Taking a page from Free-quent Flyer with his “Do This Now” series, if you don’t have a US Bank Checking account you should open one now. I mentioned in the past that if you are thinking about being a US Bank customer, you should open up a checking account. A friendly reader also left this comment:

The Gold Checking account trick appears to be true. I mysteriously got my AF refunded last month after PCing to the Amex product. I guess the CC and gold checking acct cancel each other’s fees!

So we have confirmation – Gold Checking + Flexperks American Express knocks each other out from the fees.

Why You Should Do It Now?

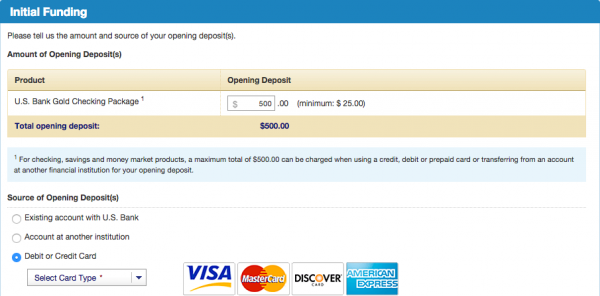

Doctor Of Credit lets us know that there’s a bank bonus for signing up, $125 and free points to opening up the account when you fund the checking account, up to $500. My assumption is that any credit card used will be coded as a purchase only because American Express is accepted. But you should also consult this resource on Doctor of Credit.

I actually opened my account a little over a week ago because I couldn’t wait for the bonus and my Flexperks anniversary is coming up and wanted the systems to sync so I would be properly refunded come August. I’ll have to chat with a representative to see if I can get the bonus match. To play it safe, I funded with my US Bank Flexperks card and it came as a purchase. If I were to do it all over again, I would have used my American Express Business Platinum card for $500 in spend for the 20kchallenge, but maybe it’s a good thing I didn’t because I see this comment on Doctor of Credit that a reader was charged a cash advance. There was a conflicting report about SPG on Fatwallet being charged as a purchase and both are American Express issued cards, so it’s a tough call with little data.

Thanks for the post. My wife is an authorized user on my US Bank credit card. Do you think that she can open up a no fee checking account because she has a US Bank credit card in her name even though she is not the primary on the account?

Thanks, I am new to this!

This one I’m not sure about. You could try the online chat, they’re pretty helpful. I want to say it is only applicable to the primary cardholder, because the checking account is tied to the primary cardholder’s SSN

I believe the Amex Bus Plat is a charge card so there should never be a cash advance when using it. I don’t think the SPG is… so they could very well treat a charge to open an account differently. Happy to be corrected here if I am confused, especially since I’m a little confused by the comment you quoted:

“The Gold Checking account trick appears to be true. I mysteriously got my AF refunded last month after PCing to the Amex product. I guess the CC and gold checking acct cancel each other’s fees!”

What’s PCing? And how is it that an Amex product cancels a US Bank AF? Is there a full explanation posted someplace that I could read?

Thanks!

Never mind! I just read your earlier post and get it now. Never having had a FlexPerks, I didn’t pay much attention when the Amex version was announced.

You should talk to Free-quent Flyer! He loves them, so do I

I thought I read somewhere about opening a free savings account at same time for an extra $500 in CC spend to fund the account for a total of $1000 for both accounts. I can’t find it anymore though. Anyone know if that’s true before my wife opens an account?

Yep Doctor of Credit mentioned that you can open the savings account with credit up to $500.