For a while, Chase was the only bank that would pay for your hotel, meals, and more when your flight got delayed. But then Citi decided to up its game.

Update (05/282016) – It seems that the Citi Prestige/Premier (but not anything else) will cover fares paid with ThankYou points.

When Citi revamped its AAdvantage and premium credit card products late last year, they also significantly expanded the trip delay reimbursement benefits along with it. Citi’s decision was clearly aimed to position themselves more competitively with Chase, who’s been offering trip delay benefits on a select number of Visa Signature products since forever.

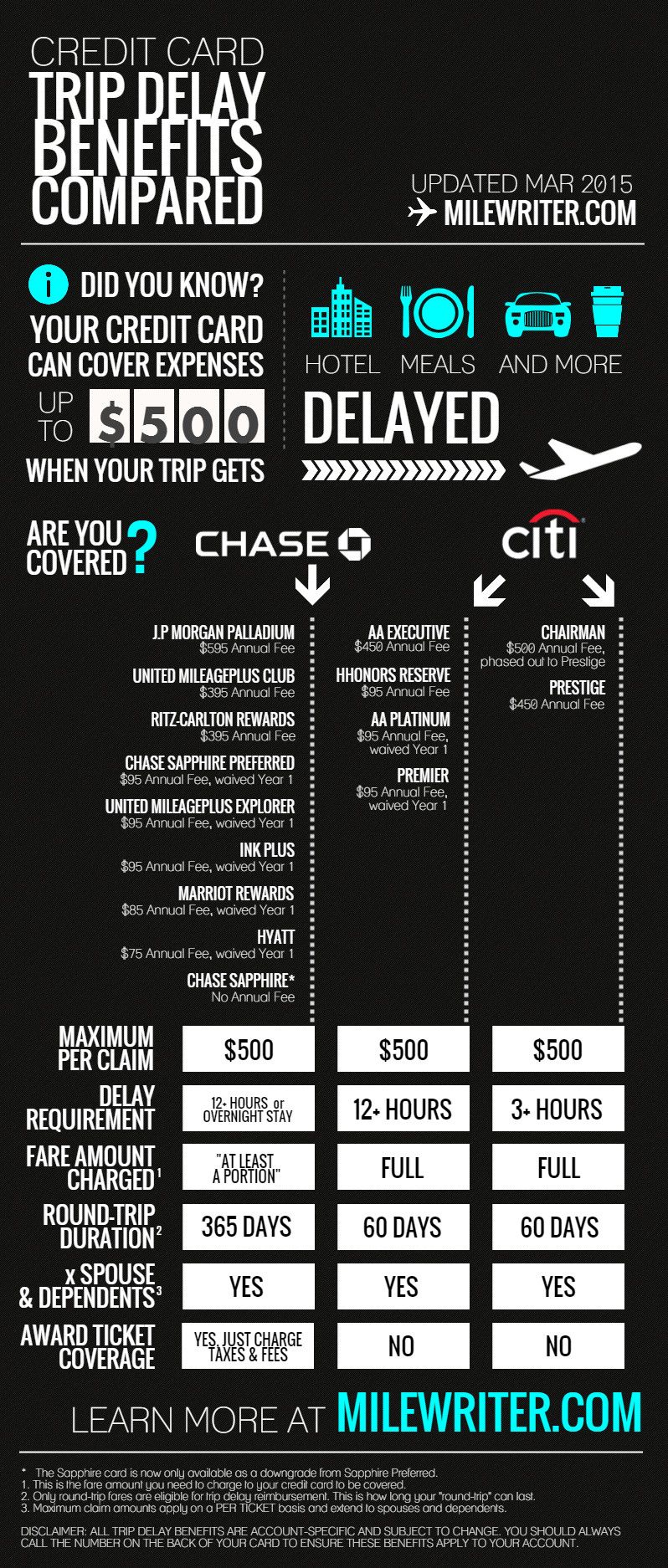

The benefits are structured mostly the same (you’ll be reimbursed for accommodation, meals, and other reasonable expenses incurred by an extended flight delay), with a few key differences in how long the delay has to be and whether coverage extends to award travel.

Chase requires delays to be longer than 12 hours or require an overnight stay. This is important because 12+ hour delays don’t happen too often, while missing a late-night connection because of a delayed first flight happens all the time. Citi knows this, and their mid-tier products are noticeably silent on the “overnight stay” provision.

But if you’re willing to shell out $450 a year for Citi’s flagship Prestige card, your trip only has to be delayed three hours for coverage to kick-in. Since the Prestige card offers the same market-standard $500 claim cap, this is pretty generous. There’s no word on whether a hotel charge for a 3-hour delay would be considered “reasonable,” however.

The other major difference is that Citi requires you charge the full fare amount to an eligible card to activate coverage. Presumably, this means award flights booked with miles are not covered through Citi. I’ve heard that travel booked with ThankYou points (through Citi’s booking portal) may be covered, but be warned that this exception is no where to be found in Citi’s official benefits guide. Chase only makes you charge “at least a portion” of the fare to an eligible card, which means award tickets are covered as long as you charge the taxes and fees appropriately.

So there’s no clear winner in the trip delay reimbursement game. Citi’s Prestige card offers the most generous provisions, but you’ll pay dearly in hefty annual fees.

The value proposition and trade-offs will vary for each and every traveler, and what better way to weigh the pros and cons than with an oversized infographic? Here’s what you need to know (click to enlarge):

This disclaimer is worth repeating: All trip delay benefits are account-specific and subject to change. You should always call the number on the back of your card to ensure these benefits apply to your account.

This disclaimer is worth repeating: All trip delay benefits are account-specific and subject to change. You should always call the number on the back of your card to ensure these benefits apply to your account.

Great chart! A couple of comments on the Citi details:

The Citi AA Executive card has the 3 hour coverage like Prestige and Chairman. The Citi AA Platinum ($95 annual fee) and Gold ($50 annual fee–not sure if there’s any way to apply for a new Gold card, though) have the 12 hour coverage.

While the Citi AAdantage and HHonors cards that have the trip delay coverage say it’s a requirement that, “The trip was paid for in full including taxes and fees with your Citi card,” the Premier and Prestige card benefits guides say, “The trip was paid for in full including taxes and fees with your Citi card, Citi reward points or a combination of both.” So it’s pretty clear that tickets bought with ThankYou Points qualify if you have one of those two cards.

It’s not clear to me whether other kinds of reward tickets (particularly those purchased with airline miles) are covered or not. The “paid for in full” language implies that they aren’t covered. But the the Baggage Delay Protection benefit includes the identical “paid in full” requirement and goes on to specifically say that a trip is NOT covered if “Your travel is free because you use travel awards, such as airline points, vouchers or free companion tickets.” The Trip Delay Protection benefit terms do not include that specific carve-out.

You mentioned “Chase only makes you charge “at least a portion” of the fare to an eligible card, which means award tickets are covered as long as you charge the taxes and fees appropriately.” does this mean you need to charge the full amount of taxes and fees or just partial ?

The reason I ask is I had to make a change and used a different credit card to pay for additional taxes and fees.

thanks

Please let me know if you’re looking for a writer for your site.

You have some really great articles and I feel I would be a good asset.

If you ever want to take some of the load

off, I’d absolutely love to write some content

for your blog in exchange for a link back to mine. Please blast me an e-mail if interested.

Regards!

FYI, Citi Prestige now requires only a portion of the fare be paid, like Chase. It’s spelled out clearly in the current benefits guide (and in contrast to the previous version of it).