Chase will pay for your hotel, meals, and more (up to $500) when your trip gets significantly delayed.

Update (05/28/16): If you’d rather read through a few example scenarios of how this benefit actually applied to my delays, click here or here.

Which Chase cards offer trip delay reimbursement?

When and how does this benefit apply?

How do I file a claim?

What’s a “reasonable” expense?

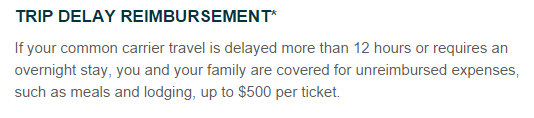

Check it out:

Which Chase cards offer this benefit?

- Chase Sapphire Preferred

- Chase Sapphire (now only available as a downgrade from Preferred)

- United MileagePlus Explorer (personal and business)

- United MileagePlus Club (personal and business)

- Ink Plus Business Card

- Marriott Premier Rewards

- Ritz Carlton Rewards

How to get covered:

- Call the number on the back of your card to double-check if you’re covered. Even if you don’t see your card listed, it might be worth calling to see if trip delay reimbursement has since been added.

- Charge at least a portion of your fare to an eligible card.

- This means that award tickets are also covered as long as you charge the taxes and fees to your card.

- Be traveling round-trip and not know about any delay in advance of your departure (i.e. if your airline cancels flights in advance and tells you to stay home, you should).

I’m not sure whether whether Chase or Visa actually underwrites this benefit, so it’s possible that you’ll find trip delay insurance offered on other Visa Signature products. This benefit is, by the way, different from trip cancellation/interruption and baggage delay coverage, which I’ll cover in a separate post.

When and how does this benefit apply?

If you’re a contracts nerd like me, you might enjoy reading through Chase’s fascinating discussion of Covered Trips, Covered Hazards, Covered Carriers, and other Capitalized Legal Terms and Exclusions To These Capitalized Legal Terms. Otherwise, read on.

When you’re covered:

- Your trip is delayed more than 12 hours. Thankfully, this doesn’t happen too often.

- Your trip is delayed so that it requires an overnight stay. This happens all the time. Have you ever missed your connection and been stranded in an airport overnight because your first leg was delayed? Or had inclement weather put your travel plans on indefinite hold? You’re covered.

What is covered:

- Up to $500 in reasonable expenses per ticket – as long as at least a portion of all tickets was charged to an eligible card and the ticket is for an immediate family member.

- This means that if you purchase two tickets on your eligible card, one for you and one for your spouse, you are collectively eligible to file a claim for up to $1,000 in reimbursements!

- Reasonable expenses include hotel accommodation, meals, ground transportation, necessary toiletries, and so on.

This benefit is the most useful when your airline refuses to provide meal/hotel vouchers because the cause of the delay is outside its control (i.e., inclement weather). However, it can also be useful if you just want to skip a long customer service queue or would rather stay someplace nicer downtown when your airline offers to put you up in a nightmarish airport motel.

Before you file a claim, you should note the exclusions:

- This benefit does not cover tips or alcohol, though you might get around this by billing these charges to your room.

- This benefit does not cover extra-long overnight layovers you knew about in advance.

- I would also imagine that this benefit does not cover delays that are your fault (e.g., I slept-in and missed my flight or I got lost in the airport).

How do I file a claim?

Call the number on the back of your card and explain that you’d like to be transferred to a benefits administrator to file a trip delay claim. You need to initiate this process within 60 days of the delay. Your benefits administrator will email you a 2-page claims form. This is due within 100 days of the delay.

To file a claim, you’ll need:

- An airline receipt showing that the fare was charged to your eligible card.

- Your credit card statement specifically showing the charge made to the airline. This isn’t required in the benefits guide, but they’ve asked for it every single time I’ve filed a claim.

- A copy of your tickets. All. your. tickets. More specifically, the ticket for your original trip as well as the ticket for your delayed trip. A copy of your itinerary might not cut it. You’ve been warned.

- Receipts for incurred expenses. Sounds fair. Remember you’re covered up to $500.

- A statement from your airline explaining why your trip was delayed.

I’d also recommend a scanner or mobile scanning app like Cam Scanner because sending all these documents by mail would be a pain.

What qualifies as an airline statement?

The airline statement is by far the most confusing requirement. Some people have told me that you can request an official letter from the airline after your trip. Others have suggested to take a screenshot from a third-party website that tracks delays.

But do you really trust your airline to follow-up with all the necessary documentation in a timely manner? Would you trust any claims adjustor to allow extra leeway in claims requirements??

