EDIT: This is a stupid idea, please refer to Matt’s post here on why it’s terribly dumb

The other day, Matt shared a little history about his past debt and cautioning you to be careful of your finances and cognizant of your credit card spend. You must absolutely be on top of your game and becoming fiscally responsible before you even remotely consider what I am outlining below. This is similar to opening credit cards, you need to know what you are comfortable with and know you can handle whatever is thrown at you. That being said, I am not advocating that you should go into debt, but this is something I am going to do in the coming years while I am a student.

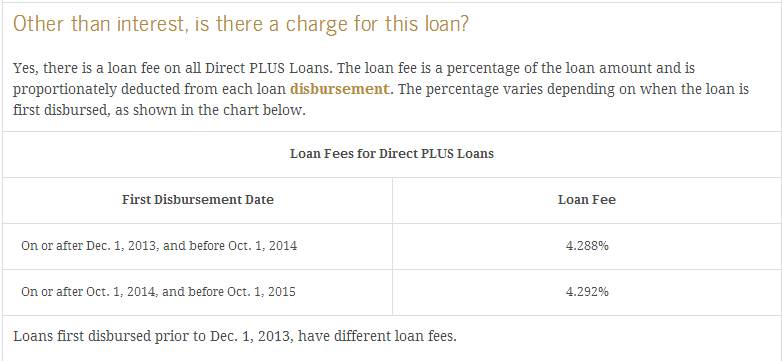

It’s not free and can get expensive, loans all have fees and interest rates. Depending on the year of disbursement, there’d be a different origination fee.

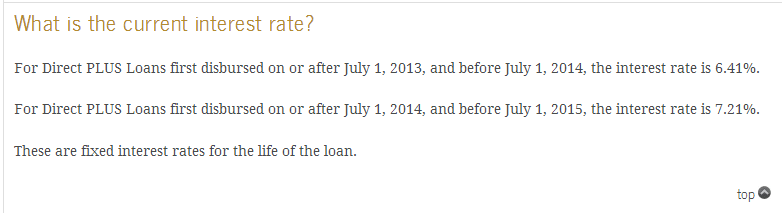

As interest rates are rising, so are the loans:

I’ll be looking at a 7.21% interest rate for the life of the first loan

My Reason:

No doubt, the loan will be expensive, 7.21% interest and a 4.288% origination fee. Why am I planning to do this? Taxes. I am planning to deduct all of the fees and interest and take the cash that I would receive today and invest the cash into the stock market. With the current landscape, and using automatic ACH payments I will also receive a .25% discount on the interest of the loans. In addition, the loan servicer, GSMR, is available to be paid on Evolve Money. I plan to manufacture spend using my Old American Express Blue card for 5% back on pay the loans. Depending on the situation, I can also see using the Fidelity AMEX + portal cash back.

The math isn’t simple, but the premise is to use the credit card cash back rewards to help lower the interest rate. Combine the tuition for further tax deduction, I hope to come out ahead with taking the loan and investing the cash.

Perhaps I am missing something here.

You are aware that the market can go down, correct?

Wow, 7.21 % rate, that is high. A year ago I got 3.25% on a 250,000 line of credit with zero points/fees.

Sounds risky, but it sounds like you know what you’re getting into! I would be more likely to MS on CB cards and then use the “income” to help fund investment accounts.

Do you have a contingency plan if your income goes over the limit and your student loan interest becomes non-deductible?

I’m stuck paying 8.5% on student loans with no chance of deducting the $30,000 of interest I pay every year and it sucks.

This is possibly the worst idea I’ve ever read about. You’re taking out a loan at a very high interest rate to invest in the stock market that is at all time highs. Brilliant.

Gambler thinking I think…

You might consider spending half of it on wine, women, and song…

And the other half foolishly… 😉

I gotta lean on the side of – this is crazy don’t do it! 🙂

I’m solidly in the “worst idea ever” camp.

Tax — I know you can deduct student interest above the line ( before AGI) , but I doubt your income is that high since you said you’re a student. May be you can project your income taxes, and may be standard deduction alone is enough and dont need this student interest for deduction.

stock market — do you know how to pick stocks?

loan fee, interest rate — too high to justify this move.

Tread carefully.

“A fool and his money were lucky enough to get together in the first place.”

You say “You must absolutely be on top of your game and becoming fiscally responsible before you even remotely consider what I am outlining below.”

However, what you are outlining is fiscally irresponsible in and of itself.

Please tell me this is a joke…right?

If I don’t tell you “don’t to do it” and you did, I feel like it’s my responsibility. If I told you “don’t to do it” and you did what you planned like this then it’s your fault and I can sleep at night. “Don’t do it”, you probably need to use up all the miles and points you earned to go some where to clear up your thinking.

I want to acknowledge all of your comments and that I’ll be responding at a later date, have gotten pretty busy the last couple of days with a few upcoming things I need to take care of – thanks!

This post wasn’t meant as a joke – Yes, the market is closing at all time highs, everything is overpriced, high risk, and to be honest, I should have brought out a calculator before posting.

If you haven’t seen Matt’s post (big thanks!) for running through the math, (http://saverocity.com/travel/please-dont-get-debt-manufacture-spend/) and seeing the numbers before me, it’s a very stupid idea. That’s my fault because I didn’t follow through with doing all of the math.

I’ve been tossing a few ideas on paying fees (not all of them are bad) in my head and wasn’t sure what the order was going to be and chose this post to go first and actually came out to be a very half baked idea.