Comenity credit cards don’t get much press in the points-n-miles world since most them are cobranded offerings with small retailers, but they can be valuable to hardcore fans of those stores as well as to people trying to rebuild their credit. I thought it would be interesting to take a more comprehensive look at their offerings to see all that they have to offer in one fell swoop.

A couple of notes before we begin. First, note that Comenity Bank credit cards can sometimes be obtained via the shopping cart trick, which is a way to get a credit card without a hard pull. I’ve noted below which cards you can do this for any cards I’m aware of, please comment if you’ve had luck with the SCT. Second, you can get multiple cards from them, and the vast majority have no annual fee. I’ve only got a couple myself, but a couple of commenters below report having more than ten. And they also report that you can get credit line increases every few months without a hard pull. So if you’re looking to rebuild credit, take a look at Comenity cards.

I used this list on MyFico as my starting point. It’s a little outdated, so I’ll add in a few others I’m aware of. If I leave any out, or if I’ve missed any benefits of any of these cards, please let me know in the comments. Let’s start with the two Comenity credit cards I have:

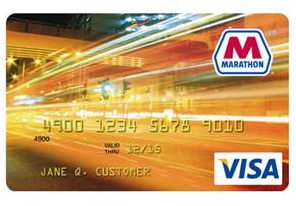

- If you can find a gas station willing to sell you gift cards, the Marathon Visa is potentially one of the most lucrative credit cards out there. I explained here why falling gas prices and Comenity’s odd rewards scheme mean rising rewards for cardholders. Currently, the rewards are around 10%, but only if you’re able to spend $1,000 in a month at Marathon, and most Marathon stores either don’t have gift cards or else won’t sell them to you with a credit card.

- I have the Fuel Rewards MasterCard as well, but I haven’t found it to be particularly valuable. The rewards aren’t great and you don’t get much in the way of good offers once you’re a cardmember. You can skip this one and focus on cards with better gas rewards.

As for the others:

- The BJ’s MasterCard can be a pretty good value depending on how much you spend at BJ’s. Lucky for you I ran the numbers to see exactly what level of spending to make the card worthwhile, so go here and take a look. Note that if you’re on BJ’s email list you can get a preapproval for this one, though I don’t know what the credit limits will be like.

- The Bed, Bath, and Beyond MasterCard recently moved from US Bank to Comenity. The card itself is not much to speak of: you get 5% back at BBY, but only 1% back on everything else, plus 2% on gas and groceries which is nothing to write home about. If you’re not spending ridiculous amounts of money at the store–and I really hope you’re not–I can recommend about a hundred other better cards. I’m not aware of whether they’re in the habit of sending out marketing incentives to cardholders, if anybody has any experience please comment below.

- A commenter on this post identified the Sportsman’s Guide Visa as a card worth looking into:

The Sportsmans Guide Visa issued by Comenity bank often has 4x or 5x promos.I can remember at least 3 in the last year and a half. I think one in November was unlimited. Their store has a far wider variety of products than Banana. I wonder if their Gander Mountain card has similiar promos.It is a good second card for those building credit, before moving on to premium cards.

And commenter Tia writes below: “I just got the Sportsman Guide Visa with a soft inquiry using the SCT. It only wanted the last four of the SSN. I’m 14 months post BK. They soft pulled EQ 652 score and credit limit is $3,500.”

- Like the SNL card, the Virgin America Visa is a new addition to Comenity Bank’s portfolio. Unfortunately–and unlike most major domestic airline cards–this card does not have a great sign-up bonus. I don’t see much use for it unless you’re a regular VA flyer. If you’re still curious, TPG has a good rundown here. UPDATE: This card is going away due to the Alaska Airlines takeover of Virgin and the cards will be closed on January 4, 2018.

- Ann Taylor MasterCard / Love Loft MasterCard: 5 points per dollar spent at the eponymous clothing store family, plus a $15 gift certificate annually on your birthday. Only one point everywhere else, however. Pass.

