select Business Account you are approved for within 60 days of opening a Business Advantage checking account, you will earn an additional $500, provided you meet the related qualifier(s) as defined below.

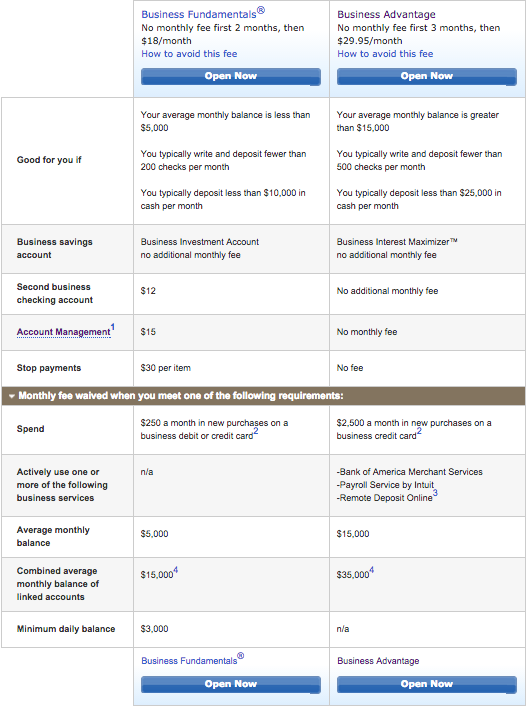

The “problem” is you must open a Business Advantage account. I use “problem” loosely as you will see why it’s really not an issue. There’s a monthly minimum balance if that was a route you were planning to take to avoid the monthly service fee.

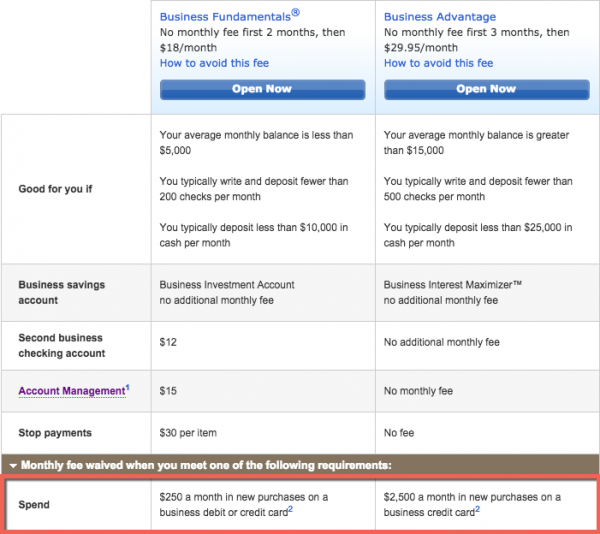

But that’s OK! Because Bank of America has a very unique way to build relationship banking, you can spend your way to waive the fee.

Yes, that’s right, it ties into the bonus very well, spend $2500/month on your credit card and all the checking account fees will be waived. Add in the this checking account type with the Business Preferred credit card, you will now receive a free credit card and a free checking account and $100 a year.

You are already reading this blog, so you will know how to manufacture spend and $2500/month should be easy peasy.

Here are additional terms and conditions, emphasis theirs again:

Eligibility: Offer only available to customers who receive this offer via a direct communication from a Bank of America small business specialist. New Business Advantage checking account must be opened by 10/30/2015, and the qualifiers of all Select Business Accounts selected must be met within 60 days of opening your Business Advantage checking account. Bank of America may change or terminate this offer before this date without notice. To be eligible for this limited-time offer, you must not currently have a business checking account with Bank of America. You are not eligible for this offer if you were a signer on or owner of a business checking account within the last six (6) months. Bank of America associates are not eligible for this offer.

To Earn the Initial $1000: You will qualify to receive the initial $1000 cash bonus after verification of the Business Advantage checking account opening by 10/30/2015 AND verification of completing at least one (1) of the following Select Business Account requirements: 1) apply and be approved for a new small business credit card and spend at least $2,000 in net new purchases on that card within 60 days of the opening of your new Business Advantage checking account; 2) apply, be approved, and open a small business loan or line of credit within 60 days of the opening of your new Business Advantage checking account; 3) open and activate a Bank of America Merchant Services account (for the purposes of this offer, the application is deemed to be a referral to a merchant services associate by a Bank of America small business specialist) and settle funds into your new Business Advantage checking account within 60 days of the opening of your new Business Advantage checking account. Activation is defined as the submission of a batch greater than $20 of any card type. Bank of America Merchant Services account must settle funds into customer’s new Business Advantage checking account. You must not be an owner or signer on a Bank of America Merchant Services account that is open or that was closed within the last six (6) months.

