Introduction to Today’s Manufactured Spending

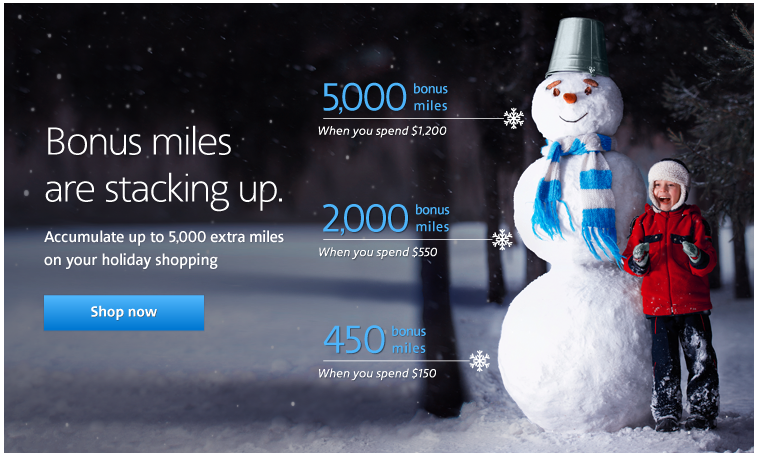

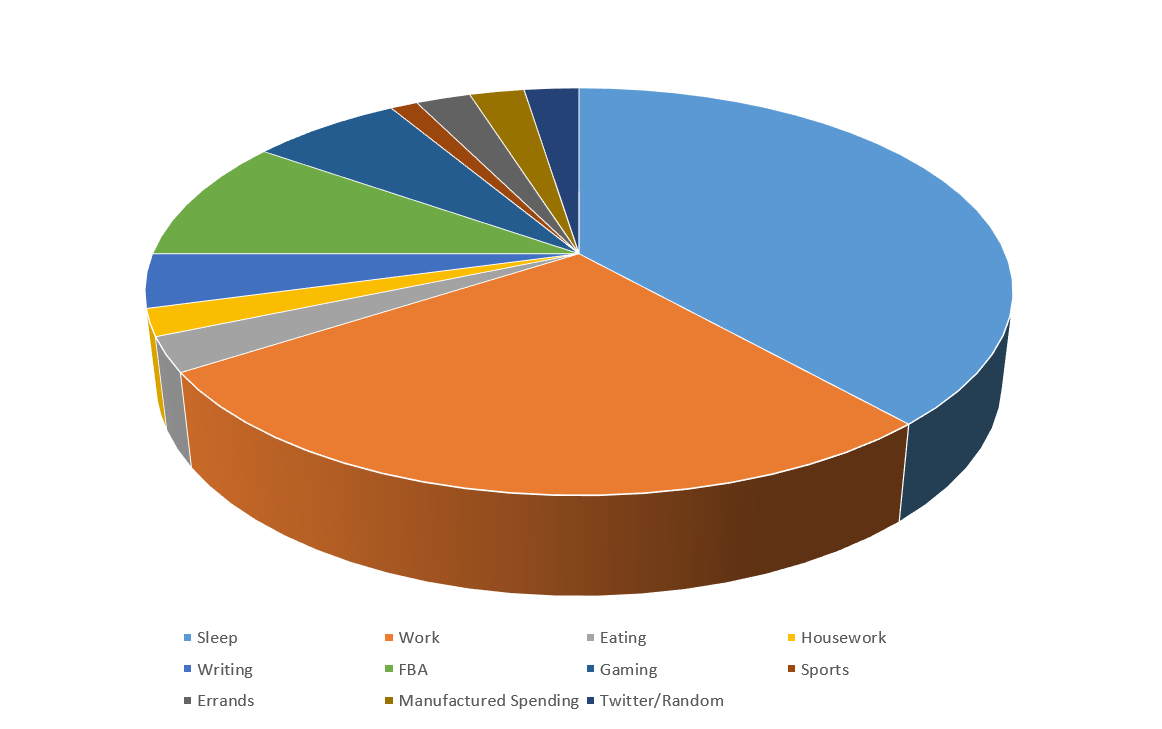

Many credit cards offer opportunities to earn miles and points from signups and putting spend on your credit card. So you put your regular—or organic—purchases on your miles and points earning credit card, but if you’re like me, you find that the miles just don’t add up quickly enough for that next planned trip! So…