In August 2013, I opened a Chase United MileagePlus Explorer card thinking I would utilize it more than I would. I wound up closing the card, but it was actually after the annual fee assessed. I paid the annual fee, then called Chase that I wanted to close the card.

As with all of my personal Chase cards, I called Chase Sapphire Preferred phone number. I gave them my last four digits to the Explorer card and told them my situation. It turns out they couldn’t close the card and forwarded me to a special United credit card desk.

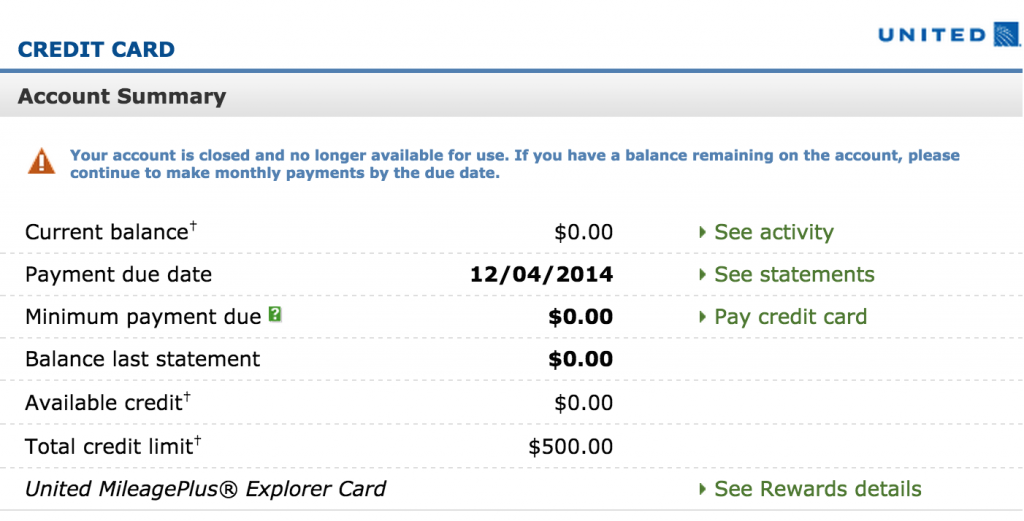

I wasn’t able to convince them to give me something for paying the annual fee and keeping the card, so I told them to close the card. They closed my card no problem and gave me credit for the annual fee I paid. However, I lost $500 worth of credit line.

When I originally called to close the account and there was a credit, the very first agent told me $500 had to remain. Now that it has cleared, the agents now can’t do anything about the $500 moving around. Therefore, I lost $500 in credit line. While it’s not the end of the world, don’t make the same mistake I made and letting the annual fee assess and you get a credit back.

So remember to do something before your annual fee hits, otherwise you’ll face a situation like I did. For Citi cards, it seems that you can product change anything with Citi into something else. Be sure to check out the comments on Miles4More.

The $500 CL requirement is standard with Chase if there is recent activity on the account (it’s a silly policy). I think you need 3+ months of zero balance to be able to consolidate the entire CL upon closing.

Yea it’s completely beat how it’s set up that way

Right on the 3+ mo’s as well, so you need to plan ahead. Chase is really tough on product changes. Needs to be within the same product family.

You can ask to be transferred to Lending Services. They’ll let you transfer the entire CL to another card.

I was able to transfer almost all of it except for the final $500 because of previous “activity”

Have you ever gotten into a situation where that extra $500 of credit limit actually got you anything? I mean I know I don’t do a ton of MS, but I’ve never been in a place where that would have made a difference. YMMV I guess

It’s not the end of the world – just some credit that I didn’t want to lose if I had planned properly and more of a notice to folks who are looking to do something like this in the future

Disagree. I always wait until AF posts – get better retention offers. CL is never a consideration for me.

I will have to agree with you, retention offers would be nice. However, I am 1 for 5 in getting those offers. The only one that I’ve gotten was for the Ink Bold where they credited me $95 for the annual fee

Tried for:

First US Airways

BAC Alaska Airlines

Citi AAdvantage card (not sure if I wanted one since I do like the idea of the Dividend)

Chase Ink Bold

Chase United Explorer