To Earn up to an Additional $1000: Earn $500 for each additional Select Business Account when you: 1) apply and are approved for that Select Business Account AND 2) complete the related qualifiers on that Select Business Account within 60 days of the opening of your new Business Advantage Checking account.

Taking It To Another Level

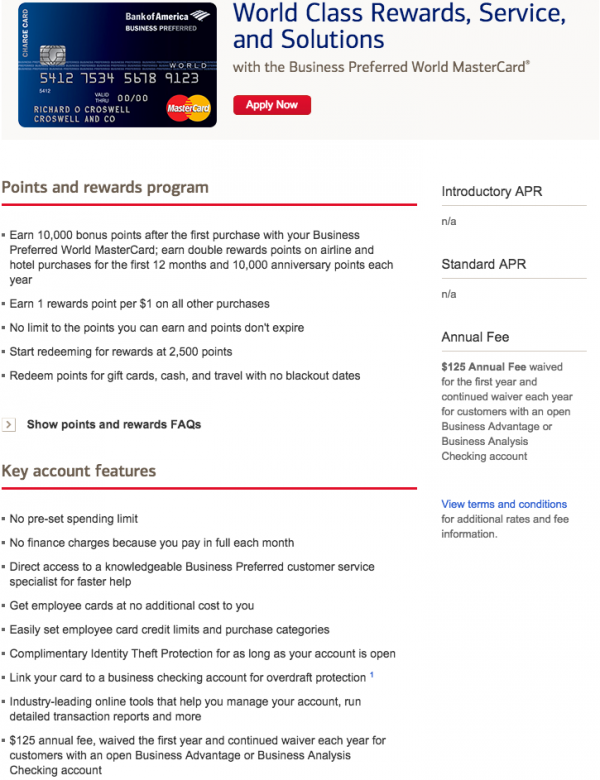

Bank of America hits the mark with relationship bonuses with credit cards and checking accounts. If you want to take this offer another level you should consider the Bank of America Business Preferred credit card. Yes, it has a $125 annual fee, but it will be waived when you open the Business Advantage checking account! Get this, at the end of your anniversary year, you will receive 10,000 points! That’s free checking and a free credit card AND free money to pay for it all. I mean it doesn’t get any better than this.

The points earned from the Business Preferred card are the WorldPoints. The only wild card is if they will allow you to consolidate to your personal Fidelity Amex so you can withdraw for cash back or leverage Milenomic’s method and supercharge the Fidelity AMEX.

Other Credit Cards:

To receive the $1000 or more bonus the easiest way is obviously opening a credit card, so you will need to figure out what’s the best credit card for your portfolio and manufacture spend $2500 per month. For folks looking for Alaska Airline miles this could be an easy way to earn some miles and get a nice cash bonus.

Closing It Out

If you’re serious about this offer, go to your local Bank of America branch and apply for the checking account and credit card. While you’re at at it, make some friends with the local bankers so you can be notified of these great offers. Thanks to my friend, I hear about many lucrative bank offers.

Bofa more than any other bank has a way to hit you with all kind of fees. Maybe I should apply to recover some of the money they took from me in 2013 🙂

Went to a branch in NYC this morning.. Story didn’t have any special promos for the business accounts. Will try a few other branches during the week. Any chance you had success at a NYC branch?

My friend who gave me the information works in a NYC branch. It is interesting to hear from your feedback that they didn’t have the promo

Tried another branch in NYC.. no dice :/. Any tips on which branch has the promos?

Sorry I missed your comment, is your email address that you left good to contact you on?

Yep. Look forward to your email. Thanks!

What credit card do you recommend for this offer? Is opening alaska airlines miles card better than other cards? For alaska airlines I can get both business version as well as personal version netting 50K miles. Is there a better option card than alaska airlines?

Nevermind. I live in GA and this offer is very much valid. Just came back from the local BofA branch and opened the business signature checking and also got approved for the 25K alaska airlines business card. So, looking forward to the $1K bonus in the next couple of months.

