In the last few weeks, I have received a tons of feedback about gift card churning. There is a lot of interest and requests on the basics. A big shout out to As The Joe Flies for coming up with some great questions and Kenny joking during FT4RL that he needed Circles and Arrows. So here is the Circles and Arrows Edition.

What Is A Gift Card Churn?

Gift Card Churning can mean different things to different people. Some people think of it as the act of loading and unloading the prepaid Visa or Mastercards. To me, it is the art of buying and reselling retailer gift cards.

Need To Know Terminology:

The reason why I list out a dictionary is because it helps the trade craft when you’re using the same jargon. It’s like I mentioned product changing the Citi card and the annual fee and I wasn’t using the right words with the customer service representative and there was a disconnect in understanding.

Bulk Seller – typically someone who sells north of $5,000/month of gift cards to a gift card exchange

Commission – these are the rates that said exchanges will charge for facilitating the gift card sale

Gift Cards – these cards are typically used for purchases at specific retailers in lieu of cash

Gift Card Exchanges – these are sites like Cardpool, GiftCard Zen, or Raise where they connect buyers and sellers to gift cards

Electronic Gift Card – these cards are like gift cards, but are digital versions

Merchandise Credit – these cards are typically issued to retailer’s customers when a refund or exchange occurs and a difference is owed where the customer usually does not have a receipt. These cards are typically used in store only. Merchandise credit may also be known as store credit

Portals – these are online shopping malls that receive compensation for directing a customer to a retailer with the portal paying out said customer a certain type of reward

Residual Value – the amount of money you typically receive after the gift card exchange’s commission

Retailer – vendor that has a gift card for sale

Rate Finding:

You need to study the list of gift card vendors listed on Gift Card Granny and know which retailer has the highest residual value. I wrote a post about finding the best rates, and reader CoolMoon gave better advice:

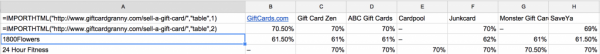

“=ImportHtml(“http://www.giftcardgranny.com/sell-a-gift-card/”,”table”,1)” in “A1″ cell, then “=ImportHtml(“http://www.giftcardgranny.com/sell-a-gift-card/”,”table”,2)” in “A2″ cell, everything will be updated every time you open the sheet.

Here is the code you would enter into the cell A1

=ImportHtml(“http://www.giftcardgranny.com/sell-a-gift-card/”,”table”,1)

Then in cell A2 you want to use

=ImportHtml(“http://www.giftcardgranny.com/sell-a-gift-card/”,”table”,2)

You will see results like this (this has been expanded so you see the underlying code in action)

The first line of ImportHtml grabs the table header and then the second line grabs all of the residual values.

The Gift Card Churn:

Now that you know what rates you’ll be receiving in a sortable table, find the best gift card exchange and sell! Good luck!

You may want to check the links. I got “Page not found” in couple of them. Thanks

Thanks – fixed them

where do you typically sell amazon gcs?

I don’t sell AMZN GC’s – residual values are too low. The reason they’re so low is because in order to check the AMZN balance, it goes straight to your account.

Never knew that was the reason they were so low, interesting!

Yep! Them and iTunes are like that

I haven’t been able to understand what you see more when opening up the GCG info in spreadsheet format, over just looking at the % rates on the GCG site. Can you clarify?

Being able to download into a spreadsheet allows you to sort the data – so I like to sort by the highest rates and reverse engineer my way down to my cost that I’d buy my cents or miles.

So if there’s a vendor that’s selling gift cards at 86%, I’ll work my way from 100% to 86% and figure out what portal cashback + miles payouts would be to get around $.008/point

I don’t see a single circle, arrow, or affiliate link!?!?!

If you want me to make you rich doing as you say and not as you do, DRAW ME A PICTURE!!!

Maybe you should talk with that nice bowtie guy, he’s way ahead of you.

Thanks for this!

May I ask what a typical profit is? The margins seem slim…

On an average churn for me it’s anywhere from -1% to 1%. So sometimes I’m paying up to 1 penny per point, or I’m making 1 penny per point. I like this method because it operates on my schedule and I don’t necessarily need to leave the house and deal with the uncertainties of a deal