Today, I want to give you a little bit of what I learned from my accounting class and a tiny bit of supply chain, working capital. Emphasis below is mine.

INVESTOPEDIA EXPLAINS ‘Working Capital’

If a company’s current assets do not exceed its current liabilities, then it may run into trouble paying back creditors in the short term. The worst-case scenario is bankruptcy. A declining working capital ratio over a longer time period could also be a red flag that warrants further analysis.

…

So, if a company is not operating in the most efficient manner (slow collection), it will show up as an increase in the working capital. This can be seen by comparing the working capital from one period to another; slow collection may signal an underlying problem in the company’s operations.

In essence, you want to ensure you have a lot of cash on hand and to receive cash as soon as you can. This is why many manufactured spenders want to liquidate all their cards as soon as they can so they can take the cash and repeat the cycle.

How Does Credit Card Closing Statement Dates Factor Into Working Capital?

The portals. Portals for credit cards often are credited within 7 to 10 business days. If you want to receive those points faster, then you’ll need to play with the closing dates. You want the portal bonus credited to your account as soon as possible, that will be your collection of receivables from the above definition. The supply chain concept here is maximizing efficiency of your returns.

Simplicity Does Not Apply Here

If you like simplicity, you will not like this method, especially if you check your credit cards once a month. But if you are manufactured spending, then we all have our complicated methods. So if you have an issue with it, then I don’t know what to tell you here.

The Deal Explained:

If you have more than one of the same card, then you are in luck. If you do not, consider grabbing an extra or 2. For the purposes of this post, we’ll talk about Discover because I love Discover and love my second one. This also works when you have different versions of Chase’s plethora of Ultimate Rewards earning cards like the Freedom, Sapphire Preferred, Ink Bold, or Ink Plus cards.

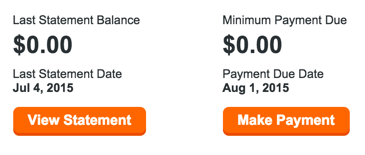

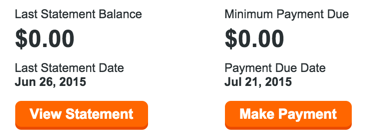

If we go back to working capital and receivables, your receivables are your portal returns. So if you want to be paid faster, you need multiple account access into a portal and stagger the credit card closing dates. My suggestion: have one close in the beginning/end of one month and the second card to close mid month. Here’s what I have on Discover:

As of writing this, we are in the second week of July. If I had one Discover card, I’d have to wait nearly a month to be paid for the portal cash back. Luckily for me, I have a second one that closes a couple of weeks afterwards. This allows the “baking” time of receiving the cash back in the 7 to 10 business day window and it ensures that I will see my portal cash back return near the end of July. If you boil it down, I have the ability to receive my portal haul twice as fast than someone who stacks up their closing dates all on the same day.

All of those people who worry about not having enough points from Chase to transfer to their loyalty programs should put serious thought into this. If you are in a bind for points, if you stagger your closing dates, you could receive your points in your account in a matter of days, then the points could be out of your account just as fast so you can book your Lufthansa First Class flight or Singapore Airlines Suite Class when your waitlist comes through.

Yes that might work for some, but we take extended trips with our points (3-4 weeks) so it is much simpler to have all due between the fifth and eighth of the month to pay ahead when traveling.