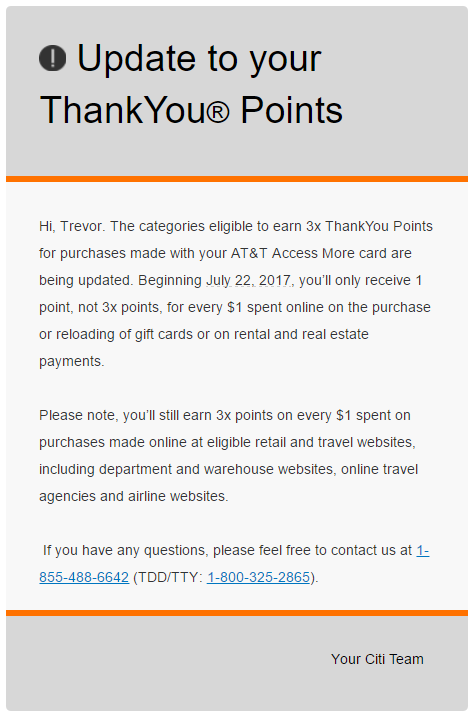

Yesterday Citi ATT Access More cardholders got some bad news. Citi clarified what purchases receive 3x Citi Thank You Points. For some this is a big deal, for others its not. For many, this was a very lucrative train that unfortunately is coming to an end.

Why the Citi ATT Access More 3x Clarification Hurts Some

The Citi AT&T Access More card is one of the most lucrative and dynamic points earning credit cards on the market. Earning 3x Citi Thank You Points (TYP) on nearly every online purchase is amazing. Some even found other ways to make the card work for them even better, paying their rent or mortgage. It was a great gig.

It shouldn’t come as a great surprise that the Citi ATT Access More would clarify further what purchases are eligible for 3x Citi Thank You Points given how it was being used. Specifically stating that you’ll earn 1x for rent, real estate, and gift card purchase or reload isn’t terribly unreasonable. Of course how they execute this will still be interesting.

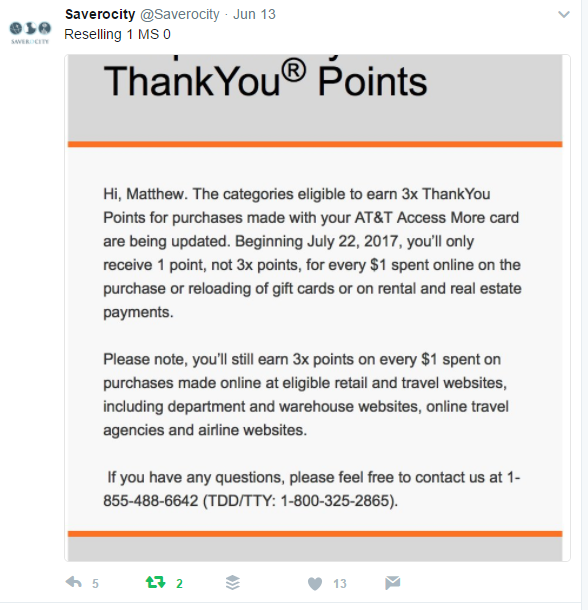

Resellers should be unaffected, but be vigilant!

The Citi ATT Access More card has been and will continue to be my go to credit card for reselling. I think Matt puts it best:

That said, I think it is important to be vigilant. Whenever changes like this happen, mistakes can happen. It could just as easily happen that a legitimate online retailer gets coded from earning 3x to earning 1x just as easily as Plastiq or other bill pay vendors can be coded differently.

Furthermore, I don’t think resellers should be terribly concerned about this development unless they leverage things like the MileagePlus X App for gift cards, or otherwise buy gift cards to stack discounts or miles promotions. I’d advise for folks that do that, to test with low dollar amounts and validate the results before going in big.

Conclusion

Overall, this is a net loss for many. For resellers, I’d say its less bad news, but there is still risk whenever things get coded differently.

Were you leveraging the Citi ATT Access More card to pay your rent or mortgage? Will you keep your card?

I was using mine pretty exclusively to pay my mortgage via Plastiq and I’ll likely dump my card when the a/f hits next

Dan, Wow, so this is a big hit for you, sorry to hear that! Have you shifted away entirely from reselling btw?