I dropped by this local branch few days back and told them about this offer. They were clueless and didn’t know about this offer. I go to this branch very often, so they told me they will look into this and check on this offer. I got a call from them yesterday confirming the offer and they also told me that they have the necessary offer code to be put on the account whenever I’m ready. So, I dropped by little while ago and opened the business advantage account as well as got approved for the business version of alaska airlines with 25K bonus offer.

Of course I don’t have a need for line of credit or merchant services, so I’m happy with $1K offer.

They did confirm that this offer is not regional.

Awesome! For Credit Card, it really depends on needs, but looks like you made a solid choice with the Alaska Airlines card

How soon can we close it? I don’t want to maintain that minimum balance and will take a hit on the monthly fee. How soon does the $1000 post?

Time frame to close I’m not sure. But if you spend $2500/month on your credit card it will waive the fees. You should ask the banker for a solid answer on how soon you could close the account without a penalty

Anthony has a good point, but if I understand this correctly as long as you spend $2500 a month than it shouldn’t matter if you only have $50 in the account, or $1 for the matter, since the credit card spend at that level just wipe out the monthly fee, correct?

Most checking account offers must be maintained for 6 months or they can claw back the bonuses. Can anyone confirm the minimum time frame to keep this open? Although, due to their other great ways to get bonuses, as long as you wouldn’t need to keep a large balance in the account I could see keeping this for a while if they don’t start hitting you with a bunch of fees.

Also, what is the minimum opening deposit requirement? Maybe it’s in this article, but I missed it.

Too bad they don’t have a branch in my state of Ohio. I was going to get this. Bummer.

I opened the account. It was a $100 minimum to open. I also talked to merchant services. If you buy their mobile payment device for $100 and join merchant services they will make the cancellation fee $0. This also will waive the checking account fee, but costs $10/month. So it would save $20 a month plus the upfront cost of$100. So the extra $500 you’d get would really be $500-$100-$60 for 6months of fees before closing = $340, so in total $1340. Worth it for the Initial investment?

This sounds like a great return of investment if you don’t spend too much time doing so. One question, they have a mobile tablet device, is this what you got or the stationary one?

@chasingthepoints Would it be possible to let me know which branch in NYC has this offer? I tried the one closest to my job the guy thought I was nuts lol

Try a few more branches and ask around. I don’t want to give up the branch my friend is in

Make sure you ask specifically for SMALL BUSINESS SPECIALIST for an offer. Personal Banker would not know about this offer. You need to make an appointment with Small Business Specialist because they server multiple branches. They may have only certain hours they will visit specific branch. Take note of below in the offer page.

==========

Important notes for Bank of America Associates. This offer should only be offered and distributed by a small business specialist.

Use Offer Code: REL4OFF

Please use the Marketing Online Redemption Systems (MORS) or call the Redemption Hotline via OneCall to process a request for an offer fulfillment on the customer’s behalf.

==========

I had a personal banker that every BOA branch has have called and setup an appointment with “Small business baker” to open an account. In my case, the small business baker severed multiple area office (is why they called field rep). Small business baker said that she need to personally open my account otherwise I would not get the promotion. Once application submitted by her, it took one day for central team to approve an application. Once application is approved, I had to go to local branch to a personal banker to make a deposit and get debit card, etc.

The “Small business baker” will now open CC for me with reference to account that she had opened and promotion code, so that everything is linked.

Thanks for posting your experience!

Walked into my local BOA branch, showed the advertisement to a banker and she was anxious to help me but then I noticed she looked glum after her manager told her it could only be opened by a small business specialist. She called him, gave him my info and put us in contact. He seemed thrilled to get the business – it was at that point that it dawned on me that likely both of them work at least partly, on commission.

He did a phone interview with me and set up the checking account and credit card. Told me they don’t usually approve lines of credit until a business has a couple years of history (mine is new).

I never did get a clarification on merchant services.

So look like that means $1K – minus taxes.

Awesome! Thanks for the feedback, glad you were able to score the offer!

What documents do they require?

Ugh, have to drive 2.5 hours to a BofA branch …

Have to work that into my next trip somehow.

It’ll be worthwhile!

Do you guys actually own a business? If not what did you told the representative before they approved your account?

I applied with a business EIN. I’m friends with the banker and didn’t have to do anything. But he had to go to bat for me to get approved for the charge card.

