Reselling is cool, but reselling when you’re double and triple dipping is even more cool. Given my mile and point background, I rely heavily on mile and point earning credit cards for sourcing. I used to spread my purchases across a bunch of cards, but recently I’ve started to narrow in on three key credit cards, augmented by others when credit lines become constrained.

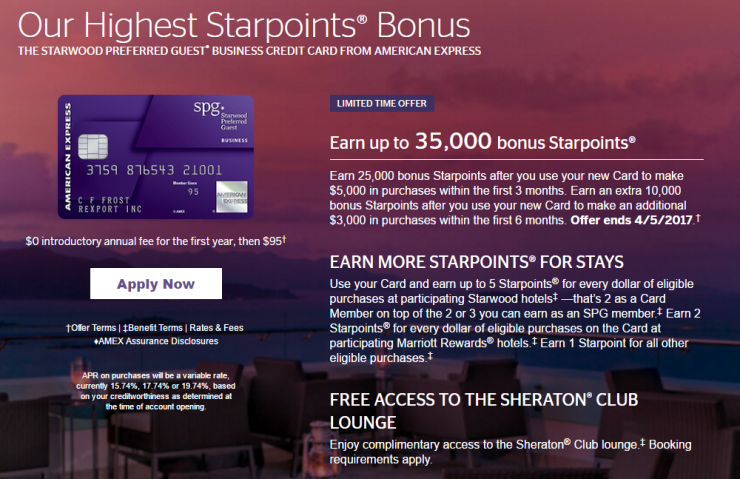

Starwood Preferred Guest (SPG) Business AMEX – The first of my credit cards for sourcing

My number one card for sourcing is, ironically a 1x card, the SPG Business AMEX. Why? Because SPG points are so transferable and that flexibility is valuable for me. I know what you’re thinking: a 1x card kind’ve sucks in general. Normally, you’d be right, but, given the Marriott merger, you have a ton of options with SPG points, even more than you had before, which was a ton. Until the end of the month, you could even transfer points to Marriott to get the Southwest Companion Pass.

Of course, the benefit of Sheraton Club Lounge can be valuable too! We used that–even though we had to fight for it–at the Sheraton Milan-Malpensa Airport hotel.

Where I use it: Walmart, Target

Of note: Right now the SPG Business AMEX (and its personal version) have a sign-on bonus of 35,000 SPG points, which is the highest I’ve seen it. I have a referral (for the business only); if you’d like to support the blog in this manner, please leave a comment and I’ll e-mail you the code. Thank you for your consideration!

Citi AT&T Access

So, the card I have gets me 3x Thank You Points for online spend; I actually got the card for that. At the time, it had a $600 toward a free phone after $3,000 or so spend, but despite moving to AT&T, I didn’t actually use that (if you need an AT&T phone, drop me a note, we can totally work something out!) I’ve only put on average $4,000 spend per month, except for Q4, but, still, the Thank You Points just keep growing. Of course this reminds me, I really need to re-engage on Online Arbitrage (OA).

Where I use it: Nearly every online store I shop at

Chase Ink Plus

I realize all the hype now a days is about the Chase Ink Preferred. I’m old school, I’ve got an Ink Bold and two Ink Plus credit cards. I love my Ink Plus card. It gets me 5x on Office Supply stores, also for internet / cell phone, and believe it or not, every so often, those stores have things to source! In general though, I’ve found the card to be pretty valuable for my sourcing.

Where I use it: Staples, Verizon, occasionally others

Of note: Occasionally, there is a Chase Ink Refer a Friend link available. If you are looking for the card, please consider reaching out to me if you’d like to support the blog in this manner, and I’ll e-mail you the code. Thank you for your consideration!

Other cards I use

Also in the mix, is the American Express Business Platinum, good for the other benefits (Gogo, Centurion Lounge, American Express Fine Hotels & Resorts, etc), Alaska Business–merely because I have my business checking account at Bank of America, and the Marriott Business–I got this for the points, but its a back-up for Q4.

What credit cards do you use for sourcing?

SPG for anything unbonused, and since I don’t have a Citi Access card I use it almost everywhere. Ink Plus for office stores and internet/phone bills.

@Ken – I definitely love the SPG card for unbonused… I’ve found the Citi Access to be great though for online; it may not hurt to try to call and see if you can product change — I think this is one of those cards that is worthwhile even without the sign-up bonus!

I have thought about PCing too, but I churn Citi cards like crazy so I’m always lowering limits as low as possible and they won’t PC a card that’s less than 12 months old. The only old cards I have are already at $2k limit which isn’t enough to buy inventory.

@Ken I’m kind’ve jealous that you’re still churning Citi cards! nix that, I’m really jealous!

Why not do it too? There have been a number of links with no 24 month language in them.

@ken – I just grabbed a AA Biz, but I can’t seem to find any links for AA personal with no 24 month… feel free to e-mail me (if you like) – trevor(@)taggingmiles.com

The no-24 month personal link died a few days ago and now it looks like the biz link died yesterday too.

Bugger; it seemed to be working when I used it yesterday evening… will let you know.

Pingback: Saverocity Observation Deck 53 - Taxes for Travel Hackers and Resellers - Tagging Miles

Pingback: Citi ATT Access More Clarifies 3x Eligible Categories - Tagging Miles

Pingback: An Introduction To How Credit Scores Are Calculated - Tagging Miles

Pingback: My crazy 2018 loyalty goal - Tagging Miles