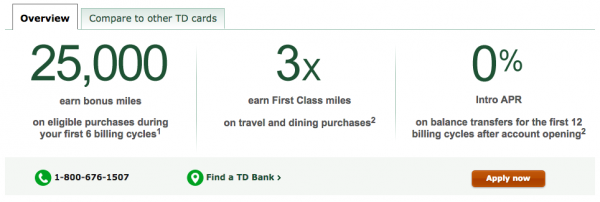

TD Bank offers a Visa credit card call First Class and you would earn 3x on the points if you spend it in dining or travel categories. Along with that, there is no foreign transaction fee for an $89 a year annual fee with the first year waived. As a sign up bonus, you could earn up to 25,000 bonus “First Class miles” if you spend $3,000 within the first 6 billing cycles. Notice, how it is billing cycles and not like other banks that say “within 90 days of account opening.” This makes TD Bank slightly more generous. On the first purchase you’d earn 15,000 “First Class miles” and the remaining 10,000 once you hit the $3,000 spend.

I put their loyalty program in quotes because it’s not what you think they are when you redeem United Miles for a first class flight on Lufthansa.

The Details:

The TD Bank First Class credit card is a chip and signature card, and basically competes in the realm of a premium travel and dining credit card like Chase’s Sapphire Preferred or Citibank’s ThankYou Premier or Barclay’s Arrival+ cards.

Again, on the earning side, you earn 3x in dining or travel. This is better than any of the aforementioned banks’ products. If you are looking for a Travel cash back card, this card will absolutely blow out Barclay’s hands down. The only thing that Barclay’s has against TD Bank is the fact that Barclay’s Arrival+ has the PIN. Other than that, TD Bank has Barclay’s beat by a mile.

If you were aiming for points to transfer to frequent flyer programs, this card will not be good for you.

Reward Options:

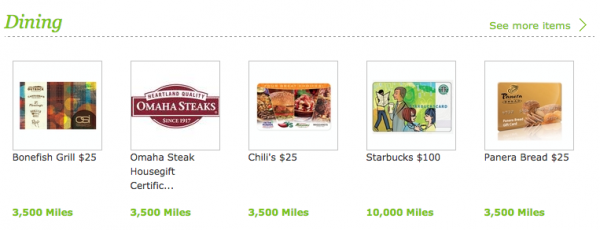

When you redeem each mile, they should be worth about 1 cent per mile. There are some options that make no sense. Like this one:

For a $25 gift card, you’d be using 3,500 miles, which means you’ll be getting less than 1 cent per mile, $.007/mi to be exact.

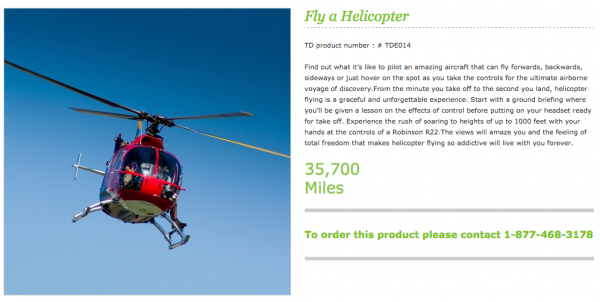

Here’s the most interesting offer available to me, at 35,700 miles. You get to fly a helicopter

If you want to review the rest of the catalog you can go to this link

The Most Interesting Option:

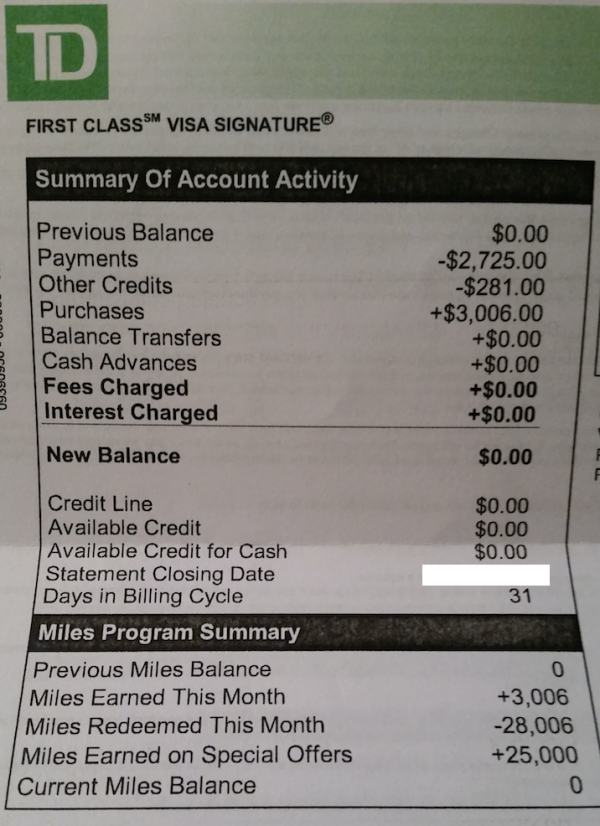

I will let you read this picture first before describing it

I applied all of my points, 28006, as a credit statement. Now read the line that says “Other Credits.” It was worth $281. It’s unfortunate you can’t redeem the points online, because if you could, I’d test the hell out of the card to see what low value would round up to $1. Instead, you have to call the number on the back of your card to redeem the miles for credit.

No Longer A Cardholder:

I was a very short time cardholder for the TD Bank First Class card because I accidentally applied to the wrong card. Since then, I cancelled the card and applied and subsequently approved for the TD Bank Aeroplan card.

If I Was In The Market To Be A Cardholder Here’s What I’d Do:

I would breakdown my spend and look at how the points will play out.

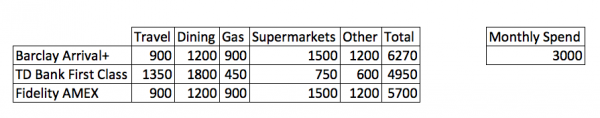

Depending on your needs and if you’re in the market for a cash back card in the travel category, I would consider the TD Bank First Class, Barclay’s Arrival+ card, and the Fidelity AMEX. The former two cards are competitive. Let’s take a sample spending schedule in a month:

For the assumptions, I liked how Frequent Miler broke down %’s in the recent run down on credit card combos. So I used them here. I did change his math from $30,000 annual spend to a $36,000 annual spend where I made it a $3,000/month breakdown.

The percentage breakdown comes out to:

- Travel: 15%

- Dining: 20%

- Gas: 15%

- Grocery: 25%

- Other bonus categories: 5%

- All other: 20%

The total for the Barclay also includes the 10% upon redeeming. Based off of the breakdown, the Arrival+ is the superior card.

Personally, I will pass on the “premium” cards because I am grandfathered with the old Citi Forward 5x and put all my dining spend on this card until the Chase Freedom quarterly bonus comes up. As soon as I am ready, I will sign up for one of the “premium” Thank You Points earning cards like the Premier so I can transfer my accumulated points.

n2people.nl