- Gander Mountain MasterCard: I had never heard of Gander Mountain before learning of this card’s existence; turns out it’s an outdoors store. You can get three points per dollar on all purchases there plus an additional two per dollar if you spend more than $10,000 per year on the card. I went to a Gander Mountain store to see if they had a gift card rack, but I did not see one. Out of curiosity, I recently got this credit card, see my review here for details. UPDATE: This card is dead in the wake of Gander Mountain’s demise. I did end up turning the $60 sign-up bonus into a very nice cast iron frying pan.

- Total Rewards Visa: This is the Caesars casino co-branded card. I wrote about it here, and it seems to have some potential if you’re into that sort of thing. Scott at Travel Codex has a good rundown of the Caesars loyalty program.

- MyPoints Visa: I’m not familiar with the MyPoints site, which is apparently some sort of deal site / portal where you get rewards for buying stuff. You get one extra point for every dollar spent through MyPoints. Their website advertises 1 pt / $ on Amex gift cards, and it looks like points are worth two thirds of a cent as best as I can tell. Is 1.4% back on Amex GCs worth it? I never mess with those things so I have no idea.

- Farmers Insurance Visa: I recently reviewed this card as well. One interesting thing about it is that you can get 3X rewards on your insurance payments, although of course you are limited to getting this rewards on Farmers Insurance products. It’s also got a 3X bonus on home improvement, which is not something that a lot of cards have. But unless you’ll be spending a lot of money in those areas, this card probably isn’t worth it.

- Orbitz Visa: This card can be useful if you use Orbitz a lot. The card lets you earn 10% back on hotel bookings if you use the Orbitz app (8% if you don’t). The card also gives you gold status in the Orbitz program, which may be good for a few benefits, and also gets you a little closer to Platinum status, which gets you a few more benefits. And Gold Status is also helpful for Best Rate Guarantee claims as well.

- Victoria’s Secret card: This one may be worthwhile if you’re a big shopper at Victoria’s Secret; it’s also rumored to be an easy one to get via the shopping cart trick. Read my review here.

- I looked at the Toyota and Lexus Visas right here. Bottom line: you can safely ignore them if you’re just looking for credit card rewards. Commenter Anthony reports getting approved despite low scores: “I got approved today for the lexus visa through comenity. 750 CL. Scores were 545-562-550. Dont know what CR they pulled, but income most likely played a part in getting an approval. Its low, but its a start.” If you’re curious about other automotive credit cards, I’ve got a list here.

- I don’t have any familiarity with the Buckle credit card, one commenter below reports: “I used the SCT a couple of years ago with them and they have increased me on their own 4 times out of the blue.” So perhaps it may be good for credit building? You also get a $5 reward every year for your birthday. And commenter Lori reports getting the card with the shopping card trick.

- The Ultamate Rewards Credit Card and Ultamate Rewards MasterCard are hilarious because the Ulta beauty store card sounds so much like the Chase Ultimate Rewards credit card program. The rewards are only worth–at most–2% back on your non-Ulta spend, so you’re better off sticking with a 2% back credit card. Commenter Kim says below that the shopping card trick doesn’t work with this one, but despite that you may be able to get this one with a soft pull–ask at the Ulta register to see if you’re preapproved. If you want to read a review from somebody who’s into budget makeup, here you go.

- Thanks to commenter Genelle below for pointing out she received three Comenity store cards via the shopping cart trick: Ashley Stewart, Avenue, and HSN. Commenter Darla says that to get the pop-up for the HSN card, you need to register there and enter a credit card number while you’re in the shopping cart.

- I wrote here about the Saturday Night Live MasterCard (edit: the card was eventually cancelled). The intriguing hook on this card is 4X the points on entertainment purchases on Saturdays. Entertainment includes gambling / casinos, and I don’t know of any other product that pays out that kind of bonus on that category. Unfortunately I can’t tell how much the points are worth from Comenity’s website, and I’m hours from any casino anyway. The right person with the right idea (and with a great deal of self-control and no proclivity to gambling addictions) might be able to do pretty well racking up credit card rewards, though.

- Univision Visa: Here is my review of this card. Long story short, it’s not that great. Pass! (Edit: This card was closed down in July 2017.)

That’s all the Comenity credit cards I see worth discussing. Your thoughts?

![]()

Recent Comments