The last few months have seen one blow after another to the miles & points and credit card churning games. From devaluations, to mass shutdowns, to reports of MSers being detained at their favorite store, to disappearing award seat availability, it’s just ugly out there. Easy churning and MS, combined with a plethora of sites getting the word out about our hobby, have brought an unsustainable number of people to it.

But… I’ve written about 4500 Avios North American shorthaul awards, but only ever booked one trip using them. My Serve is one of the newish ones that was spared and I won’t care when it does get shut down. I rarely liquidate cards at Wal-Mart, and I’ve moved most of my spending activity over to the reselling arena anyways. I never liked doing what everyone else was doing, hence the focus on local opportunities in the one post I’ve written on manufactured spending. Virgin Australia pulled pretty much all of their business class award seats, but we booked our trip before then and flew them Thanksgiving week. One way or another, we’ve managed to squeak through without these awful changes affecting us much if at all. You could say we’ve led a charmed travel hacking existence.

A long time ago…

In 2002, we saw a promotion at a Shell gas station for a card that sounded good. I think it was 5 cents back per gallon at Shell stations, 3% back at grocery stores and 1% back everywhere else. Or maybe it was something totally different, but anyways we opened one and put pretty much all our spending on it for a couple years until they changed the earning structure. That card was issued by what would, over the course of a long beautiful relationship, become my favorite bank. You know, Citi. We had such great times!

We opened a couple more Citi cards over the years. In 2012 while trying to figure out how to get to Europe affordably, I stumbled onto miles and points blogs along with Flyertalk, and the Citi AA ‘two-browser trick’ was just what we needed. From there, Citi and I just couldn’t get enough of each other. I would wind up talking to their wonderful CSRs in South Dakota at least every couple of weeks to get an application processed, make a payment or get some retention offers.

On January 22, 2016, I got the following letter:

Yes, it’s clear enough. Citi is trying to break up with me! Bonnie got the exact same letter. From conversations with others who had been shut down by Citi in the past, I was pretty sure we would lose all of our Citi credit cards around the same time as they had promised to cancel our debit cards. Over the next week, I spent our ThankYou points, paid off any remaining balances, moved my reselling spending to other cards, and began proactively closing our Citi credit cards. Last Sunday I logged in to download some statements and close a card or two, and found those cards already closed! Like more than a few friends, our household had attracted Citi’s attention. I guess they didn’t like what they saw. We got a few of these on Friday:

Yes, it’s clear enough. Citi is trying to break up with me! Bonnie got the exact same letter. From conversations with others who had been shut down by Citi in the past, I was pretty sure we would lose all of our Citi credit cards around the same time as they had promised to cancel our debit cards. Over the next week, I spent our ThankYou points, paid off any remaining balances, moved my reselling spending to other cards, and began proactively closing our Citi credit cards. Last Sunday I logged in to download some statements and close a card or two, and found those cards already closed! Like more than a few friends, our household had attracted Citi’s attention. I guess they didn’t like what they saw. We got a few of these on Friday:

Not cool, Citi, not cool.

Why?

There has been lots of speculation on the web as to why Citi closed the accounts they did. Was it churning cards? If so, how much? Manufactured spending? If so, what level triggered the shutdown? Was it this thing they call WMBP? What the heck is WMBP, anyway? Was it cash or money order deposits? Oh, then Citi closed the opportunity to fund checking and savings accounts with credit cards! That must be it, right? Abusing account funding opportunities?

The following is my opinion. It may be correct. It may be wrong.

Citi closed our accounts for credit card payment activity that they view as suspicious, and for no other reason.

While our activity was amateur compared to the epic level described in this Miles Per Day guest post, we churned some cards. Quite a few of them. We did some manufactured spending on a few of them, but rarely for more than a month or two. And we paid them in every way possible. Debit cards over the phone, checkfreepay (that’s what WMBP is by the way: Wal-Mart bill pay), checks, money orders, ACH pulls from lots of different banks, transfers from Citi checking accounts, ACH pushes from even more banks. From a statistical standpoint, this makes us appear to be a risky credit-card user, and Citi decided to get rid of some risk. The fact that we have held Citi cards for 14 years without missing a payment made no difference. We were paying our accounts in too many ways that Citi couldn’t trace, and they decided they’ve had enough of that!

But some people did all of these and didn’t get shut down?!

