On every forum that has any credit card points discussion, there’s plenty of talk on how to maximize your Chase Freedom for the second quarter. Everyone is questioning what category could they put their spend in? How are they going to maximize the spend, either real or manufactured?

As a recap for 2015, Chase has the following vendors and categories for the 5x:

- Restaurants

- H&M

- Overstock

- Bed Bath & Beyond

Of the 4, there’s only one that makes sense for a points play in manufactured spending if you need Chase Ultimate Rewards.

Why Consider?

There are going to be pros and cons to this method and will be dependent on your situation. One that stands out to me is, if you are cash rich, but points poor and this way would be to pad your balance. Why would you do it? Because you know your redemptions are going to be worth more than the price that you will pay for your points. For instance, Gary values United miles at $.016/point. The method that I am about to explain, you will buy points at approximately $.014/point. Do you need the miles for Singapore Airlines Suite classes? How about Vendoming? Are you going to use the nosebleed price on United for Lufthansa’s First Class? Only you can decide. Obviously, this technique will depend on you and your valuations at the end of the day.

How To Maximize Freedom Q2:

Anyone take a guess what I propose? If you guessed, gift card churning, right you are! Due to the sensitive nature of this deal, I can only explain a little bit of the concept in plain text, so you will need to figure out how to connect the dots.

You take your Chase Freedom [preferred] and buy whatever prepaid card that is available, Visa, American Express, or MasterCard for a fee of $6.95 on a $200 card at Bed Bath & Beyond. Now you take that prepaid card and buy a gift card with a portal and do a reverse cost engineer by finding the highest rate possible.

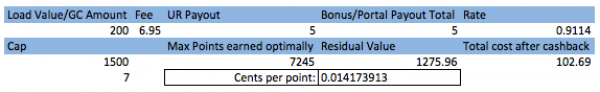

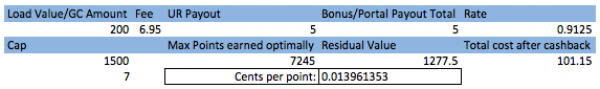

This is the math breakdown:

Easier way:

Slightly harder way:

You want to buy 7 of the prepaid cards because that will be the optimal result, going over would increase your cost because your Freedom [preferred] is maxed at $1500 in spend. The slightly easier way is to sell on Raise while the slightly harder way is to sell on Cardpool because you would have to mail in your gift cards. There’s an even harder way, but it’s too difficult to do the math since it’s a bigger YMMV situation. However, based off a back of the envelope calculation, it could at the very least be an under a penny a point buy. There’s potential for it to be a money maker as well.

In Closing:

Either option you choose, they round out to $.014/point so you need to decide if you want to spend that kind of money. I haven’t decided if I want to pursue it, but had this train of thought for those who might be interested. Because it’s a limited time offer in the quarter and takes some heat off your regular 5x cards, this is an opportunity to add some points quickly.

If you need any help, join us on the Saverocity Forum in the Level 2 area for further discussion. The thread is called “Freedom Q2.”

“On every forum that has any credit card points discussion, there’s plenty of talk on how to maximize your Chase Freedom for the second quarter.”

I agree with the fact EVERYONE is talking about it but there is ZERO recommendations on how to maximize it, besides use it at restaurants which is really not a recommendation to begin with. This fact was my biggest disappointment with all of them, even the ones that made it sound like they have some great ideas, but at the end they didn’t.

Your post is the first one I’ve seen that has an actual example. The second I saw it I was like “here we go again” some long ass paragraph about what Q2 covers and a lot of extra bullshit, I was pleasantly surprised.

Thumbs Up! 🙂

Thanks Joe, I appreciate the kind words

At a minimum, Chase points can be cashed in at $0.01 per point. So I can also just purchase the 7 x $200 MC in store, cash them in via Serve/Walmart, and at the very minimum count a $3.05 profit after the fee ($21.35 total), if I were to cash in the points at value, right? In this way, I know that I will at least make a profit on the transactions, and hopefully I’ll find a travel use for them and make a bit more. And then I can use my Discover Card for 5% off at restaurants, since I don’t see much else use of their quarterly bonus for MS.

That’s absolutely right, you can buy 7 x $200 MC and unload fee free with your method + redeeming points for cash for profit.

I must be missing something. Why would you take the second step and give up 8.86% of your principal ($1275.96 residual value on $1400) in order to get 5% back via a portal?. Just to process the $1400 without going through Serve/BB?

Valuing Chase points at $0.016 (as you reference above) you’d come out ahead by $13.23 total in the easy way, $14.77 in the slightly harder way. Using Serve/BB, you’d come out ahead by $23.80 even valuing the points at just $0.01. At $0.016 you’d come out $67.27 ahead.

What am I missing?

You’re not missing anything, my assumption is not to use the $200 GC to load on BB or Serve because of the complications stemming from using a $200 GC at WM. My local WM checks if the card has my name on it. It’s too much of a hit or a miss to know if it’s going to work or not. I prefer a nice and consistent method of liquidating a gift card. If I’m going into a WM with a prepaid card like that, it’s going to be a $500 version and not a $200

I also like to do things at home

If you have issues loading $200s your method makes it easier, true. Good alternatives are drying up.

I like doing things from home as much as the next guy, but the value difference in this case would have me out looking for a WM — or another little twist that could have the home method come out close or ahead.