Whenever I make purchases on retailers I am not familiar with, I use two cards. They are any of my Chase cards, typically the Freedom, and Citi Forward card. I value Ultimate Reward and Thank You Points more than cash. Yes, there is the opportunity cost where I am giving up at least 1% not using the Fidelity AMEX that offers 2% cash back. However, what I learn using either of my go to cards is if the categories are applicable to many of the Visa, MasterCard, and Discover cards for bonuses. American Express codes the vendors differently than the other companies. We know that with a certain convenience store that may or may not sell gas.

It’s quite easy to find the categories on many of the cards among the big banks. It’s pretty easy on American Express as well.

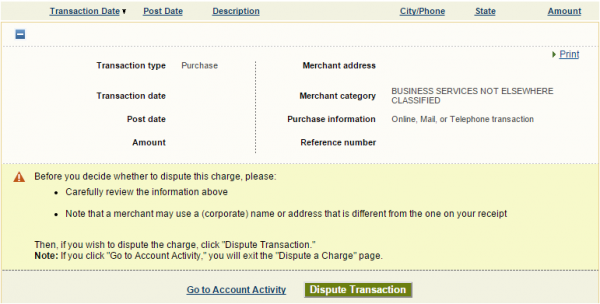

Chase makes you dig a little to find the details (you need to “dispute” a charge) for the MCC category:

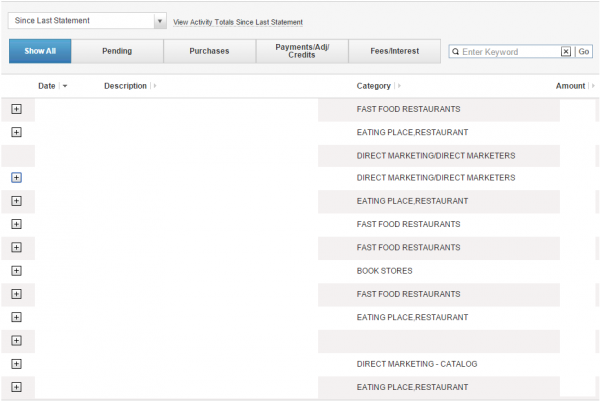

On my Citi Foward, it’s really easy without any digging:

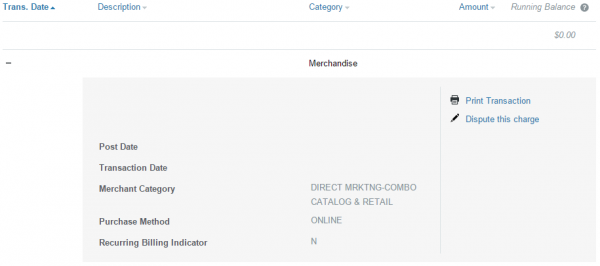

It’s also quite easy on Discover as well. I only do Discover in Q4 when they offer 5% back on all online merchandise purchases:

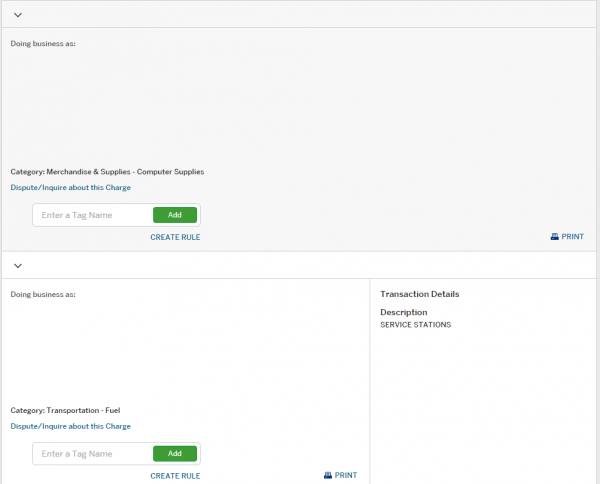

American Express:

So the next time you experiment with you purchases, you should consider the card to use. So far, I haven’t been pleasantly surprised, yet. I hope to find someone that will. I’m looking at you, all those Direct Marketing!

If you just want to know the category (MCC) of a merchant, use Visa.com/supplierlocator Usually that’s good for Mastercard and Discover too. Amex varies and doesn’t have an online lookup tool that I know of.

Yup, you’re right, the supplier locator is a great tool for Visa, Mastercard, and Discover.

I should have been clearer, in that this was geared for online purchases where it is not quite as clear what the MCC would be