Maybe, but I don’t. I’m too impatient or cynical, so I ask for a military excuse while I’m still at the airport.

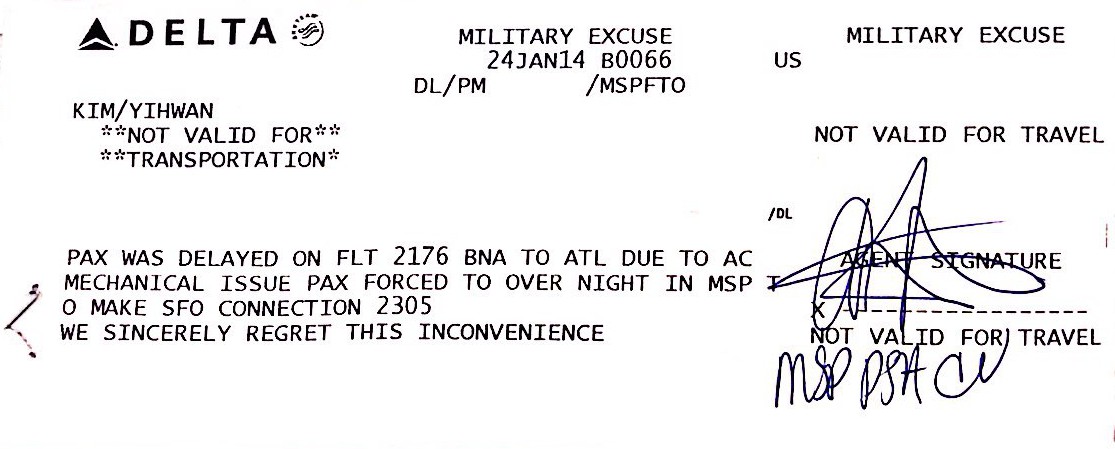

A military excuse looks something like this:

I’ve found that not all airline customer service agents know how to write a military excuse. So you might have to ask for a supervisor to get it.

When you find someone who can help, give the agent some background on why you’re requesting this special documentation and politely request that they specifically mention:

- That you were delayed.

- Why you were delayed, preferably using one of the eligible reasons I list in the previous section.

- That this delay was longer than 12 hours or required an overnight stay.

All of this may sound like overkill, but it’s worked flawlessly for every claim I’ve filed in the past year. And since I proactively provided all the necessary information (and maybe more), all of my electronically-submitted claims have been processed in full within a week of submission, and I’ve typically received a check in the mail within 2 weeks.

What’s a “reasonable” expense?

Chase specifically names meals, lodging, toiletries, medications, and “other personal use items” that you encounter during a delay as “reasonable” expenses. That’s a pretty generous range.

But some people ask if they can push the envelope on how much they can spend for hotels and meals. Can you, for example, live it up in a luxury hotel downtown when your airline only offers to put you up at some sketchy airport motel?

I honestly don’t have a good answer for this, but I encourage you to follow a Flyertalk thread that discusses this very topic. In the previous example though, make sure you decline any hotel or meal vouchers from the airline if you don’t intend to use them. Instead, ask for miles.

The general rule of thumb seems to be that as long as your expenses are less than $500 and you don’t go too crazy, you’ll be all set.

That’s it!

Chase offers best-in-class trip delay benefits on many of its credit cards, significantly better than what’s offered by Citibank (which caps the number of claims) and American Express (which doesn’t offer delay reimbursement at all).

Updated 19 March 2015: Citi’s upped their game. You can see the key differences between Chase and Citi Trip Delay reimbursement policies here.

Best of all, this benefit extends to the cardholder, the cardholder’s spouse, and the cardholder’s dependent (21 or younger) children. You just have to pay with your eligible card.

I hope you’ve found this guide helpful. Remember, your trip delays don’t have to be that stressful!

If you use your Chase Sapphire Preferred card to pay taxes and fees on award tickets and are expecting reimbursement for trip delay coverage, note that you will only be reimbursed the amount up to what you paid for taxes and fees. In my case, it was $69. Not worth the paperwork and effort. Also, claims can be made online at eclaimsline.com.

Really? That’s interesting – it’s not mentioned in the T&C’s. Let me look into this – thanks for the heads up!

Hi, did you ever find out about this? I’m planning to book an international award soon and would really like to know. Planning to charge taxes and fees to Chase Sapphire (no AF verison), but they’ll only be about $100.

