We tend to do dumb things in the miles-and-points game or hobby. By we, I mean me. Specifically when it comes t0 booking hotels. I plan trips way in advance but fail to secure hotel bookings until the price skyrockets. Or I book two different hotels’ nonrefundable rooms for the same night. For this post I’m going to look at an award redemption that everyone knows is all wrong, and see if it might make sense after all. If not, please leave a comment and at least I’ll learn more about how I get hotels all wrong!

One of the first pieces of advise given to people starting out regarding award bookings: Except for a few nights-and-flights promotions, use your airline miles for flights and your hotel points for hotel stays. In this article at The Points Guy, using miles for hotel stays is listed as one of the 10 ways not to use your miles and points. But, in the case of AA, I think the conventional wisdom is off-base for family travelers. At least for our family, and maybe yours too in some way. Here’s why:

- Southwest has opened up routes that negate the need for AA miles to get to several Central American and Caribbean destinations. Thanks to our companion passes, we booked a holiday weekend trip to Costa Rica in January for far less than half of any legacy carrier’s option if they had Saver level seats (they didn’t). Since we take a lot of 3 or 4 day trips, Southwest’s expansion South of the border has made using other programs pointless to many of the destinations within our reach.

- AA isn’t releasing enough sAAver level seats to keep us going. I’d be happy to use AA miles more and take advantage of Main Cabin Extra seating that I currently have courtesy of an Alaska Airlines status match. But the lack of award space on the flights to and from San Antonio means I haven’t been able to.

- As I feared, the once-wide-open US Airways domestic business class space disappeared when those flights switched over to AA. Without it, it’s much harder for us to connect to long-haul business class partner flights.

- British Airways’

fuelscam surcharges make many AA awards to Europe and Africa too expensive to be worthwhile. - Citi has been happy to give out ridiculous numbers of AA miles to anyone willing to churn AA cards when available. Many people stopped churning AA cards once they had ‘enough’ AA miles and switched to churnable Hilton cards. However, Hilton points are rarely worth a cent and don’t give access to nearly as many rooms as AA miles. So, the best card to churn (when churning is possible) for Hilton stays may be… AA cards! Even though churning rules have been tightened and slowed our churning of AA cards to a crawl, I can’t spend miles as fast as I earn them.

- Families contain kids. Little kids turn into teenagers within a few weeks of their 6th birthday. Well, maybe it only seems that way. Standard rooms with two queen beds go from perfect when the kids are little, to bad for everyone, almost overnight. Unless you have enough business travel paid for by others to earn and keep status (and that status gets you suite upgrades), you may find yourself needing two rooms for a stay. Or one suite that you can only book with cash. Or, in this case, cash in the form of AA miles.

- If you prefer to get off the beaten path like we do, you may find that no one hotel program is good for you. In our case, most of the time our first hotel choice isn’t part of a chain at all.

- If you have an AA credit card, you get Elite member pricing on hotel bookings with AA miles. Generally this works out to about 1 cent per mile compared to an after-taxes prepaid cash price in the same room. However, it is sometimes higher – I’ve seen 1.2 and even 1.6 cents. If you look at booking hotel rooms with AA miles without logging in and compare to the before-taxes price, it looks awful. Log in and keep clicking on both the AA site and the hotel or OTA website for a real comparison.

- You can combine AA miles and cash, and save money on a paid stay. We’ll look at that more in a minute.

- Hoarding make miles sad. If I sat on 1.5 million AA miles waiting for that perfect opportunity to maximize their value, I might wind up spending $15,000 on hotels I could have booked with those miles, just in time to run into a major AA devaluation. While I don’t try to burn miles as soon as I get them, I certainly don’t want to hoard them either.

