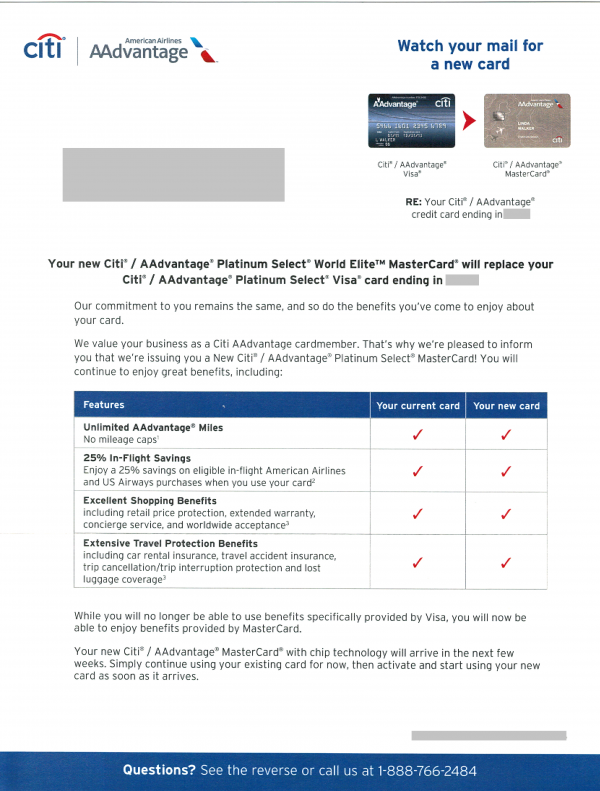

You’ve probably been getting lots of mail and email relating to the AAdvantage/US Dividend miles programs. Lots of it is just marketing nonsense, but if you have a Citi AA Visa card you might want to double-check that mail. It might be bad news, not junk mail! It seems innocent enough: ‘Your new Citi® / AAdvantage® Platinum Select® World Elite™ MasterCard® will replace your Citi® / AAdvantage® Platinum Select® Visa® card ending in ****’. All of the card benefits and fees seem to remain the same. However, this card type change may be a major problem due to Citi’s new rules for churning cards.

In the past, Citi had unofficial rules for churning that seemed to be ‘whatever the computer decides’. Generally, most of the time, you had to wait somewhere between 12 and 24 months after opening an AA Platinum level card to open another one. It didn’t matter whether the card was Visa, Mastercard or the Citi AMEX AA card – only the opening date mattered. In fact, there was no need to close any AA card, ever. Also, back then, if you got the card you got the bonus. Occasionally Citi’s computers changed the rules and allowed monthly churning, and many of us got two or three Platinum level cards in Summer 2013 during one of those periods. I had since closed or product changed all but one – the one Visa card that this letter from Citi pertains to.

No mention of the 10% rebate on redeemed miles, but I assume that stays too. I’m not sticking around to find out!

Citi’s new policy will allow you to get a card before you are eligible for the bonus and then not give you the bonus you expect. Also, the card type is now part of the terms and conditions that are enforced. From one of the links out there now: ‘American Airlines AAdvantage® bonus miles not available if you have had a Citi® / AAdvantage® Platinum Select® MasterCard® opened or closed in the past 18 months.’ [Edit: be very careful to check the language on both the landing page and the offer, as some require an 18 month wait after closing any Platinum level card!]

I checked my spreadsheet and, sure enough, I closed my most recent AA Mastercard back in January 2014. If I allowed my Visa to get converted to a Mastercard I’d likely be resetting the clock for my next Platinum level card and accompanying 50,000 mile bonus. In my Citi account my AA card account still shows up as a Visa, so I called Citi to do a product change. I’ve been thinking about doing that anyways to get either a Double Cash or Thankyou Preferred card account. Interestingly, the rep said I could convert to a ThankYou preferred Visa or Mastercard, and that the account number would remain the same if I chose Visa. Yes, please! The only reason I’m doing this product change right now is to avoid holding any kind of AA Platinum Select Mastercard!

While I may lose the 10,000 miles I could have earned in rebates this year, I can live with that. Or maybe I’ll get a new Mastercard in August, in time to take advantage of the rebate. Most of our miles are in Bonnie’s account anyways, and she has both the AA Platinum Mastercard and the Barclays AA Aviator. We won’t know for a while whether AA will in fact give the 10% miles rebate for each of those cards for a maximum of 20K, or not. Her cards also get us the baggage fee waiver, and none of the other benefits of my now-downgraded card matter to us. Here’s hoping I can get in one of the sweet 3X everywhere offers that some have gotten for the ThankYou Preferred card!

The language on the back of the letter makes it sound like all AA Platinum Visa cards will be converted to Mastercard. Check your mail, and decide for yourself if you want to let Citi potentially screw up your ability to get a bonus on the Citi Platinum Mastercard next time you’re eligible! For anyone currently eligible, here’s a link that specifically excludes Mastercard holders within the past 18 months, where some other links exclude all Platinum level cards. Again, check all of the T&C carefully! [Edit: A friend contacted Citi and was told that the card would be converted on expiration, but mine wasn’t set to expire until August. You may have more time before you have to do anything, but definitely keep an eye on mail from Citi.]

Disclosure: If you pay interest on a credit card balance or have any credit card debt, I recommend an entirely different product change. Like from plastic to cash.

