Avoiding sales tax while shopping on Amazon is actually pretty simple. But at the risk of stating the obvious (did everyone already know to do this?!), I figured I’d share it here anyways.

I should also mention up-front that this will allow you to avoid paying sales tax at the point of sale. You, and only you, are responsible for reporting online purchases in accordance with your state’s “use tax” regulations when your annual tax bill rolls around.

Also, any debate over whether paying taxes is “patriotic” or “the right thing to do” is outside the scope of this article. To engage in such discussion, please bypass the comments section entirely and head on over to Biden’s annual BBQ Buffet – I hear they serve a mean Cuban.

Anyways, here’s the tip:

Always check third party seller pricing before checking out.

Due to all the legal whos-it-whats-its of incorporation, trans-state transactions, and fulfillment processes, the sales tax that might apply to an item “sold and shipped by Amazon” often doesn’t apply to one of the third party vendors selling that very item.

More often than not, you can find a third party selling the same item at the same (if not lower) price – with Prime shipping to boot. I’m no expert on FBA and re-selling, but I suspect that sometimes it’s also the exact same physical item being sold through multiple channels. Crazy.

Again, this might strike a lot of people as obvious – but it was definitely a light bulb moment for me. Most of my Amazon purchases are through 1-Click™ orders on mobile, so I don’t always think to shop around.

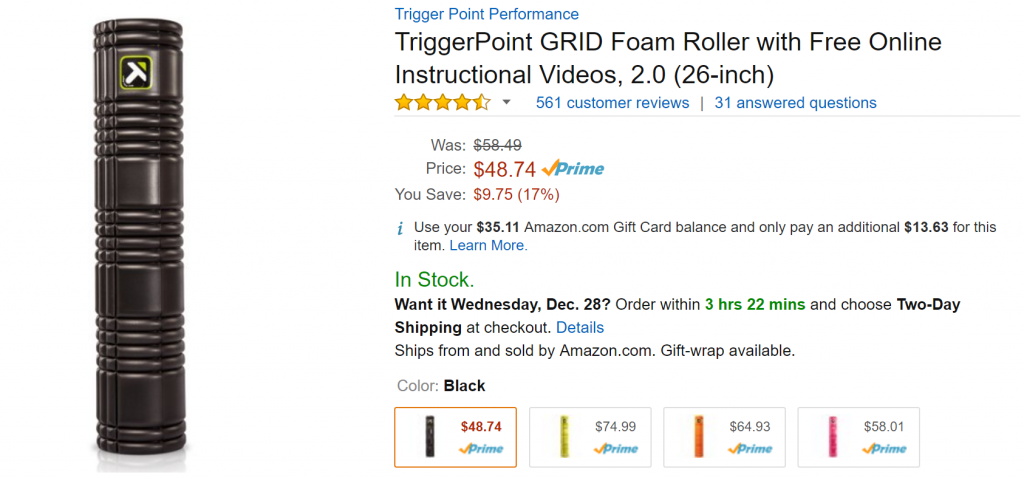

Take for example this medieval torture device I was looking to buy earlier this month:

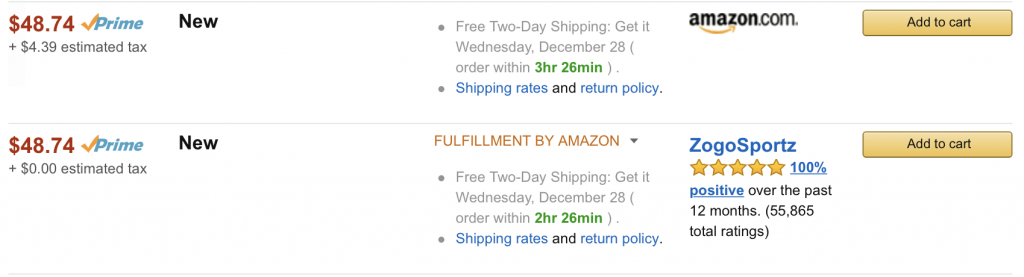

Living in the lovely Los Angeles, I have to pay an additional 9% sales tax at check-out, which works out to about $4.39. But after clicking on the “other sellers on Amazon” button to the right, I noticed that a third party was selling the same item, at the same price (down to the cent), with Prime Shipping since it was fulfilled by Amazon.

Since Zogosportz seems to be based in Utah (best I can tell), they don’t apply sales tax at check-out:

Obviously, you won’t find an out-of-state seller for every item you buy on Amazon, but it doesn’t hurt to take that extra click to check. You’ll also be supporting wonderful small businesses who sell through Amazon – and who knows, probably a few like-minded re-sellers too.

But remember, while you won’t have to shell over sales tax at check-out, you’re supposed to report all out-of-state/Internet purchases to figure out what taxes you owe when you file every year. So yeah, um. Do that, please.

The obvious is not always so… so great idea for sharing!

Also funny with the product you chose! I used to sell those…though not sure that it was that size. TriggerPoint did send me a couple of nastygrams, but gosh were they great margin….

Hah – you re-sold foam rollers? That’s quite a diversified portfolio! 🙂

Thanks for the tip, never thought of it!

Thanks for the advice. Amazon just started acting as the tax collector in Utah and I’m ready to ditch my prime membership. I love the two day shipping but if I’m going to pay sales tax, I’m not really saving much.

Secure Arkansas wrote an article “Amazon Took Over Collecting illegal Sales Taxes for the State” that explains what is really happening with unconstitutional collection of the sales taxes. The article can be read at this link https://securetherepublic.com/arkansas/2017/07/30/amazon-took-collecting-illegal-sales-tax-states/

1992 Supreme Court decision in Quill Corp. v. North Dakota held: “requiring collection of tax by out-of-state retailers with no physical presence in a state would be burden on interstate commerce and would therefore violate Commerce Clause of U.S. Constitution”.