I was driving the other day and when I’m on my “A” game, this is where I have some of my best thinking done. However, I’d rather not be driving an hour each way because I would rather learn something new. On one of the many commutes, this scenario keeps playing over and over and over… Sometime commuters have same goal.

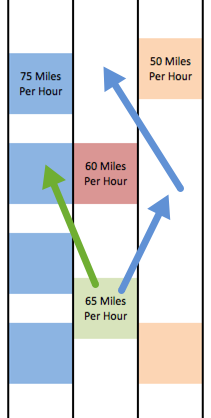

You’re on a three lane highway in the middle lane traveling at 65 miles per hour. In front of you is a car at 60 and in the right lane there is a gap between two vehicles traveling at 50 miles per hour. Finally, in the left lane there is a chain of four cars moving anywhere from 70 to 75 miles per hour.

You don’t want to stay behind the red car because it’s too slow. You are left with a decision. Do you zig and zag into the right lane to get back into the middle? Or do you wait until the fourth car passes you on the left and you jump into that lane traveling at 70 to 75 miles per hour?

What Do You Do?

If you take the zig and zag approach, it is risky because the red car is traveling at 60 MPH and is closing the gap next to the 50 MPH vehicle. You would need to accelerate quickly to pass the red car to get in front then switch into the middle lane without slamming into the slower vehicle. It’s risky, but not impossible.

Or take a “safer” approach is to let the final blue car pass you and you can switch into the left lane and pass the red car.

Either way, the main objective is trying to get in front of the red car. Think of the red car as an obstacle when you manufacture spend. The obstacle could also be risk of shutdown.

You can take the right lane approach and look at that being your limited time offers like the 5% cards for six months sign up bonus or a yearly cap like the AMEX Old Blue Cash. Also included in this approach are your other limited time offers.

If we take the left lane, I look at this as the more “sustainable” methods like gift card reselling, Nationwide Visa Buxx card, and other reliable methods.

What’s The Point?

The point that I’m driving home is that when you manufacture spend, it doesn’t matter which way you go. Take this example, you hit a store so hard and for a prepaid card that the store banned you. You got what you wanted, some spend, but now that relationship is over. This is like speeding up in the right lane and pulling those quick and fancy moves with the police pulling you over for speeding and reckless driving. There was a time when I was engaged in risky behavior in the manufactured spending sphere. As an example, I was paid out handsomely when a certain vendor paid out portal points to new accounts only. I skirted that rule and created a few new accounts. I was testing a few theories and many worked, but I stopped doing a lot of it because they crossed the line. There are various other I realized it was risky business so I stopped that quickly.

When a deal is announced to be over like the US Bank Visa Buxx, you should jump into zig and zag method because what’s the worst that will happen? A quicker shut down? I would also take this approach when there’s an expiration date on some of the stores in the Discover portal. The only time I would not hit the Discover portal hard is when we approach Q4. I take it a little slower because during the last quarter Discover usually pumps up the pay outs leading up to the holidays.

Keep this in mind too, when you learn of a new deal, you need to toe that line carefully. Making a decision to do the left lane or the right lane route is difficult. As an example, when someone figures out the secret sauce to gift card reselling, your once profitable gift card can be a break even or money loser. I have seen this happen far too many times and the volatility is maddening. Worse are the depressed resale values and I have had to retract from certain vendors altogether.

This is an ongoing battle and process where adapting to the situation needs to happen. There is no one size fits all solution and sometimes you have to take a gamble on the risky approach. It is risky for a reason like me losing $2000

Wow it’s RECTANGLES AND ARROWS!