Do you need to do something while in the US to make the card aware of the PIN set online/on the phone? I vaguely recall something like that...And when I found myself at a self-service station on a Sunday, I did a happy dance when I successfully swiped card and punched in the magic code.

The appeal of the Barclays Arrival card?

- Thread starter b_c

- Start date

wasser

Level 2 Member

After setting your pin online, you have to then use it at an establishment that uses chip & pin or chip & sig to activate it for chip & pin. I just made sure I used it when I stepped off the plane at Heathrow (bought a bottle of water). The only places it defaulted to chip & pin (as opposed to chip & sig) were gas stations and a few train/bus ticket machines.Do you need to do something while in the US to make the card aware of the PIN set online/on the phone? I vaguely recall something like that...

MarkD

Level 2 Member

Woohoo!!! Just got approved for Arrival+ after calling Recon for $7.5K. Stupid Barclays auto-denied my app since I applied back in March and was turned down. WTH???I ended up applying this week and got the dreaded "unable to give you a decision at this moment" message. I just checked the status page and it says they are unable to give me a card at this time and they will mail me an explanation.

I'm done with Barclays. I'm cancelling my last US Airways card.

I was about ready to tell them to GTH and cancel my last card with them...

Road Humps

Level 2 Member

I have had the Barclays US Airways card for a couple of years and they gave me $12.5k. I just recently picked up the A+ and got just $10k. So I had them shift $7.5k from US to A+. Just throwing it out there as an easy way to pump up your CL on the A+.

shoppergirl

Level 2 Member

Love this card. I had around $80k in spend on this last year. My $89 annual fee just posted. I tried my best to get it waived which they agreed to do only if I switched to another Barclay's card. Not interested. The specialist said she didn't have any options to waive my annual fee. Since my husband has another Barclay's Arrival, I think I'll just cancel it and try again in a few months for a new card.

shoppergirl

Level 2 Member

So, this is a card you haven't put much spend on?My BA+ annual fee is due this month & got a letter two weeks ago from Barclay mentioning this - and offering a $50 statement credit if I spent $750 in each month of Feb, Mar, Apr. Shouldn't be a problem - LOL.

Camplear

Level 2 Member

I put a lot of spend on the card - but not sure what triggered the $50 promo offer.So, this is a card you haven't put much spend on?

How did you receive the offer? Snail mail, email or on site?I put a lot of spend on the card - but not sure what triggered the $50 promo offer.

Camplear

Level 2 Member

It came from the Snail 'bout a month prior to AF date.How did you receive the offer? Snail mail, email or on site?

druiddation

Level 2 Member

I usually have no problems getting instantly approved for credit cards, even multiple cards from US Bank. I guess I really offended Barclays at some point as they now refuse to give me any new cards, including the Arrival.

Steven58

I like hats.

I have a couple of questions. I've skimmed the thread and didn't see the question answered, but I only skimmed, so pardon me if it's already been addressed. After I finish getting my intro points on my Amex SPG's (one business, one personal card), I am considering others. One would be the barclay's elite master, the other would be chase sapphire, and the frontrunner would be the ink plus. I think the ink plus for sure because all of my telecom charges would net me between 50 and 60k points per annum, but the other one may be the barclays W.E. card due to the 2 pts/$1. So, here's one question to those in the know:

Does world elite REALLY get you free hotel and airline upgrades based upon availability? Is that a real benefit or is it on paper only. If real, how do you get it?

Another more simple question: I didn't see the term FTF in the glossary. Enlighten me?

Thanks!

S58

Does world elite REALLY get you free hotel and airline upgrades based upon availability? Is that a real benefit or is it on paper only. If real, how do you get it?

Another more simple question: I didn't see the term FTF in the glossary. Enlighten me?

Thanks!

S58

I don't see the context, but I'd guess Foreign Transaction Fee - the Barclays card does not charge this fee. (Yes, I found the reference, and that's what it means).I didn't see the term FTF in the glossary.

Chase issues CSP and Ink. The former is personal and the latter is business. Barclay issues Arrival+.I am considering others. One would be the barclay's elite master, the other would be chase sapphire, and the frontrunner would be the ink plus.

Why not get all of them?

