I have written a on the merits of:

In this post, we’ll discuss Barclay’s UPromise MasterCard and really, why I was so upset not being approved. Reader Gabriel had mentioned that if you link a UPromise savings account you could earn an additional 10% back on all of the earnings. For a 5% vendor that could mean 5.5% cashback. If you use the UPromise MasterCard there could be an extra 5% on top of the portal cashback. That 5% vendor could now be 11% cashback after the savings account link.

The team here at Saverocity have discussed the merits of the card and we’ve come up that this is a pretty powerful card.

Basically, it’s the trifecta to make 11% cash back combination of savings account, portal, and credit card that make this card incredibly powerful. There will be double dipping opportunities using the card and portal. Using the 5% example, that could boost it up to 16.5% cashback. We’ll let you connect the dots, but here’s a quick one:

Giftcertificates.com sells all sorts of gift cards. During the holiday seasons they have a 5% off coupon for the super certificate (Giftcertificates.com’s own GC) and oftentimes the UPromise portal is 5% cashback. Use your UPromise credit card and you’ll save 16%. Use the super certificate through the UPromise portal again for another 5.5% back for a total discount of 21.5%.

You could use the gift card and buy American Airlines and discount the fare by 21.5%, not bad right?

EDIT: After several experimentations, the above theory for 16%+ off doesn’t work. I can only see getting 11% off using the UPromise MasterCard + UPromise portal.

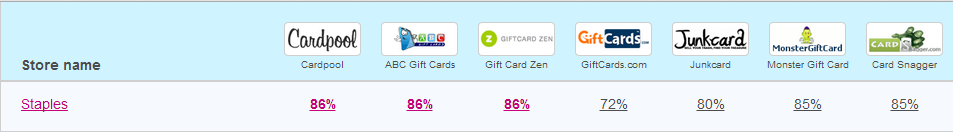

You could buy Staples gift cards and resell and profit 7.5% at the current sell rates of 86%

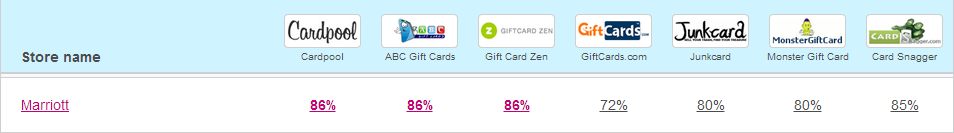

The same goes with Marriott at a profit of 7.5% that is if you sell too much Staples and cause the rates to go too low:

Some of your embedded links aren’t working properly.

Thanks – they are fixed

There are reports that Upromise take months or never to get the cash back.

I had seen a post on FT about the card, but I am not sure if it’s an isolated case or not. In my next round of applications, I will definitely be signing up to experiment more.

My personal experience is that they are late or don’t pay on all orders made. I have yet to see a Best Buy order change from pending to funded and have about a 66% success rate with Staples. The 4% bonus over the first 1% on the credit card is also sketchy in my past 4 months experience.

YMMV

Thanks for the feedback, that doesn’t sound very promising