A couple of weeks a go I wondered how Chase may be ridding the Fairmont card because it is no longer displayed as an option on the Chase website. Doctor of Credit noticed this happening since July 2014. It’s definitely a normal occurrence for all credit card providers to send surveys and evaluate their product offerings to make it more competitive in the ever changing landscape.

However, to me there’s a pattern with Chase working in the background that’s causing me to speculate they are working on contracts with all of their Hotel partnerships. Check out this post on Doctor of Credit regarding the IHG credit card just a few weeks ago. In the post, the survey had several options for the credit card like different annual fees for different annual fees. The Ritz Carlton card has the on again off again 140,000 point offer and a newer free night for a Tier 1 to 4 hotel category. Chase is playing around with their issued cards and looking to see what’s the best offerings to acquire more customers and have them be the front of the wallet credit card.

In Will’s post on his predictions for 2015, he’s predicted a few things already in the survey. Quoting the post, which I hope I don’t butcher and change his meaning.

Because customer acquisition costs are so high, card issuers want to ensure they get good value out of their current cardholders.

Relationship bonuses will change.

Before releasing screenshots of the survey, I want mention that in the survey, the card is specifically asking if you were to have the new concept card, how much money would you put on the card per month. Would you find it compelling to find more information and sign up for the card. The relationship bonus is a feature in question in the survey. In it, it asks if a 10% rebate would be a compelling factor for you to sign up for the credit card. That being all said, I’d like to say Will’s predictions are pretty spot on.

The Survey:

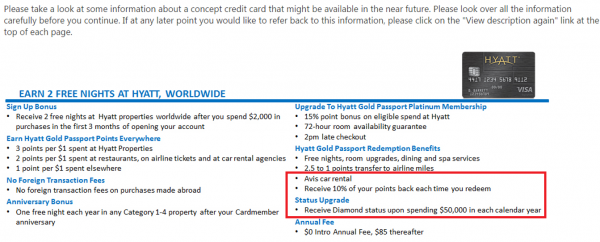

The survey is regarding the Hyatt credit card which currently has a sign up bonus of 2 nights at any hotel after spending $1,000 and a 3,2,1 points earning structure

The concept card that they presented is very much similar, instead of $1,000 minimum spend it is $2,000. Same 3,2,1 points earning as well. The only differences that I can tell are:

- “Avis car rental”

- Receiving 10% back in points upon redemption

- $85 annual fee

- Diamond status upon $50,000 in spend

To go back to Will’s points, if they make the card really attractive, they could make it your first card to use like the $50,000 spend. With the relationship bonus, they would be introducing a rebate a la the Chase Freedom 10% in Ultimate Rewards as well as earning Diamond status. It’s funny that Chase nixed rebates on the Freedom and Sapphire Preferred and is asking in a survey about the 10% for the Hyatt. To me, this looks like a direction that Hyatt wants to explore to make it special for being a Hyatt Visa card holder.

Some options I would choose in the survey:

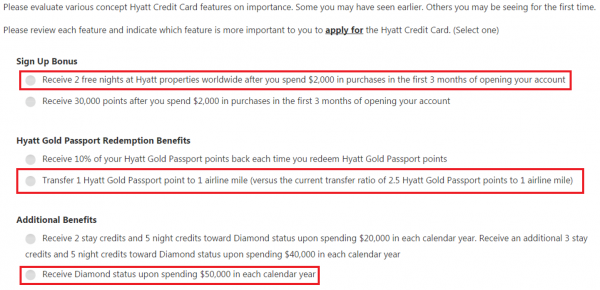

On sign up bonus, it is asking if you’d like 2 free nights at any Hyatt properties worldwide or a 30,000 points bonus. It also asks a benefit regarding the points, would you like to see a 10% rebate or a 1:1 hotel point transfer to airline miles. Finally, it also asks if you would rather keep the stay and night credits as it is now or would you choose the $50,000 spend for diamond status.

Conclusion

There are some very interesting survey options. Between what Doctor of Credit covered on the IHG credit card survey and Hyatt’s, I would love to see some of the new changes. I currently don’t have a Hyatt or IHG card, but if they made any of the changes, it could be on the top of my list to sign up and keep. Chase is definitely making it interesting and I would love to know who else have the surveys and can report back on.

I bet there are quite a few in this hobby who would be excited about getting diamond for $50K spend. I certainly would. Though I guess if you’re someone who is often close to Diamond, the top up of a few stay credits that they give you now for high spend would be preferable because the tiers are lower.

That’s a great point you raise, if someone is close and would prefer stay credits. I’m in the camp that is excited for Diamond + 50k spend

I have read some good stuff here