World Elite is meaningless for you as a customer. It mostly means the merchant pays more to the payment processor (MC).Does world elite REALLY get you free hotel and airline upgrades based upon availability? Is that a real benefit or is it on paper only. If real, how do you get it?

World and World Elite are Mastercard's card designations; similarly Visa has Signature and Infinity.

Foreign Transaction Fee.Another more simple question: I didn't see the term FTF in the glossary. Enlighten me?

Steven58

I like hats.

I just got approved for the BA+. I think for my needs and seeing as I'm a rank beginner, this is a good everyday card for me and my DW on CERTAIN purchases that aren't covered by the 5x pts Ink+ card. I'm going to finish my initial spends on the SPG business and SPG personal (soon) and start on these. I'll be doing a lot of churning in general.

Steven58

I like hats.

Ok.. now I'm having doubts. My sister, who is an experienced points geek, and is on this forum, is questioning the fixed value of the BA+. I may go to the amex everyday or preferrred for everyday as those points are more flexible. Honestly, there's so much here and so much to learn that my head is spinning. I know I get 40k points on the BA+ .. I just may use them and churn.

Don't sweat it. It all depends on YOUR situation, needs and preferences. For me, I put a high value on flexibility. I also like to spread out my spend across different banks.Ok.. now I'm having doubts. My sister, who is an experienced points geek, and is on this forum, is questioning the fixed value of the BA+. I may go to the amex everyday or preferrred for everyday as those points are more flexible. Honestly, there's so much here and so much to learn that my head is spinning. I know I get 40k points on the BA+ .. I just may use them and churn.

For example, I max out the OBC and Ink. The third card I use a lot is the Arrival+. Remember you get 2x points on every purchase and can use those points for any travel expense. Any hotel, airline, taxi's, Disney theme park tickets, etc. Outside of pure cashback that's as flexibile as it gets. Now to make it a better card than the Fidelity Amex, you need to put over $45k (roughly) to offset the annual fee. But on the flip side, you don't get the $400 bonus.

Take a look at the other cards in your arsenal before you just use and churn. You may discover like I did that it's worth keeping. YMMV and all that.

Last edited:

Panache

Level 2 Member

I too am considering the A+ card, but like some others, I wonder how useful the card is once the signup bonus has been spent/the amount of MSing that needs to be done to earn it back. Amol from TC has an interesting post from May of last year about using the Barclay shopping portal with the A+ card to get AGC and thus earn 6x. Is that still true? Looking on the the shopping portal without logging on it looks like all the airline shopping portals and I don't see AGC as an option. Are there maybe other ways to leverage it (and maybe this needs to be discussed in L2?)

Unfortunately that portal hasn't offered Amex GC's for quite a while. Best current offers are 1.5% from TCB and Befrugal.I too am considering the A+ card, but like some others, I wonder how useful the card is once the signup bonus has been spent/the amount of MSing that needs to be done to earn it back. Amol from TC has an interesting post from May of last year about using the Barclay shopping portal with the A+ card to get AGC and thus earn 6x. Is that still true? Looking on the the shopping portal without logging on it looks like all the airline shopping portals and I don't see AGC as an option. Are there maybe other ways to leverage it (and maybe this needs to be discussed in L2?)

Steven58

I like hats.

As I understand it, this is a flat 2 point card, which, because of it's limitations, devaluates the point value. TPG had each point worth about 1 or 1.1 cents in this month's valuation. I have it, along with ink+ Spg and SW airlines. My plan is to use it for the misc travel expenses. A nice perk is that TripIt pro is available for free with the BA+. That's a 49.00 value per annum. Not bad. I like the way you can keep everything (point totals and itineraries) in one place automatically. It's really cool. It's one of TPG's favorite apps. Cheers!

essenn

Level 2 Member

Those of you that have a better relationship with numbers (no sarcasm or malice intended) please explain the flaw in my thinking about this card. One ground rule to stipulate here. No category bonuses, etc., just cash redemption (that wouldn't be a fair fight). Separate the Arr+ card into earning side and redemption side. As far as earnings go, I'm thinking of a matching 401k from your employer. I know it's not the same but to illustrate my point, it's close. For every dollar you put in, your matched .01 for 1. No limits. As much as you can afford. Obviously, not a wealth builder because no interest or dividends are paid on the card, that is, until redemption. So, on the earning side, you deposit .01 your money and .01 house money (that's for you gambling folks). Or, put a bit differently, for every .01/1$ you spend you have .02/1$ on the books. Now the redemption. When you redeem, you are only charged (effectively) .018 because you get back 10% 0f your redeemed .01+.01 = .02 * 10% = .002. Yes, the redemption was at .01 of dollar redeem cost, but the deposit was at 2*.01. Factor in 10% back after redemption equals a .022 card when all is done. Your contribution .010 plus their contribution .010 plus .002 credit.

