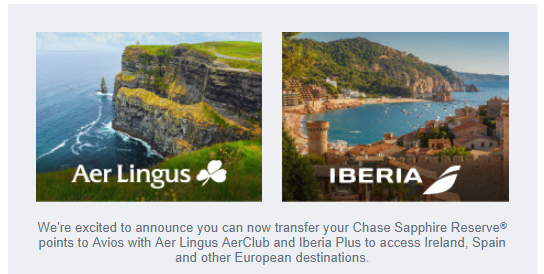

Chase Ultimate Rewards adds 2 new partners!

I’m a huge fan of Chase Ultimate Rewards, so it was great to see a note from Chase in my e-mail about adding yet more transfer partners! Chase Ultimate Rewards adds 2 new partners!The particularly exciting thing about this is that Iberia usually has fewer fuel surcharges on premium cabin awards! There is a way to…