This post is sponsored by Allianz Global Assistance (AGA Service Company) and I have received financial compensation.

We had a really good conversation recently about Why Chase Sapphire Travel Insurance is not enough. The post generated a lot of comments and questions that I want to address further. Allianz and Traveling Mom are working together to promote travel insurance annual plans. They asked me to dig deeper into the options and share my thoughts.

Review: Why you need travel insurance

Five Star Service You Don’t Want

That’s Deal Dad’s hospital bed in Gran Canaria. He spent five days of last year’s spring break in that bed. While it was stressful and basically a nightmare, it wasn’t expensive thanks to a $38 policy from Allianz. $38 instead of a $5,000 hospital bill? I’ll take it.

The daily routine I didn’t see coming.

Here’s Deal Girl’s antibiotics in Vietnam. She came down with a fever on the plane between Hanoi and Danang and had full blown tonsillitis two days later. Fun fact: western medicine is widely available in Danang, but kids’ formulations? Not so much. Tonsillitis + horse pills does not a happy kid make. We ended up dissolving the pills into an soda.

The bill for Deal Girl’s hotel room call and medicines? $80. The bill for my hotel room visit and drugs four days later for bronchitis in Hong Kong? $400. Allianz paid for both within 10 days.

Nuff said?

Travel Insurance vs. Credit Card Insurance

It’s that simple.

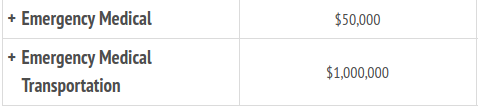

Travel insurance covers medical and evacuation at levels you can actually use: credit card insurance might cover one or the other but none covers both. I covered Chase Sapphire Reserve in detail last time. I’ve since learned that American Express Platinum and Citi Prestige also cover evacuation but will be no help with medical bills.

Travel Insurance vs. Medical Insurance

Your standard medical insurance will cover you when you travel- it’s a matter of how quickly and how much. By default you’re out of network so will have to pay higher copays if your plan requires them. Domestically you may be fine, but our hospital bill in Gran Canaria was 24 pages long…in Spanish. I’m so glad I didn’t have to submit that claim to my medical insurance company!

Travel insurance is primary- meaning no copays or network hassles. I’ve had three claims and all got paid within two weeks.

Travel Insurance Annual Plans: Pro and Con

Many of you asked me the pros and cons of annual vs. each trip plans. I shared that I have an annual for myself via Allianz and buy for Deal Dad and the kids as needed. I use the $125 basic annual plan for singles. Going forward I may put everyone on an annual depending on Deal Dad and the kids’ travel plans.

The pro of going with an annual plan: set it and forget it. Existing conditions are going to be covered because you already have the insurance in place- no worrying about buying the insurance within 14 days of the trip. You can also choose not pay for the pieces you don’t need such as cancellation if you have a credit card that takes care of those. My main reason for buying travel insurance over and above the credit cards is medical- the annual plan takes care of that piece for an affordable price.

The con of annual plans: you have to pay for every family member. With the trip only plans you can buy insurance for the adults, then the kids are free. It may be more cost effective to buy as needed for the less frequent travelers in your family.

Allianz has a new option only available via phone: The Premier Annual Plan. Starting at $450/year, it covers an entire household up to and including grandparents if they live with you. It could be a real cost saver for families. I’m definitely checking it out for my own family.

What are your thoughts on annual plans? Any other questions? Please share in the comments.

The Deal Mommy is a proud member of the Saverocity network.

Thanks for the info.

Instagram: worldtravelguy

Pingback: How do you make your money work for you? - Frequent Miler

Do you by any chance know if the credit card insurance covers you if you pay by Plastiq with the credit card? My gut feeling is no, but I haven’t looked into it yet. Thanks.

Haven’t tried it, but I agree with you.