I recently came across this thread on FlyerTalk and thought it was apropos because I was working on the math on some of the 2% cash back cards. As of writing this, I have 37 active credit cards issued in my name only and I do not think I have any more bandwidth to add additional cards. I will expand on this in the near future, but let’s jump back into the 2% cards.

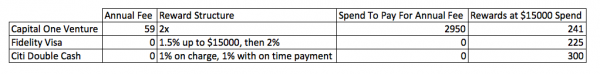

In the breakdown above, we’re looking at spending $2950 for the Capital One Venture card to pay for the annual fee. Meanwhile, the Fidelity Visa where you earn 1.5% cash back up to $15,000 then 2% afterwards you need to spend the $15,800 just to break even with the Capital One Venture card and that calculation is using the rewards to pay for the annual fee. Finally, the Citi Double Cash card is the clearest winner with the assumption that you are paying the credit card on time.

Astute readers will know, the Venture card isn’t a true cash back card as it is akin to Barclay’s Arrival+ card. However, as “travel hackers” we all have some sort of travel expense and tricks that could use this bank of points. I did not include the Arrival+ into my consideration because I have 3 Barclay’s cards and assuming the annual fee sticks, I do not want to pay for it. Personal Finance Digest plotted it would take $45,000 to break even for the Arrival+ a little while ago. The math changes after Barclay’s devaluation.

From the looks of it, Citi Double Cash appears to be the clearest winner. But Citi plays games as you will see what Ari left on Travel With Grant’s review. The one thing that I am leery of with Citi is the history of cash advances. I would love to load all my Buxx cards with Citi, but I don’t want to be loading my Buxx cards automatically and overnight my 2% method becomes a cash advance method.

Going For The Cash

For as long as I have had this blog, I was chasing the points. Every mile and point I snapped up. I “own” over 600,000 transferable points and over million miles across all the programs. The transferable points include Chase Ultimate Rewards, American Express Membership Rewards, and Citi Thank You Points with no end in sight on the accumulation due to the various programs and my every day spending.

As I’ve mentioned, I am switching the way I earn points, but for “regular manufactured spending”, my goal is now cash back which is why I have been looking at cash back cards a little closer.

Citi isn’t really charging cash advance fees often anymore which is a positive.

Definitely a positive! But I am still overly cautious with that because at any moment’s notice they could change it again

Is there a reason you don’t set your cash advance limit on your DC low and use it to load buxx? I haven’t done it myself. Do buxx loads need to initially post as a cash advance before converting to a purchase?

Both the Citi cards I referenced below had their CA limits intact — they did not initially post as CA, as Chase cards appear to do, I am not sure that Citi even has that functionality on their online system.

The debit went from pending to completed and is termed a purchase and there are no other fees of any sort surrounding or coupled with my purchases noted below.

I’ve left all my CA limits intact for all the cards because of how some purchases take the CA and then post as a purchase and don’t want to see a declined order

I can echo what William stated above.

I used my HHonors Reserve Visa to open both a US Bank Checking and Savings account and neither was posted as a cash advance.

More recently, my partner used their Cit Prestige card to load a NW Buxx card and that did not post as a cash advance, either.

It seems that Citi has re-classified these sort of transactions, perhaps in an effort to expand market share, just like they are doing with the various incentives its cards are offering when compared to AMEX and Chase?

That’s interesting, in the beginning, I think I saw it was Mastercard not processing as cash advances and now it looks like Visa is the same as well.

I’m not sure why they reclassified, but it’s a good direction for us

I find your blog posts hard to read, as if you’re talking to an old friend who already knows your inside jokes.

Thanks, I’ll keep that in mind for the future posts

This is a crummy post. It assumes (without making it clear to the reader) that you’ve already had the Venture card for a year (no AF the first year) and completely discounts the $400 bonus on the card. And so it’s accurate for someone in that situation. But many of your readers are likely deciding which of the cards to get, and this is a terrible analysis for them.

This is my analysis of the cards for someone trying to decide which of the two to get. The cards both earn 2%. Since the first year of the Venture is free, it takes eight years for the annual fees to completely eat up the $400 signup bonus. If you were to get both the Citi DC and the Venture at the same time, then the Venture would outperform the DC for the next seven years.

Considering there is no chance that I would keep the Venture that long without churning it, why in the world would I ever consider getting a DC instead of it? (I know that the answer is likely that the reader would not apply for the DC, but downgrade another Citi card to it, but you don’t say that to your readers.)

And all of what I just wrote assumes that I am unable to ever get the annual fee waived on the Venture—a situation that I think unlikely. If I can get the annual fee waived every year, then the Venture outperforms the DC indefinitely.

From my perspective, I don’t count the sign on bonus into the calculations because I don’t churn credit cards and look at MS’ing on the card long term.

Including the sign up bonus, I agree with your analysis. I am on the fence to recommending the double cash. With the Thank You Points improvements, I’m still figuring out which card is best.

Why choose Fidelity Visa over Fidelity Amex? Fidelity Amex has 2% on everything, can be used to load serve monthly and have the benefit of the amex offers.

I made a conscious decision to try to “even” the field by choosing the MasterCard/Visa front instead of the AMEX version

I have the Venture card as well as the QuickSilver card. I have completed the spending requirements for the Venture card already and I often find myself torn between which card to use. My intention was to use the Venture miles for a trip for the wife and I (maybe the kids), but I can just as easily use the cash back from the QS card and not redeem it until it is time to plan/book the trip.

I am very much new to MS and have been doing loads of reading up to this point. Hopefully I can figure out the best options going forward.

You should hang out in the Forum on Venture redemptions, they’re very similar to the Arrival+

If you are looking for cash back,

Chase AARP visa gives 3% cash back on food and gas. That plus Citi Double Cash gives pretty good rates of return. Then of course there is Chase Freedom/Discover 5% cash back as other options for additional cards.