For the month of December, I’ve nearly maxed out my credit limit on my American Express Starwood Preferred Guest card. The reason being, I wanted to ensure I had spent $30,000 on my SPG card for Gold status. I understand the status is not very useful compared to other chains for this status level. When I made the decision, I had no extra benefits for high spend and could use the amount of SPG points to transfer to the airlines. Next year, I will reconsider the enormous amount of spend on the cards.

The AMEX card has a $6,000 limit and with all of the American Express Sync offers I had to take advantage of all of the deals and the deals just racked up my balance.

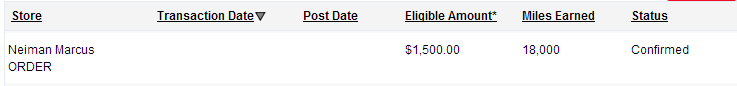

On the Chase cards, I maxed out $3,000 in the department store purchases on my Freedom churning Neiman Marcus on the triple/double miles days as well as spend thresholds, which the American Airlines mall posted accurately:

My US Bank Flexperks has over $4,000 in charges because of the A&P deal and the targeted offer of the bonus 3,000 points.

My Citi Forward card has $1,000 in purchase because of the Campus Edition card for 5x at bookstores. I want to rack up all the Thank You points and redeem for my Hyatt gift checks.

What’s the total cost for all the points? It came down to about $50. If I counted the A&P vouchers as cash, I would have made a little over $80.

Well done! Aside from an app-o-rama, my credit card fun has dropped near zero since the baby came, hoping to get it going again in a month or two.

Thanks buddy! Time to “spend” more to make up for the lost time

Hmmm. Looks like I missed alot of deals. I am new to credit card churning. I would have come to our site little before.

I wouldn’t worry too much about that, deals come and go, but mastering manufactured spend will help you get through it.

I missed out on plenty of deals and this is where the creativity on MS makes it fun

Did you buy jpc GC using your Synced Amex. Did you use portal.?

I did do the JPC gift card, I used the AAdvantage Shopping mall, miles have not posted (yet) hopefully it will

Hey, How are you planning to unload Nieman Marcus GCs.

Assuming you maxed out on 7500 Points on one Freedom card and 18000 miles but, aren’t you stuck with those cards ? One can unload via cardpool but that’s a decent hit. Just trying to figure out the math here.

thank you

I unloaded it all with Cardpool, sold it for a loss of $235 ($225 on the actual gift card, and $10 total in shipping), but after doing the math, I’d be paying $235/25500 miles and points for $.009 per mile and Ultimate Rewards point.

My math is always to try and buy at a penny or less, unless I am researching for a post and then that number is out the window

thanks for the reply.