I'm not saying there aren't better cards. Every card has a place in the way you spend for your situation. My discussion is just about the "math" of the card. Remember, it's all about the economics for the issuer. They could care less what value you get as long as they are making money off your spending. One other thought about devaluation. Assuming the redemption values remain constant, inflation of the dollars charged is where a devaluation would occur. That's something the card issuer is not in control of.

Ok, I'm ready. Have at me and my math.

I'm not saying there aren't better cards. Every card has a place in the way you spend for your situation. My discussion is just about the "math" of the card. Remember, it's all about the economics for the issuer. They could care less what value you get as long as they are making money off your spending. One other thought about devaluation. Assuming the redemption values remain constant, inflation of the dollars charged is where a devaluation would occur. That's something the card issuer is not in control of.

Ok, I'm ready. Have at me and my math.

Last edited:

You did all that math to come up with .022 cash back? (I believe you can argue it's 0.2222...)Those of you that have a better relationship with numbers (no sarcasm or malice intended) please explain the flaw in my thinking about this card. One ground rule to stipulate here. No category bonuses, etc., just cash redemption (that wouldn't be a fair fight). Separate the Arr+ card into earning side and redemption side. As far as earnings go, I'm thinking of a matching 401k from your employer. I know it's not the same but to illustrate my point, it's close. For every dollar you put in, your matched .01 for 1. No limits. As much as you can afford. Obviously, not a wealth builder because no interest or dividends are paid on the card, that is, until redemption. So, on the earning side, you deposit .01 your money and .01 house money (that's for you gambling folks). Or, put a bit differently, for every .01/1$ you spend you have .02/1$ on the books. Now the redemption. When you redeem, you are only charged (effectively) .018 because you get back 10% 0f your redeemed .01+.01 = .02 * 10% = .002. Yes, the redemption was at .01 of dollar redeem cost, but the deposit was at 2*.01. Factor in 10% back after redemption equals a .022 card when all is done. Your contribution .010 plus their contribution .010 plus .002 credit.

I'm not saying there aren't better cards. Every card has a place in the way you spend for your situation. My discussion is just about the "math" of the card. Remember, it's all about the economics for the issuer. They could care less what value you get as long as they are making money off your spending. One other thought about devaluation. Assuming the redemption values remain constant, inflation of the dollars charged is where a devaluation would occur. That's something the card issuer is not in control of.

Ok, I'm ready. Have at me and my math.

That's been the consensus forever and I got there myself by simply knowing I get 2% back and a 10% rebate on using the points. But I do now have a headache!

essenn

Level 2 Member

My post was an attempt to educate, not create ailments. Sorry I gave you a headache. Yes, the math is straight forward and as you correctly point out in your reply, has been there forever. Which brings me to the point of my long winded post. It's a .022 card (ignoring the march to infinity) not .011 as some are led to believe. I guess that would have sufficed. I'll do better (shorter) next time.You did all that math to come up with .022 cash back? (I believe you can argue it's 0.2222...)

That's been the consensus forever and I got there myself by simply knowing I get 2% back and a 10% rebate on using the points. But I do now have a headache!

Daniel

#hackingtheplane(t)

You can't argue. It is 2.22222222.....You did all that math to come up with .022 cash back? (I believe you can argue it's 0.2222...)

That's been the consensus forever and I got there myself by simply knowing I get 2% back and a 10% rebate on using the points. But I do now have a headache!

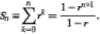

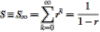

To actually be productive, and for those who don't know the math, basically we have what's called an infinite series where each successive term in the series (call it x[n+1]) is defined by taking 10% of the previous term. So if you redeem $10, you get $1 back, which you compute from x[n+1] = 0.1 * x[n].