– Kenny

Hey Kenny, quick Q – TYP cards come in @ 3 diff levels right? No-AF Preferred, then then Premiere & finally the Prestige.

Are you saying a product change to the lowest level Preferred makes sense because it doesn’t ever come with a sign up bonus? Or is your game plan more about preserving the history/age of your current CitiAA account which may outweigh any small token sign up bonus?

Lastly how many other Citi cards do you have and what all have you converted to? Want to get some insights whether it makes sense to have multiple Double Cash products etc just to preserve account history/age while avoiding AFs.

Last Q – does closing a CitiAA card also reset the 18mo clock, I mean is that why it’s a good idea to product change?

Correct on the 3 TYP card levels. I can’t imagine spending a Citi application for just 30K TYP, so I’m happy to downgrade to the Preferred and save an app while improving my average age of accounts. I have had 9 Citi cards at once but am down to 3 now: Dividend, TYP Preferred and TYP Prestige. Closing an AA card definitely resets the clock but now only for that particular product, Plat Visa / Plat MC / etc. The jury is still out on whether you can get a new one and the bonus for it without closing the old one.

Why not downgrade to the Double Cash rather than the Preferred since you already have a TYP card (Prestige)? I’m positive that can be done because I did the same on both my account and my SO’s.

Yes, that was offered and would make more sense for most people. We have two other more useful 2% cards, and I wanted to go fishing for 3X TYP.

Thanks for the heads up! I haven’t received a conversion notice, but since I’m due for an AA Mastercard application anyway, I’m going to do it right now so I don’t jeopardize that bonus.

I am quite confused about the 18-month rule on FT. I got approved for my current AA visa platinum on 7/12/2013 and I am keeping it. The next card was Citi AA Executive open on 2/5/2014. In Feb 2015, I called the rep to downgrade my Citi AA Executive to Citi Dividend since I did not want to keep it. Am I eligible in the rules to apply for a Citi AA mastercard next month to get 50000 miles? Thanks.

Assuming there is no AA Platinum Mastercard you left out, you should be able to go ahead and apply now before your product change occurs, using a link that only references Mastercards. The one I added to this post is #9 on FT and should be good for anyone in your situation.

Really appreciate it! It is quite hard to read between words to find #9 link on FT emphasizes the word “Mastercards”. I just now applied and got approved.

Hi,

I have not received a conversion letter as you described. On July 19 and 23, I got 2 AA Select Platinum Visa cards. I cancelled one in Aug.2014 when AF came due. I also got a Citi Business Card on Feb.2014, and cancelled when AF came due in March, 2015. Am I eligible to apply for Citi AA MasterCard now or since I cancelled one Citi AA Select visa Aug.2014 (and it has not been 18 mos since, I won’t be eligible. I vaguely remember that I tried to apply for the CitiAA Select MC, but was denied since they claimed it is the same product as the Citi AAdvantage Visa which I already have.

Thanks for your help. I’d like to apply for AA MC now if I’m eligible for the bonus points.

I’m guessing you applied under the old rules. If your Visa has not been converted, and you haven’t held an AA Platinum Mastercard for 18+ months, and it has been 8+ days since your last Citi app, and it has been 65+ days since your second-to-last Citi app, you should be eligible to open a new Platinum AA Mastercard and get the bonus using the link in this post.

Executive and Gold level cards no longer affect Platinum card applications.

Hi Kenny, we know that the Citi/Barclaycard rebates don’t stack, you’re limited to 10,000 miles even if you have both cards open: http://www.doctorofcredit.com/barclaycard-aviator-10-miles-back-benefit-is-now-live/

Kind of surprising that Citi is doing this after their big partnership with Costco and Visa.

Thanks for the update, I fixed that. It seems Citi just wants consistency across each co-branded product line.

Hi Kenny, thank you for your reply to my previous question. Just a follow up and/or clarification, you are saying I would be available to apply for personal Citi AA MasterCard now, even though the Citi Business card I got & cancelled March 2015 is a MasterCard. Also, with regards to 10% rebate, my account has already been credited for I’ve already booked award flights for October, 2015.

My understanding is that neither your Visa card nor your cancelled Business card should affect your ability to get a card and bonus using a link that only excludes Mastercards. But unfortunately I don’t have any experience myself this year and won’t until July, so I’d read a month’s worth of posts in this thread for a datapoint that lines up with your situation. I intend to apply when eligible even though I have a business Mastercard open. Good luck!

Great info here, thanks. Would appreciate some advice, I opened a Citi AA M/C 4/14 and dont want to pay the $95 AF due soon . Received 5,000 miles when I called but not a statement credit as I had hoped. If I downgrade the card , does that constitute a closure thus resetting the clock until my next approval?

I expect a downgrade counts as a card closure for the purpose of churning timing. So I guess you could take the miles, pay the fee and keep the card open until you’re eligible for another in November or so, or downgrade and then wait the 18 months.

Converted an AA card to Citi Dividends back in Dec. Guess that makes it a closure and marks the beginning of the new 18 months I must wait 🙁

Wait, that was a Platinum VISA that got converted. If I apply for MC now (which I’ve never had before), I should get the bonus. Yeah?

You should be good as long as you use a link that specifically excludes only Mastercard holders.

Does the back of the card say World or World Elite? Thanks.

Since I never allowed them to switch my card from Visa to Mastercard, neither.