I’m thinking about stopping by my local BofA to give this a try. Probably going to just do the Business Advantage checking and one business card. Just trying to figure out which CC to apply for. Right now its between the Business Preferred or the Alaska Biz card. The bonus is 10k points (~$100) vs 25k (~$500) respectively. Waived AF vs $75 AF. To waive the monthly fee on the checking account, I’d spend $30k annually. That is worth 30k points worth ~$300 vs ~$600, but the Business Preferred also gets 10k yearly bonus and the Alaska Biz has a $75 AF so its more like $400 vs $525 annually. From that perspective, the Alaska Biz looks like the clear winner, however I’m weighing yearly cash rewards of $400 vs having to get value out of mileage plan points. I don’t currently have any mileage plan points. Have only been using AA, SW, and UR transfer partners. Any advice?

Do you foresee yourself using milageplan? If not, then the cash sounds best. It really depends on your travel needs. For me, I plan to use Alaska miles to get to Australia with a stopover in HK

Hey. I think the article made a mistake. The required spending for the credit card is only $2000 between 60 days in order to get the $500 bonus. To waive the monthly fee the required cc spending is $250 not $2500. At least that’s what my the SBA from bofa and the page I was given to select the account said.

If you do this offer, you’ll be signing up for the Business Advantage card and to waive the monthly fee you’ll need to spend $2500 on the credit card. The $250 checking account is not the product in this offer.

You are correct on the $2000 new spend on the credit card in order to receive the $500 bonus

Hi. You are right. My representative highlighted the wrong info. I also read that you won’t be charged any Monthly fee during the first 3 statement cycle closes. This is to establish a relationship with the customer.

BTW. Can I use the Alaska BCC to buy VGC at Staples or such? Would those purchases count towards the $2000 spending bonus? I could use some help with MS ideas. Thanks.

Certainly. I have been buying VGCs from giftcards.com with their 1% back in rewards. They call counted as purchases. You have to realize that any purchase you make online or in store, the CC company doesn’t know what you actually bought. All they see is a charge posted from the merchant at their end. Of course you don’t want to buy anything from Banks which will code the transaction as cash advance and you end up paying high cash advance fees + the amount will not count towards the purchase. Hope this helps.

That’s not entirely true. Merchants that provide level 3 data will allow the CC issuer to see line items transactions and descriptions.

In Jacksonville, found a Small Biz specialist who was an Asst VP, so I knew I had the right person. We talked for awhile and established good rapport when I mentioned I had heard about this BoA offer. She was very happy to offer it to me. She could not give it to me unless she asked. I don’t fly often so I got the Charge Card, which gives you 10K points (no idea what I can redeem it for yet). It gives you 10K in points every anniversary. I also opened Merchant Services account to go for the extra $500. Banker said I needed to be in biz for 2 years before the Loan or Line of Credit.

I am starting a side business so the timing was perfect. I had to get an EIN and show her my approved LLC from State of Florida (which was $125 to register, I believe, but I’m using it anyway).

Process was very easy overall, thanks to everyone’s comments who have helped out.

Awesome! Congrats! Glad it worked out

Phew! Was able to get in on this deal (Biz checking and Alaska Biz). I spent about 2 hours overall today getting this done. Hopefully it’s worth it.

Thanks to CTP and DoC

Has anyone gotten their $1K bonus posted yet. I met the requirements within 2 weeks after signing up. So, I asked BofA when to expect the bonus posting and was told end of Nov….:(

Miles- i opened in late August and hit requirements within 2 weeks as well as as of now, Dec 1, have not seen any bonus.

You may need to call the branch. I opened mine in early August and it posted about a week ago. I kept in contact with the branch manager and she made sure it got posted. I withdrew all the money yesterday and I’m closing the account today.

I went into the branch and was approved for the business checking account and the Alaska cc in branch with small business specialist before 10/31/15. I forgot to mention the offer that I read about on this website.

Do you think this is worth pursuing or should I just forget about it?

Thank you

I suggest asking about it and seeing if they could add it after the fact. It never hurts to ask in situations like that

Thanks for the reply.

You’re awesome!

I did it with a friend,

we both set up two separate accts

he got bonus, never even called

i did not, in fact when i just called they dont even see the bonus as notated on my acct. AAHHHGG

Hi.

I got the bonus in Dec. I was planning to keep the card, but without MS opportunities around I think I am going to just close the account… Is it safe to do so? Or are there any chances of a clawback?

No claw backs that I know of, if you truly do not have a need for it, you should close it