This 10% (or 0.1) bit is called the ratio. The cool thing about this kind of series (a geometric series) is that you can compute any arbitrary value in the series. So if I want to know what cash back I'll get after redeeming the leftover 10% of my leftover 10% of my leftover 10%, all I would do is multiply my original value ($10) times the ratio that many (3) number of times. So after 3 redemptions, I would be left with $10 * 0.1^3 = $0.01. I'm rich!!

If you're with me so far, you can see pretty easily that if you can compute any arbitrary term in the series (so the 100th value is just 10 * 0.1^100), you should also be able to compute the total redeemed value up until that point. There's a pretty cool derivation that shows that basically you end up with your initial amount of cash back ($10) times some factor of the ratio. It looks something like this:

Let's take it a step further. What happens if we redeem our leftovers 1000 times over? 1 million? 1 billion? How about an infinite number of times?

Okay. For those of you who are confused by the concept of finding the sum of an infinite series of numbers, don't worry about it. The point is that for a sufficiently large number of consecutive redemptions, the amount you get refunded by the A+ gets smaller and smaller and smaller until it is (effectively zero). That's the '1-r^(n+1)' term in that equation. So basically we can approximate this infinite sum by taking the sum of a few terms, which is what @essenn so beautifully explained. Thus, the A+ is a 2.2% or 2.22% cash back card, depending on who you talk to.

Now for those of you who are still with me and want to take it a step further, let's actually compute this infinite sum. In the limit as n->infinity, the term in the numerator (1-r^(n+1)) basically becomes 1. Why? Because r (our ratio) is a number smaller than 1 and greater than 0 (it's 10% in our case), and if you multiply such a number by itself enough times, it approaches 0 fairly rapidly. So the numerator disappears and we're left with:

1/1-(0.1) = 1/0.9 = 1.1111111111111. Multiply that by 2 (which is our 'initial' balance), and we have our 2.22222222....% cash back A+.

Phew. Hope that made sense. Happy earning!

(Image source: http://mathworld.wolfram.com/GeometricSeries.html)

Last edited:

essenn

Level 2 Member

OMG, that's exactly what I was trying to say. Thanks for clearing it up for me. You rock!You can't argue. It is 2.22222222.....

To actually be productive, and for those who don't know the math, basically we have what's called an "infinite series" where each successive term in the series (call it x[n+1]) is defined by taking 10% of the previous term. So if you redeem $10, you get $1 back, which you compute from x[n+1] = 0.1 * x[n].

This 10% (or 0.1) term is called the ratio. The cool thing about this kind of series (a geometric series) is that you can compute any arbitrary value in the series. So if I want to know what cash back I'll get after redeeming the leftover 10% of my leftover 10% of my leftover 10%, all I would do is multiply my original value ($10) times the ratio that many (3) number of times. So after 3 redemptions, I would be left with $10 * 0.1^3 = $0.01. I'm rich!!

If you're with me so far, you can see pretty easily that if you can compute any arbitrary value in the series (so the 100th value is just 10 * 0.1^100), you should also be able to compute the total redeemed value up until that point. There's a pretty cool derivation that shows that basically you end up with your initial amount of cash back ($10) some factor of the ratio. It looks something like this:

View attachment 1384

Let's take it a step further. What happens if we redeem our leftovers 1000 times over? 1 million? 1 billion? How about an infinite number of times?

Okay. For those of you who are confused by the concept of finding the sum of an infinite series of numbers, don't worry about it. The point is that for a sufficiently large number of consecutive redemptions, the amount you get refunded by the A+ gets smaller and smaller and smaller until it is (effectively zero). That's the '1-r^(n+1)' term in that equation. So basically we can approximate this infinite sum by taking the sum of a few terms, which is what @essenn so beautifully explained. Thus, the A+ is a 2.2% or 2.22% cash back card, depending on who you talk to.

Now for those of you who are still with me and want to take it a step further, let's actually compute this infinite sum. In the limit as n->infinity, the term in the numerator (1-r^(n+1)) basically becomes 1. Why? Because r (our ratio) is a number smaller than 1 and greater than 0 (it's 10% in our case), and if you multiply such a number by itself enough times, it approaches 0 fairly rapidly. So the numerator disappears and we're left with:

View attachment 1385

1/1-(0.1) = 1/0.9 = 1.1111111111111. Multiply that by 2 (which is our 'initial' balance), and we have our 2.22222222....% cash back A+.

