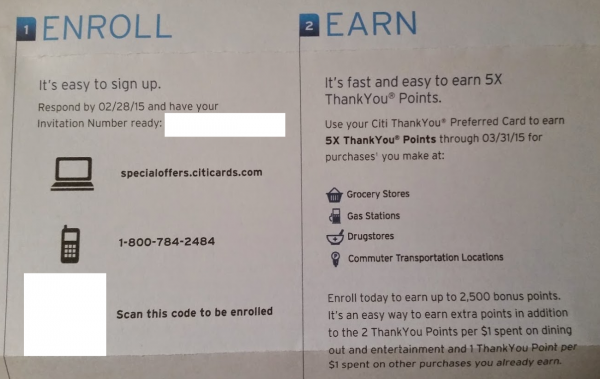

My mom has been a Citibank customer since 2004 and for whatever reason in 2013 without requesting, Citi product changed her Diamond Preferred to a Thank You Preferred. Citi is good with mailing out letters when it is targeted offers. And here is her offer:

This offer is for generous categories, but the dollar spend at $500 is not too generous. Either way, it’s a nice way for some extra Thank You points. I’ve been seeing various targeted offers have different categories, and obviously, this set of categories are the easiest to manufacture some spend.

Last time, Citi offered me this: after $600 in spend in these categories department store, restaurant, gas, or grocery stores for lounge passes. I like my mom’s offer a lot more at a round $500 because then all I need to do is buy 1 $500 prepaid card.

The below is an edit:

I visited the Citibank website and was able to copy and paste the terms:

1This offer starts upon enrollment and will end on 03/31/15. Earnings associated with this program will equal 4 bonus ThankYou Point(s) per $1 spent on eligible purchases and may overlap with other special offers in which you are currently enrolled. Bonus points awarded with this offer are subject to a maximum of 2,500 additional points. Eligible purchases exclude purchases made at discount stores, balance transfers, cash advances, convenience checks, items returned for credit, fees and interest charges. Grocery stores, including supermarkets, are classified as merchants that provide a complete line of food merchandise for home consumption. This offer includes convenience stores which are classified as merchants who sell a limited variety of food items. Gas stations are classified as merchants that primarily sell vehicle fuel for consumer use. Drugstores are classified as merchants that sell prescription and proprietary drugs and nonprescription (over-the-counter) medicines. Commuter transportation merchants are classified as merchants that provide mass passenger transportation including railways and buses, bridge and tunnel fees and temporary parking, but does not include the purchase of Amtrak tickets. All purchases must be posted during the promotional period. We do not determine how merchants are classified, however, they are generally classified based upon the merchant’s primary line of business. We reserve the right to determine which purchases qualify for this offer.

In order to qualify for this offer, the account must be open and current at all times. If your account is closed for any reason, including if you convert to another card product, you may no longer be eligible for this offer. You may receive more than one communication regarding this bonus offer with a reply-by-date of 02/28/15; however, if you have already enrolled in this offer, no further action is required. This promotional offer is non-transferrable and applies to the account ending in the last 4 digits referenced in this offer.

If you have transferred a balance to this account or do so in the future, interest will be charged on purchases made with your credit card, unless your purchases have a 0% APR, or you pay the entire balance (including any transferred balances) in full each month by the payment due date.

Did any one also notice that you can’t earn any bonus points for buying Amtrak tickets as part of the commuting expense?

The offer is actually on $625 spend- it’s 2500 “bonus” points, besides the regular 1 point you earn on these categories.

That is weird, I don’t see anything in the T&C about $625 in spend