Prior to working in New Jersey I was at a company in New York that has a $10 billion market cap. It was an interesting journey because I started that corporation as an intern and held several different roles. My experiences in a $10B company mostly revolved around “fighting fires” ensuring the systems were up and running for “business as usual processes.” My complaint were the projects that I participated in were mostly supporting development of using the cheapest solution possible or creating specialized solutions that did not make sense. Instead of solving the root cause, we were adding layers of complexity. I fought hard to stop developing processes that were not value add. For success of the business should have extra value.

Understandably, business rules and requirements change and subsequently, software deployed need to be modified, but it was incredibly frustrating when the requirements were always in flux. We could deploy the changes and 3 months later the requirements change again. The worst part are all the tedious testing scenarios involved. The company was completely engrossed in growth and the implementations were meant to be done today and then worry about the real fix tomorrow.

Today, I am in a $200 billion market capitalization company. With a large company, growth is not the biggest driver of change. There are so many processes and protocols involved to make any change. As such, any kind of business changes that require system changes are slower compared to my previous employer. Every business require extra value.

The one thing that sticks out the most in this large company is the process. Business as usual at a $200 billion company means everything is on autopilot and work is only involved when there are exceptions. The business is managed by exception.

The Look Of Manufactured Spend

Now, let’s turn to manufactured spending. The entire process is a business operation.

When you think about this for a second, during your manufactured spending runs almost everything you do is on autopilot. You go to Walmart or Target to feed your birds. You go to your favorite seller for Visa cards. All this is on autopilot.

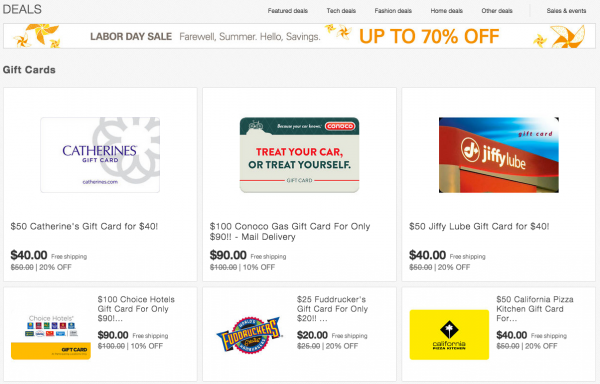

Now let’s look at managing through exceptions. These are deals that pop up that you need to make a decision. American Express checkout offer? AMEX sync offer? Bank of America BankAmerideal? EBay gift card deal? Huge portal payout? After you move past the growth stages, you will find some peace in working on the exceptions. Manufactured spending with the exception method is easier.

I remember just 6 months ago, I was attacking every online “deal.” I was doing that because I thought I could use it all because there was a sale. It wasn’t worth it. I was spending so much time engaged in disconnected, disparate manufactured spending that at the end of the day it was a drain and a struggle to liquidate back to cash. Remember that managing the exceptions, you need to pick and choose your battles. As an example, for Labor Day Weekend 2015, there were a few gift cards I could have purchased and profited from eBay, but the amount of work wasn’t within my interest level anymore.

Understanding the processes will set the foundation. Building a routine will help you get to an autopilot. Thinking outside of the box will bring you to the next level. Mentoring someone with a fresh set of eyes can teach you a few things too. Outsourcing will free yourself to begin finding value add to your work stream.

I appreciate articles about how to plan the game. By thinking about our decision process, we can make better decisions.

Definitely and it’s a tough behavioral change sometimes!

Very thoughtful reflections. Much appreciated.