For February and March, here are my utilized, active cards:

For the reported utilization on Credit Karma, I have used the statement dates

Bank of America Alaska Airlines – statement date, April 10:

Chase British Airways – statement date, April 10:

Chase Sapphire Preferred – statement date, March 28:

Barclay’s Lufthansa – statement date, March 28:

Powered with this information, I will lightly use my cards until it is reported to keep a low utilization level and apply for 1 card, the Old AMEX Blue, even after the CVS cash only policy. If you wanted to do a manual reporting, you could log in with your bank’s account information, but I think that would defeat the purpose of seeing what’s reported into the credit bureaus

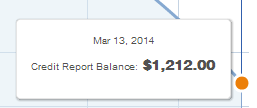

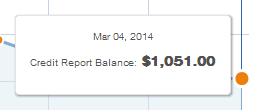

From reviewing my credit report, I’ve noticed that even though different cc send their balance on diff dates, the balance is always the statement balance and not the balance on that reporting day or day before. For example, if my Amex statement closes with $1000 on April 1st. Amex might send a report on 5th of every month. If I make a purchase of $5000 on April 2, the balance reported will be $1000 and not $6000. Similarly if I make a payment of $1000 on April 2nd the report will still show $1000 and not 0. The pics Uve shown above r probably balances from ur statement closure from the previous month. Was ur BOA alaska cc march statement balance $1212?

Correct, in the examples above all of the balances were statement balances because I did not have any charges between reporting to CK and the statement closing date

I see. Even if you had a charge between statement closing and reporting date, it would not show up on the initial report because cc companies report only statement balance as of the closing date. You can test it if you like with a small $10 charge.

Yup, I will try and test it out – just waiting for statements to close and upload to CK

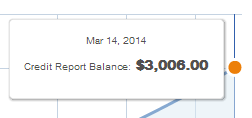

De facto tested this last month, at least for FIA card services:

My fidelity amex statement closed on March 10th, with a balance just over $4k. I made a large purchase on the 11th, which posted on the 13th. When I pulled my credit report on the 18th, it showed a balance over $7k.

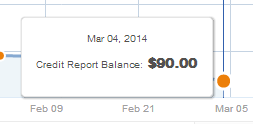

By contrast, my Amex Bluecash closed on Feb 24. I made purchases that posted on Feb 25 and Feb 26. Experian report pulled on March 18 showed only the statement balance, not any new purchases.