It’s not often one could say gift card churn AND profit, but there is a lucrative offer floating around. I am really excited about this opportunity and will be jumping on it soon.

Hat Tip to Hustler Money Blog for compiling the list of Best Bank Bonuses

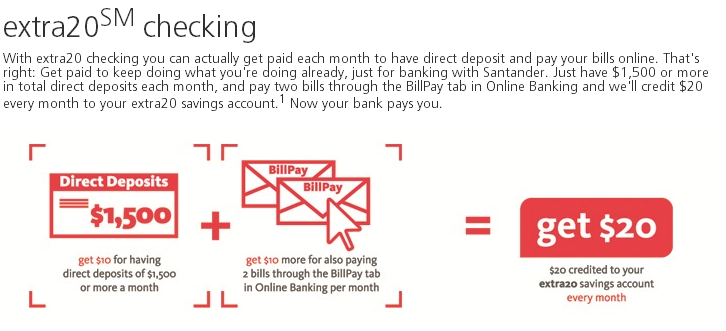

Most of the bonuses on the list are a one time sign up bonus similar to opening a credit card. There is one that caught my eye, Santander Bank where you need a checking and savings account. They have a program called “extra20” where you must have a direct deposit of more than $1,500 a month and do 2 bill pays in the month and for each you will receive $10 for a total of $20 a month and

If you are part of a bulk gift card program, you could have the proceeds direct deposited into this account as well as Serve (Thanks PF Digest!) and earn $240/year while the program is running. The money from this extra20 will count as part of interest income.

Here is the Terms and Conditions:

1 To receive extra20 bonuses, you must have both an extra20 checking and an extra20 savings account (minimum opening deposit of $25 and $10, respectively). Conditions to receive bonuses: You will receive a $10 Direct Deposit bonus with direct deposits of $1,500 or more to your extra20 checking account in a service fee period. If you qualify for the Direct Deposit Bonus and you pay two bills from your extra20 checking account through the BillPay tab in Online Banking in the same period, you will receive the $10 BillPay bonus. Bonuses will be credited to your extra20 savings account on the first business day after your extra20 checking account service fee period ends. Your bonuses will be reported as interest on a Form 1099-INT in the year received. Limit 1 extra20 package per person.

2 You can withdraw funds from your extra20 savings account no more than 6 times by computer, telephone, preauthorized transfer, check or Debit Card purchase each service fee period. Fees apply if you exceed these limits, and if you repeatedly exceed these limits, we will close your account or convert your account to a type of account that does not have these restrictions, such as a checking account.

3 No fee when linked to an open extra20 checking or $100 average daily balance (otherwise, $3.50). All other fees apply.

4 Please refer to the Online Banking Agreement for details on guarantees and your responsibilities for promptly reporting unauthorized transactions.

5 When you promptly notify us. Does not apply to transactions made using your PIN. Please refer to your Personal Deposit Account Agreement for more details.

6 Certain restrictions apply. For full details, see the Guide to Benefits insert that will be sent with your new card or visit mastercard.com for more details. Remember to keep all receipts to properly review your claim.

7 Cash rewards are earned on purchases made at participating online retailers through the Santander Cash RewardsSM Program tab in Online Banking or in-store at participating national and local retailers when using your Santander Debit MasterCard. Look for terms of the participating retailers’ and sign up on the Santander Cash Rewards tab in Online Banking. Participating retailers are subject to change.

8 We charge our standard overdraft fee of $35 per transaction when you make a transaction, including checks, Online Banking payments or any other type of withdrawal, and you do not have sufficient available funds to pay the transaction. There is an additional one-time $35 sustained overdraft fee on the 6th business day any checking (other than Premier Checking), savings or money market savings account is overdrawn. If you enroll in Santander Account Protector, these fees will apply to overdrafts caused by ATM transactions and one-time debit card purchases. Any overdrafts that we pay must be promptly repaid. Whether we pay an overdraft is at our discretion and there is no guarantee that any overdraft will be paid by the bank.

9 All applications subject to approval.

If you’ve been a bad customer with Santander previously, don’t expect to participate in the program as pointed out in #9.

Hustler’s list is a bit out of date (lots of offers that are no longer available) and missing a lot of key information (e.g whether it’s a soft or hard pull) so I decided to create this list instead:

http://www.doctorofcredit.com/current-bank-sign-bonuses/

Hopefully your readers find it helpful!