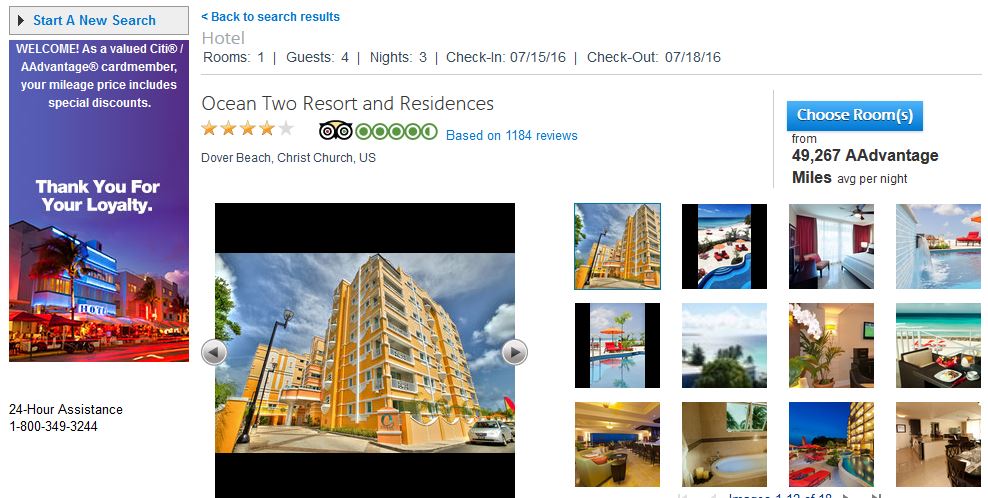

Let’s look at a real-world example. Just for fun, I chose the property we stay at when we visit Barbados: Here’s a 3-night stay for July 2016 using AA miles

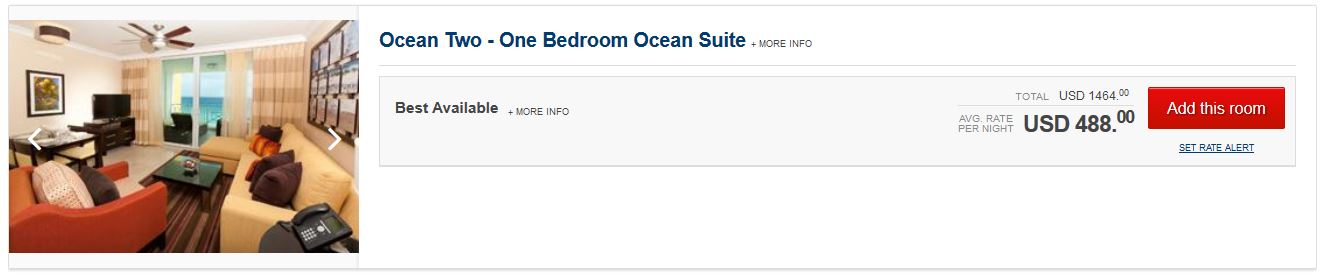

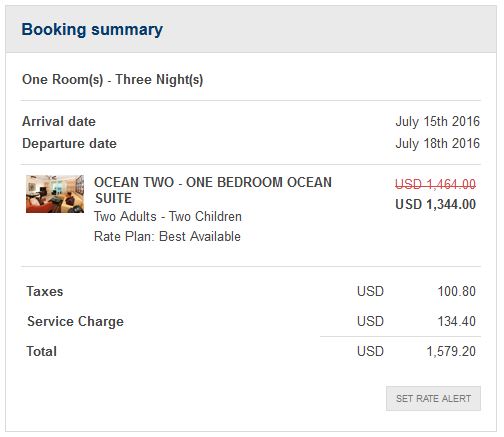

A one-bedroom suite with a full kitchen runs 147,800 AA miles for 3 nights.

$1464 on the hotel’s site. So that’s just under 1 cent per mile, right? No deal! Until…

you add taxes. Then it’s 1.07 cents per mile.

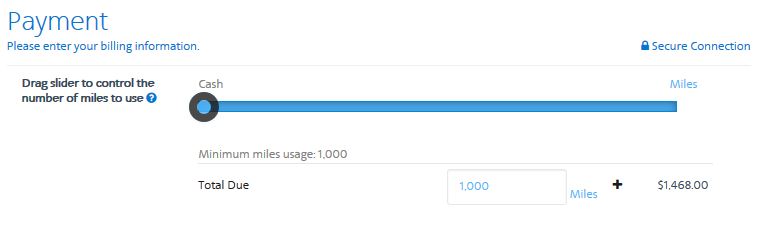

Expedia priced out the same as the hotel. But, if we keep clicking on the AA site, we see that you can use up to 147,800 AA miles, or any lower increment of 1,000, down to just 1,000, and pay the rest in cash at one cent per mile. So, in this case you could use 1,000 AA miles to save $110! And, since your payment for the remainder will be to AA, it should count as travel be able to be redeemed with Arrival or Capital One points.

For most of the long weekend stays at expensive (for us) non-chain hotels I priced out, using this method would cost 1,000 AA miles and save up to $150. Sometimes there was no savings at all. If you find one of the instances where AA miles are worth 1.6 cents per mile, you can turn that into a 37.5% discount. Not bad for a thousand miles!

