As originally posted in Interesting ATM’s there is a special ATM called a Vcom where you can pay bills.

Reader pier11 and I have tested the Vcom ATM a few times and this is what we’ve come up with:

- Despite an option to reload a prepaid card, our experience is that you can not load a Bluebird or Serve account

- Bill Pays cost $2

- Nationwide Visa Buxx can’t be used at all

- Gift cards with PIN can’t be used at all

- Paypal debit card works

- Max amount may be $1000/transaction

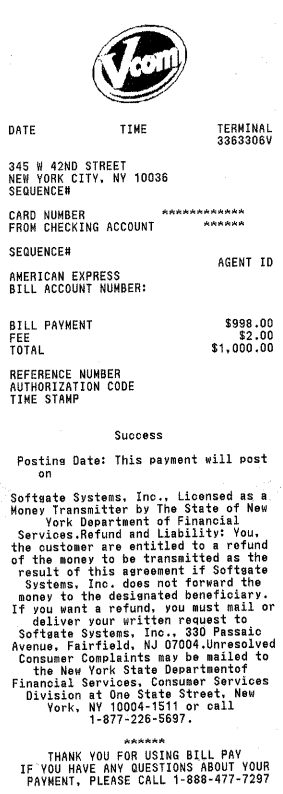

In the heavily redacted receipt below, I paid my AMEX card $998 using my Paypal Debit card. Based off the receipt, if the cards that do not have a “Checking Account” it looks like it will not work.

Manufacturing spend via Paypal + Vcom I am generating points at $.0049/point @ a 2x multiplier using my US Bank Flexperks and Chase Ink Bold. Total fees per 1k transaction, $9.90. 2016 points for the $1000 + fees for Paypal Cash Cards. 9.90/2016 = $.0049/pt. If you use a 1x card the cost would be twice that, and you would be paying about $.01/point.

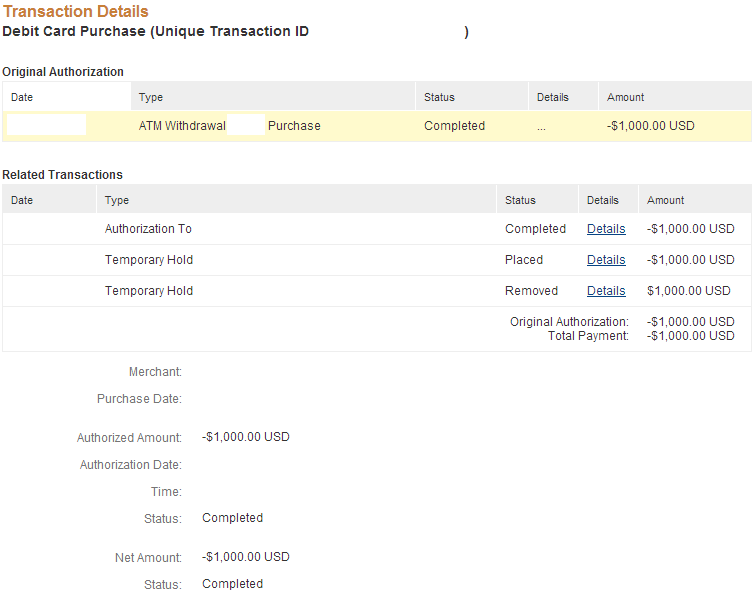

Below is the transaction details on the Paypal side

Nice success!

Looks the transaction is not settled yet. I think transaction description might change to better. So far “ATM Withdrawal” doesn’t sound encouraging 🙂

I think atm can pass 1K + $2 fee, i.e. $1002 at once. I remember it complained when I entered something like 1.3K (was descending in increments from 2K to figure real maximum)

Thanks – I’m going to try again with different cards, and can’t try any more with the Paypal card. I’m maxed out for the month

Are generating points with PP debit, or simply cashing out PP reloads? If the second, then ATM versus purchase doesn’t matter.

That said, how does the $0.0049 math work? What about the cost to load PP?

