In mid December, I opened a few cards and finished the minimum spending quite fast. While completing that, I wrote about bill paying, but they required a paper statement. Generally speaking, I always pay my credit cards before the statements close out. For the last two billing cycles, I have been leaving a balance on all of my cards so the statement is issued and my credit score according to Credit Karma has dropped and hasn’t picked back up, yet.

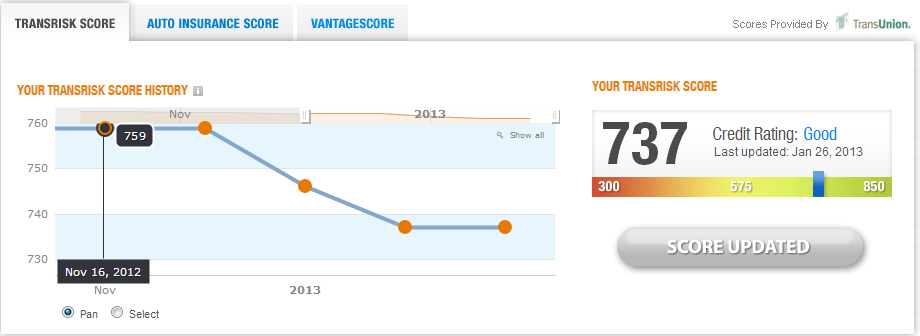

Here’s a screenshot a little over a year ago:

As you can see and as everyone has reported, the credit score does increase, but does not take into effect immediately. It will take some time to balance things out, even with a high utilization ratio on my cards for leaving the balance on the card.

Don’t like that..

How many did you apply and how many hard pulls?

Thinking about my upcoming AOR

I had 5 hard pulls altogether

Completely meaningless drop. You’re still well above average and actually closer to the 680-720 “sweetspot” that issuers love…

Right – anything above 720 means you have not been aggressive enough 🙂

haha perhaps not, I am still not sure which ones out of all the ones I have are worthwhile yet