Yep. Lucky buggers. I hope they aren’t next! I also heard from several people didn’t get shut down, but in the past couple of weeks they got calls from Citi asking about the source of funds used for payments, usually checkfreepay payments at Wal-Mart or other stores.

This letter I also got from Chase last week makes me wonder if the major banks are feeling pressure to crack down on payments that could be used to mask risky or nefarious use of credit cards:

Again, I may be way off base. But if your cards remain open, I would recommend getting the number of linked banks in your Citi credit card accounts down to two or three, use those for payments, avoid overpaying, and keep all your payments out in the open where Citi can see them. The same goes for Chase, but I’ve felt that about them for some time.

Again, I may be way off base. But if your cards remain open, I would recommend getting the number of linked banks in your Citi credit card accounts down to two or three, use those for payments, avoid overpaying, and keep all your payments out in the open where Citi can see them. The same goes for Chase, but I’ve felt that about them for some time.

Some people, including me, had all of our Citi cards closed but one. On that one remaining card I’ll keep my payment activity very simple, and hopefully Citi will let me product change that one card to one that’s useful for ongoing spending. The closed card I’ll miss the most (hopefully temporarily) is the AT&T Access more card, with its 3X online earning. I have no idea if or when we might be able to open a new Citi card account. The prognosis, based on past datapoints, is not good at all.

Citi is still one of my favorite banks.

How could they not be? These are a few of the memories that came courtesy of Citi, and we have earned more in signup bonuses from Citi between 2012 and 2016 than we likely ever will from any other bank!

If we took a trip on an airline other than Southwest, at least one way was probably funded with Citi points! Routes in red were booked with Citi-earned miles and points both ways. Includes trips booked for this year.

Let’s all hope Citi is done with their shutdowns! But if you get a bank account shutdown letter anything like the one in this post, you probably should have no ThankYou points within a day or two. Most who were shut down (found the available credit on their cards reset to $0) on Sunday with no warning had around 24 hours to redeem their ThankYou points, and those who didn’t are looking at fighting or suing Citi to get some value out of their lost points.

