In my post about the Chase Freedom 2014 calendar, I had mentioned that I had not figured out how to maximize This method would only work if you are trying to buy points as this is a money loser if you use a cashback card.

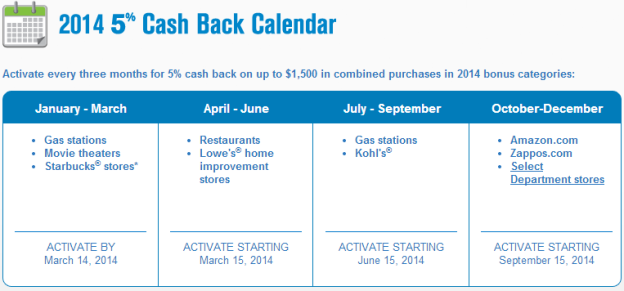

Chase Freedom 2014 Calendar:

Quarter 2 – April to June:

- Lowe’s

If I were to take advantage of the second quarter, I would go to Lowe’s. Except, I haven’t figured out how to leverage Lowe’s gift cards to churn profitably. Ordering online for bonus points or cash back and reselling Lowe’s gift cards sell for too little value for this to make it a profitable proposition. Buying gift cards inside a brick and mortar Lowe’s do not offer enough high value cards.

There’s still a few months away to think about this one. For 2013, I did not participate in Q2. Oftentimes, Lowe’s gift cards only resell for 86 or 87% of the face value. If you click through the UR mall for 5x and the Freedom for 5x, there’s still a 3 to 4% loss which does not make this a good proposition.

The above is the excerpt of my thoughts on manufactured spending for the second quarter. At the time, I did not figure out that you should ask for higher rates in which the gift card exchange would buy then the price to manufacture spend greatly reduces and you can maximize the quarter.

How To Execute:

Plink is currently offering up to 10% back after spending $50 or $25 at Dunkin Donuts or Quiznos.

Cardpool currently sells these gift cards at 10% off. Obviously, they will be buying it from you lower in order to market a discount on the gift cards.

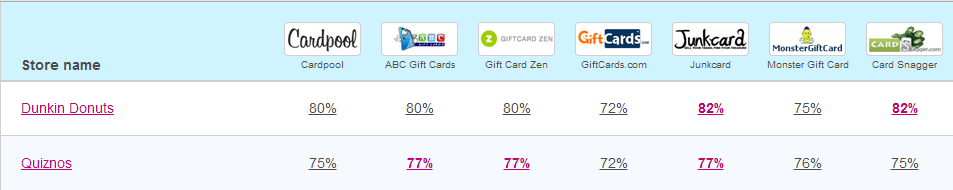

Here is what we have from the exchanges on the two vendors:

If we request the exchanges for a higher payout at 85% or 86% and coupled with Plink, you could be buying points at $.0101/point or $.009/point, respectively.

Therefore, if you buy a bunch of $50 gift cards at Dunkin Donuts or $25 cards from Quiznos, you would maximize Plink and be able to MS cheaply for points. All of this is contingent upon the gift card exchanges agreeing to pay you at a higher rate.

From the example of Cardpool, if they pay out at 86%, that means they have a 4% margin – which may not cover their expenses and they may be unlikely to accept. It definitely doesn’t hurt to ask and find out. I will definitely ask because I have sold many cards with them.

Final Thoughts:

In order for this to really work, the gift card exchange would need to agree to pay out the rate that you want. The only way I see it happening is if you have a good, established relationship with the exchange where they are willing to take a smaller cut. The screenshot above displayed that Cardpool had no inventory. If we were to sell $1,500 worth of Dunkin Donuts at 86%, they might not sell it 10% off to maintain their margin.

What is the best way to request an override of the payout rate listed on sites like Cardpool? Do you need to have an inside contact or can you just contact Customer Service?

I would email bulksales@ cardpool.com

I have no inside contacts. I always email the general email box and get a pretty quick response