This bill pay is a debit transaction, so no points/cashback from PP.

Main credit card earns points when reload is bought. The math (as I understand OP) was to use 2x credit card for reloads purchases. Assuming 2 * $500 reloads, 2x credit card: (2*$3.95 + $2bill pay fee) / 2000points = 0.00495 points per dollar. (~0.5 cpm)

PP is known to shut people down for using product the way not intended from their point of view. Load/drain is one of such undesirable patterns. Read about MMS shut down with PP for example.

So the more transaction looks like a regular purchase the better. That’s why I was not super excited to see (thought temporary) “ATM WIthdrawal” in transaction description in the original post.

Thanks for replying to Tom-ct!

Pier11 is correct on all accounts. I am trying to figure out ways to liquidate the prepaid cards without Walmart access to free Gobank/Bluebird loads or buying money orders.

awesome.. but the costs involved are not small. I have access to WMT MOs so I’ll continue to do that. I was really hoping for an option to pay large bills for $2 and also avoid the WMT visit

What’s with credit union membership? If $2 fee eliminated then you might be good to go… in 1k chunks.

I haven’t had a chance to try out a credit union to find out more details.

Like pier11 mentioned in my post about triple dipping on buying miles if you can buy the Paypal Cash cards it would drop the cost significantly.

Wow, consider me impressed! 🙂

Me too, I’m excited for a new avenue to liquidate the Paypal debit card

@Chasingthepoints/Pier 11

Where are you buying the paypal reload with 2x multiplier, I dont understand how you getting 2x for US Bank Flexperks and Chase Ink Bold cards.

Do you think PP will shut you down for using your PP to pay CC bills? Do you know how this will work with tax bills? I am not loading and dumping but loading and actually “using” the card to pay for bill/taxes. Please advise!

Thanks.

I purchase the Paypal cash cards at 7 Eleven – so I everytime I purchase I use the Chase Ink Bold or US Bank Flexperks and receive 2x because 7 Eleven is categorized as gas.

I don’t know if Paypal would shut me down if I would go that route – I’m sure if I did loading/unloading using the Vcom they would. I use different methods of loading and unloading the card. On the rare chance I don’t use the aforementioned reward credit cards and buy at 7 Eleven, I would use my Citi card and buy at CVS to load my Paypal account. When I do that, I try to swipe use the PP card as much as I can to recoup the fee.

I have never used the Paypal card for taxes, so I can not speak on that front.

Walked nearby the atm, played some more:

– Looks 1K is a max to send to payee ($1001 was declined; $1900 was declined as well). It was towards my Chase CC with >2K debt on it.

– Found “Tagret” and “Target Visa” payees… Unsure if it of any benefit to us. Amex for Target?.. Doubt it. Rether some in-store credit card.

What is CU Swirl? Where did you see the info about waiving fees?

@korrinda CU Swirl is a consortium of credit unions under “CU Swirl.” Info for waiving fees:

http://www.fscc.com/cuatvcom

It looks like the shared credit union part of Vcom is separate from the bill pay feature and is contractually operated by different entities. I doubt the two dollar bill pay fee will be waived if you log in as a CU user. The sites that hype the sharded CU features don’t include bill pay. As it is, it looks like the best deal here is a $1000 bill pay at a cost of $2.00. MOs and Walmart are probably cheaper options for liquidation. And for what it’s worth, MVD works as a bill pay debit card on Vcom.

Thanks for data point.

WM is cheaper, but sometimes can not be as easily reachable as the atm.

Extra 0.2 cpm might very well save people time, gas and tolls to reach WMs…

What’s the transaction description on your card? Does it look somewhat legit?

Any suitable MO options we have other than WMs in NYC area?

I haven’t found anything similar to money orders at Walmart in NYC. It’s pretty tough out there with everyone requiring cash only.

Thanks for the input!

Here’s the description on MVD. CardtronicsATM@7-Eleven. Can’t say I like how it looks but what are you going to do? I assume MVD could shut me down any time and try to take precautions but you have to move the money off some how.