Hi Matt, I did and I couldn’t find any information to support the idea that award booking reimbursements are limited to taxes and fees.

This caveat isn’t mentioned anywhere in the T&C’s and the benefits administrator I spoke with over the phone said the claim limit is always $500 as long as portion of the fare (i.e. not taxes, but a charge that is part of the fare construction itself) is charged to the card. It also sounds like a counter-intuitive and inconsistent limitation in the first place. Why cap claims on just award flights? Why not cap claims to the actual fare paid (e.g., if you pay $200 for a round-trip fare, you only get up to $200 in reimbursements). The latter is not the case, so I don’t see why the former would be.

As always, your miles may vary. Hopefully your flight doesn’t get delayed so you don’t have to worry about this in the first place.

\ Safe travels!

I am still waiting to hear back from my primary insurance (Chase is secondary insurance only) and will only know what Chase does when I finish my claim to them by telling them how much I got from the primary insurer. I had travel insurance as my primary insurance. I guess if I had no other insurance, they would have become my primary. Not sure. Will keep you apprised,but it will be a couple of months. These claims take a long time.

I was just told by a Chase Sapphire Benefits person on the phone that I might not be reimbursed for a trip delay caused by carrier cancellation because of volcanic ash which clouded the air and made flying dangerous. He said it had to be “inclement weather” and ash from volcano eruptions doesn’t count as “inclement weather.” This seems totally wrong per the definition of weather, so I am hoping he is wrong or referring to a situation where there was no carrier delay, but someone claimed, “I was late because of a volcanic eruption” without more. If he’s correct, I’ll try to remember to let you know.

Also, I charged six tickets on Chase, all for family members, but he said they would reimbursement me only for the tickets for myself and my husband because the other family members were not “dependent children.” Again, this seems wrong to me since my husband and I were paying all expenses for everyone on the trip. Will try to remember to let you know the outcome.

Hi Jane, thanks for this information about your situation.

It is interesting that Chase is trying to deny a claim under a strict definition of “inclement weather.” The benefits booklet I have does not specifically limit coverage to Covered Hazards, but rather lists examples of them. You might have better luck calling a different representative and saying that the cause was an “Act of God” or “force majeure.” I’m not sure if force majeure is specifically listed, but IIRC I do think “labor disputes” are – and labor disputes qualify as force majeure under most definitions. Please let us know how that works out! Alternatively, just say that there was a volcano eruption and let the representative figure out which category it may or may not belong under.

The language surrounding family members is more clear: only your spouse/dependent children are covered. So unfortunately parents, grandparents, uncles, aunts, etc. would not be covered (or at least, the maximum claim limit would not be increased for these non-covered family members).

I hope that helps, and please do keep us updated on further developments!

You mention the need to be travelling on a round-trip, Do you know if a multi-city booking would qualify? would it qualify if there is an open jaw at the destination?

Hey Jacob – I believe Chase defines “round-trip” as any trip more than some number of miles away from your home – and then back within a year. You should double check this in your benefits booklet though.

So yes, open jaws and multi city itineraries should technically qualify, even though I’ve read some reports of CSRs claiming otherwise. As long as the benefits booklet has a specific clause that supports the definition of “round-trip” I outline above, you should be reimbursed.

Let me know how your experience goes! Would love to get some concrete data points.

Recently used the Trip Delay benefit as our flight home (from Europe) was cancelled due to air traffic controller strike. I had booked United Award flights but paid the taxes/fees on my United Visa card.

We called Chase before making arrangements to get home to see what was covered. I saved the webpage showing the airline cancelled our flight for that day, which was sufficient for my claim. In addition, my statement showing 2 round trip award flights were paid on the card, and all receipts were submitted online.

Chase covered our expenses: lodging (apartment i booked since I figured same cost as a hotel), subway tickets, taxi to airport, meals, and toiletries. It took a few months but they also had to translate receipts. Happy with the experience overall. Great benefit to having the card! They paid my entire claim minus $50 for alcohol and tips paid to restaurants.

Does Chase’s Trip Delay Insurance cover you if you get delayed at your airport of origin? Say I went to my home airport for a noon flight, but due to inclement weather, the flight ended up being delayed until 8pm that evening. Would I be able to reimburse meals during that time? Thanks!

The last time I checked the benefits guide (which was admittedly a while ago!) I believe there was a requirement saying that the delay needed to occur some amount of miles (I think it might have been 30 or 50?) from your home. So presumably, if the originating airport was far enough from your home, you would be covered. I’d check to see if there is a comparable clause in the most current benefits guide.