Phew. Hope that made sense. Happy earning!

(Image source: http://mathworld.wolfram.com/GeometricSeries.html)

Last edited:

MickiSue

Level 2 Member

I believe that I commented, upthread on the infinitely reproducing 2's....but what do I know? I'm a nurse, not a mathematician.

Here is the real life usefulness I have found, so far, from the A+. Paid the AF, bought one thing, got the $40K miles. Used it sporadically for the next three months, and had enough, in the end, to pay for 7 days in hotel, including 12 breakfasts, 2 lunches, 2 dinners and an unknown number of drinks by the pool, taxi to and from the airport, and still had $25 left over, when all was said and done.

Starting to work on adding miles for holiday house in IT and other travel expenses for the fall. Will also use the miles to pay AF, due in Oct.

This one is a keeper.

Here is the real life usefulness I have found, so far, from the A+. Paid the AF, bought one thing, got the $40K miles. Used it sporadically for the next three months, and had enough, in the end, to pay for 7 days in hotel, including 12 breakfasts, 2 lunches, 2 dinners and an unknown number of drinks by the pool, taxi to and from the airport, and still had $25 left over, when all was said and done.

Starting to work on adding miles for holiday house in IT and other travel expenses for the fall. Will also use the miles to pay AF, due in Oct.

This one is a keeper.

Daniel

#hackingtheplane(t)

That you did -- wasn't intending to steal your thunder, just hoping to educate for anyone interested.I believe that I commented, upthread on the infinitely reproducing 2's....but what do I know? I'm a nurse, not a mathematician.

Daniel

#hackingtheplane(t)

I'm sorry -- I'm a kleptomaniac. I take things literally.I was teasing, of course.

And you've made me think even more about this all afternoon. That really wasn't necessary, was it?!!That you did -- wasn't intending to steal your thunder, just hoping to educate for anyone interested.

Let's throw a wrench in all of the mathematical formulas. There are 2 limiting issues here, as eluded to before in the number of decimal places makes the next return amount "approach zero".

At first I thought I had something with rounding to a penny, either up or down. They don't award fraction cents, so eventually at some decimal length, the benefit stops. I figured I'd let those who are having this much fun at math do the work and tell ME what that is

Then I realized that you have to use your points in clumps of $25 minimum (right? Am I remembering this right?) To use your last $25 award returns $2.50, but you can't redeem that. You have to build back up to $25 in order to redeem anything. How does this play in, or does it?

If we ignore the $25 minimum redemption issue, I think that the cent units and rounding terminates the decimal 2s pretty early. I'm going to scratch my head for a second and guess ... 2.222% is the real "effective" number. Plus or minus a decimal place

Daniel

#hackingtheplane(t)

"Let's assume....."If we ignore the $25 minimum redemption issue, I think that the cent units and rounding terminates the decimal 2s pretty early. I'm going to scratch my head for a second and guess ... 2.222% is the real "effective" number. Plus or minus a decimal place. I had to scribble on paper to come to that, too ... I don't want to risk losing any more hair on this.

(started every great mathematical or physics theorem).

Yes, you are correct. In practice most of the 2s don't matter. Unless, of course, you have a billion dollars in points. Or a billion billion. At that point, the 2s don't matter, but for other reasons. One can always hope

As for the $25 minimum -- basically how you deal with this is you subtract it out from your total redemptions over all time, which gives you a lower bound on the return. The upper bound is computed assuming no minimum. Or you can again go to extremes and assume you redeem an infinite number of points so the $25 is meaningless.

Or is it a function of the max award you can accumulate? I did my scribbling based on $100, and found that on the second time the award was multipled by 10%, you'd get ($2, 0.20, 0.02) and 10% of 2 cents isn't going to get you anything. But if we started with 1000, you get another decimal position. Hmmm. I'm done now.If we ignore the $25 minimum redemption issue, I think that the cent units and rounding terminates the decimal 2s pretty early. I'm going to scratch my head for a second and guess ... 2.222% is the real "effective" number. Plus or minus a decimal place. I had to scribble on paper to come to that, too ... I don't want to risk losing any more hair on this.