The view from our balcony at Ocean 2 in Barbados, where we stay for free thanks to a very generous relative who owns a room.

We have used AA miles for stays in Alaska and Belize, and at check-in our stay appeared to the front desk personnel as a prepaid cash stay. While it may be possible to add your hotel loyalty number and earn points for your stay, this is a big YMMV just like all OTA bookings.

With stays to book in Costa Rica in January, Peru in June and Victoria, BC in July, I fully expect to get rid of some of our AA miles while keeping the cost of those trips to a minimum.

The downside

Most hotel bookings made at the AA site, whether all miles or mostly cash, are non-refundable. I’m fine with that, but not everyone will be. Chain hotel bookings made there may not earn points. Also, you miss out on potential money-saving opportunities such as OTA coupons, sales offered by other sites, and free fourth or fifth nights offered by some programs and cards.

Conclusion

You may not have enough AA miles for the flights you want to use them for, or you may not want to keep up with the latest ever-changing churning opportunities. Maybe you live in a city with far better availability than I have on AA awards or partner service. If any of these are true, you probably don’t want to burn AA miles for hotel stays.

But if you find yourself with an opportunity to earn ‘too many’ AA miles, remember that flights aren’t the only possible use. And next time you’re going to be booking a hotel with cash, give the AA car and hotel booking site a spin. You just might like what you find!

Disclosure: Aggressively churning credit cards requires a great deal of tracking and management, and lots of time and spending. It’s not for everyone! If you churn credit cards, start slowly and find a pace that you can manage.

Nice to hear a different perspective. Thanks.

Does the 10% bonus on redeemed miles not factor into this?

Good point! Yes, you do earn the 10% back up to 10K miles per year when redeeming for hotels.

How is that year determined?

It is the calendar year, and only the date of booking matters.

Interesting. I’m going to check on a few hotels now.

For Crop Over that’s a bargain. the prices are often ridiculous but sometimes you find interesting offers such as 12000 AA points for a night at Hilton Barbados. Gold status was recognized. I believe this was in the off season.

So is it just AA, or can this be done with other airline programs?

I haven’t researched any others thoroughly, but I think BA Avios and Virgin Australia miles can sometimes be put to good use for hotels.

When booked hotels using the AA miles, do you get hotel stay credit & hotel status benefits?

You may or get credit, just like any stay booked with OTAs such as Orbitz. We have only booked non-chain hotels with AA miles.

It’ll be interesting to see what life is like post-US F availability. Most of my domestic connections have been on US. Not good, hmm….

I think this type of value comparison is wrong, and most bloggers…and travelers in general fall into this trap.

Have you looked into alternative accomodation options, like Airbnb? You can often rent entire apartments for way less than a suite at a hotel. You should be comparing your savings against the cheapest equivalent alternative….except of course there are hotel snobs who must stay at a 5-star property or else there’s just no way to enjoy a vacation.

I would always prefer to stay in a vacation rental house such as Airbnb, then a small non-chain hotel suite, over a large 5-star hotel. However, rentals are rarely cost-effective for one or two night stays. These are the only stays I have or would consider for AA miles. It is only the ‘perfect storm’ of Citi’s crazy generosity over the past 3 years, lack of AA Award availability for our limited schedule, and these short family stays, that results in AA miles hotel stays making sense for us.

How’s the shortness of stay affecting the cost on Airbnb? The only thing is a cleaning fee which you pay every time you move out, but it’s usually minimal compared to the rental cost.

In the past year I’ve traveled abroad a lot and have almost never stayed in a chain hotel, or even a higher tier local no-name hotel. The only exception is maybe SE Asia, where airbnb is often rare and there are plenty of dirt cheap, modern, low end hotels.

I totally agree that many travelers (myself included) often inflate our perceived value of lodging by shopping only for hotels. And I also prefer rentals to hotels. But many Airbnb properties do have 2-night minimums, cleaning and/or service fees, and limited check-in and check-out times. All of which are usually fine for longer stays, but can be more trouble or cost than they are worth for one-night stays.

We like Airbnb and have stayed at their properties multiple times. However we’ve also found that on short stays, the Airbnb fees (totally non-refundable) and cleaning fees frequently make it an uneconomical choice compared to booking a hotel with points of some sort or via a discount with one of the travel sites. In addition, location is important to us, and often a hotel is better situated to our planned agenda.

It’s valuable to look at all options. I use points to enhance our travel opportunities and experiences which means I don’t always maximize their monetary value. That’s ok!