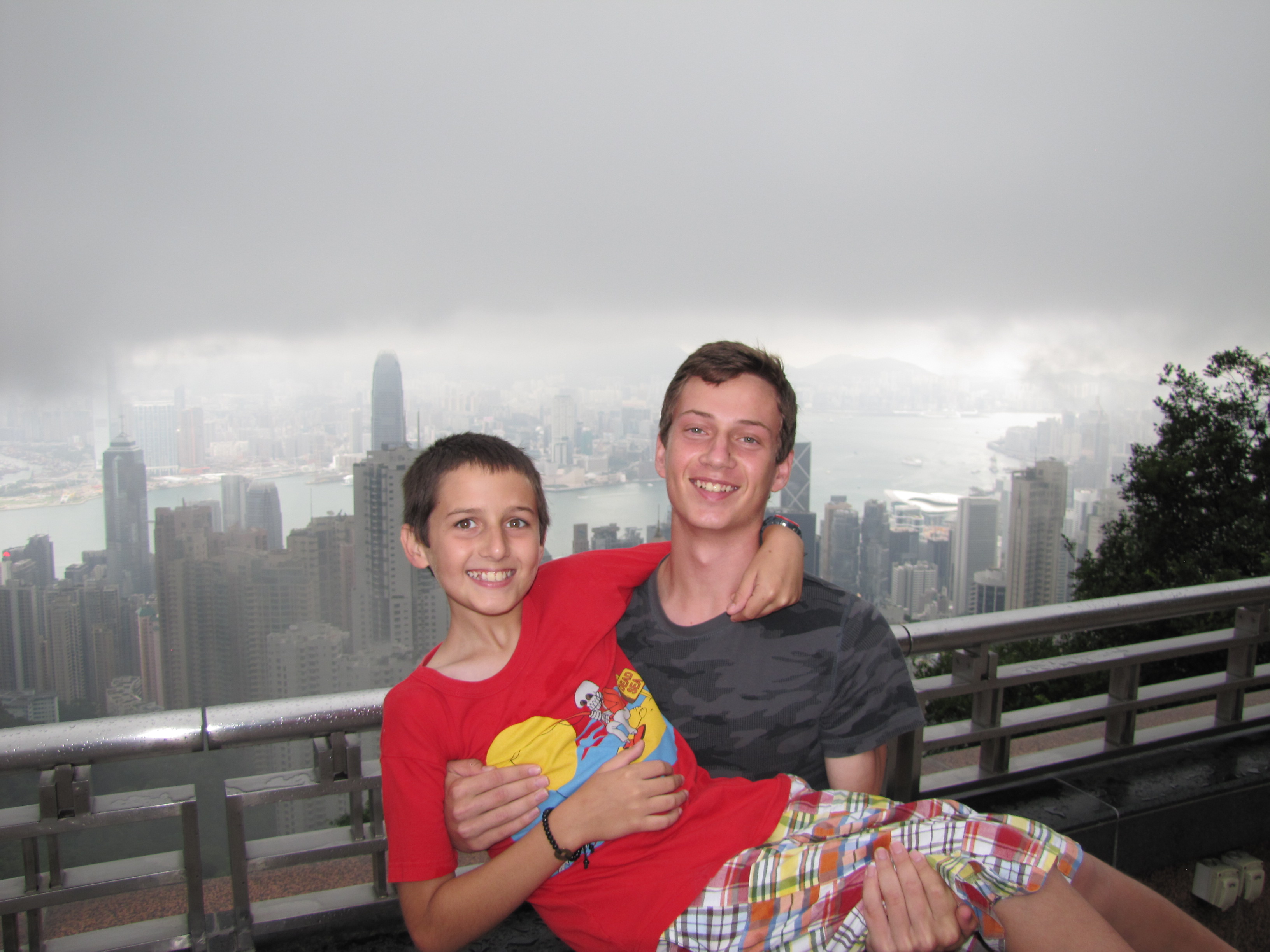

Unlike credit card relationships, some relationships really matter. This week Bonnie and I will celebrate the first 16 years of our marriage, and with or without this game we look forward to many more! On that note, happy Valentine’s Day!

– Kenny

Amen. Had the same thing happen to me. Only way I knew that my cards had been shut down was b/c I tired to buy me some dinner. “Hey Citi, why was my card declined?” “Because it’s closed.” “But I didn’t close it; can you look at this account, and this one, and this one……” “Closed.” “Closed.” “Closed.” “Closed.” “Okay, thanks. I gotta go scarf down this meal and run home to cash in all my TYPs. Bye.” The end.

Nothing new here. Many of us got similar letters over the years. Honestly, if you haven’t rec’d one, you really weren’t doing all that much. Some were doing half a million MS a month when the unlimited TY card was going.

That said, I’m 110% sure the recent spate of shut downs (from all sources) is a direct result on the fatuous “war on terror”. Homeland (In)Security has run amok. They are trying to cut off all funding methods that might allow cash to head to ISIS and other scum. So if that means the Average Joe loses more rights in the name of “security”, then who cares! It’s all about Big Brother having to know about everything you do – from tracking your movements via your cell phone, to tapping all your voice and data, to physical surveillance. The American Public has grabbed both ankles and loves to take it hard without any lube.

Read about Operation Chokepoint. Banks are put under pressure to stop dealing with certain businesses or profiles the federal government doesn’t like. This is not new but you’re probably right that it’s been stepped up recently. Just a guess

I think Citi broke up with you because they read a previous post where you wrote “Crazy, illogical, wonderful, infuriating Citi”. Who wouldn’t wanna break up with you if you called them that!

The one thing not mentioned here is the amount of spend being done. Have people been shut down for MSing $12K a month spread thru 4 or 5 banks? Or only people doing 100K a month per bank. If it’s limited to people doing over half a Million $ a year it doesn’t apply to me. Without knowing that, I can’t begin to figure out if I’m at risk or not.

Some people were closed with not very high spending it all. I was well below the numbers you’re talking about. I think this round of closures was related to payment activity Citi didn’t like.

I got a Citi letter today too closing one of my accounts, but of a different variety. Mine was a bronze AAdvantage that I downgraded to way back when to keep the old account open but not to pay any annual fees. I have had no use for this account, and got 6-9 different Citi cards over the last 2 years. Some are open, some I have closed, including a Platinum one just last week. Anyway, the letter said that they are closing my Bronze account because I had no transactions on it for 4 years and this product obviously doesn’t interest me. Fine with me, except I find it a little odd that a non-activity, as compared to over-activity, would be the basis for closing it. I assume that’s where this story ends. Does anyone think any different?

That is typical, and you should be fine.

The key to survival for all people–msers or churners or otherwise–has always been the same. I predict one day it will be true in the world of reselling but hey, that’s not my bag so who knows. But you heard it here first if it ever does…

I have said it over and over and no one listens. People cannot and will not listen. The FTers and bloggers especially cannot listen by design because they are either trying to get their 15 minutes of being cool “fame,” or they are trying to make money by giving up deals and offers online so people click their links in the guise of “sharing and helping” others.

It is for this reason I have little sympathy for this issue to anyone who blogs. Sorry.

Everything we all do or did in MS or churning or whatever else could have lasted years and years longer had one thing been adhered to all along, but no one listens. They just cannot. I have proof of this–we all have such clear proof of this.

So this whole post, as sad as it is to see your own family in the likes of those in these pictures, is nothing more than yet one more fool falling from the pack. One has in part dug his own grave here.

This one thing I speak of that is so simple and plain is what people should have been doing all along so as to make those letters of shut down never come. This one thing I speak of that is so simple and plain would have enabled all bank and CC deals to continue and would have made it so gigs and promos still yielded 5x and 4x and even 3x… so the cops or the feds wouldn’t stop people in stores and the stores wouldn’t make up phony fraud rules and the airlines would allow for more redemptions, and so on…

I do not care if people do not agree with my stance here. I know I am right and whatever people say does not affect me. I stepped away from trying to help or convince or speak about ways to curb it a while ago, and people are going to be idiots anyway and then complain when all this dies even more. And it will. Also, this post of mine may spark debate and heated vollies that bring business to this blog for a couple of days too. So be it. That’s like the jolts of energetic life a prisoner may appear to feel just before the strong electric current zaps through his or her body and finally kills em off.

This one thing I speak of that is so simple and plain is this (when it comes to online posting of any kind and especially to blogging about this stuff in ANY way):

SHUT UP!

Thanks for taking the time to comment! I agree, a whole lot of what I read makes me cringe. There are too many people in this game, and the low barrier to entry offered by Redbird has probably pushed it off the cliff. At least as we knew it. But you also had a site/blog (that even linked to my one post about MS) back in the day, and I think we stopped posting on public MS forums at about the same time. Reselling isn’t something I’ll be writing about at all – in that arena, if you share a deal publicly you will have likely killed it (by introducing too much competition and driving prices down) before you manage to sell a single unit. Other than the occasional post-mortem or warning post like this, I’ll be sticking to family miles & points redemptions and various randomness I decide to write about. I could care less about “business” or pageviews – ads earned me under $300 last year and I don’t have or want affiliate links of any kind. Cheers!

I started this stuff in the late 1990s and started MSing as we know it in 2001. I made many mistakes back then, and yes, I wrote for a site (that did not make money pushing links) that talked about theory of MS and later, ways to make it so people could do MS without yapping about it.

Fact is, we all make mistakes and you have seen yours come to life today. Tashir mentioned he would stop posting about MS since his encounter with LA’s finest.

the fact is clear: people should not be talking about MS. Period. People can and should share it in small offline email and text groups and among friends who they know and can vet personally or over time. Those friends may share with others, so in the end, yes, people do learn it but slowly. I helped invent many deals and I also picked up tips. I was proactive and creative. I also know there have been and continue to be many deals I cannot do or do not know about. And guess what: I dont wanna know about those until or unless the people who have those secrets feel I am worthy to share with. Then those things will stay alive longer. I would hope the same is true the other way.

It is no ones duty to share this stuff. One is not a jerk for NOT sharing. (one would be a jerk if one said something like, “I have a deal and a secret and I am not gonna tell it” so the best thing to do if one does have a secret, is to NOT say that!)

Blogs have proven to be the bane of and the antithesis of all that is MS.

Again: the solution is to stop. You will then stop the bleeding and begin to prosper. Only you can make that choice.

I for one am glad you got shut down. You run your mouth way too much about MS. As if the MS Gods came down and taught a lesson.

I was active on MS forums like Flyertalk until 2014 and even wrote a blog post encouraging people not to follow the MS herd, so clearly I run my mouth way too much about MS. And I certainly have far fewer accounts to manage, which is a good thing! Thanks for stopping by.