For years now the holy grail of manufactured spending for cashback as well as miles and points has been any card that offers 5 points or 5% cashback on spending. Whether it’s capped or uncapped, on a very narrow category or on all spending, it’s hard to argue with 5X. The Miles Professor proved this very effectively by handily beating a whole host of other MSers in 2013’s Mile Madness competition by skipping more creative strategies and developing a very simple, efficient routine that earned her 5X. Recently, though, there have been a lot of shutdowns on 5X cards. I think this is going to continue as the sieve gets finer and banks decide to part ways with the card accounts that cost too much for them to keep open. In fact, I’ll probably have one sports-themed card shut down in a month or two. You can’t score if you don’t shoot, right?

So I’ll be part of that wave if it happens, but for the most part I’ve moved on beyond 5X. It’s just not sustainable for large-scale MS over a long time period. For two weeks out of the year, or maybe the first three or 6 months after signing up, banks seem to be willing to endure the losses just as they would with a signup bonus. After that, then what?

Eco-MS

I think we can find a sustainable path that earns enough cashback to make it more than worthwhile if we split up our earning between multiple companies. This has become my favorite approach, even though it’s not a lucrative as it might have been a year or two ago. I don’t think we’ll see 4X and 5X on AMEX gift cards portal payouts anytime soon, but 2%+ has been possible at least every couple of weeks with just a couple of monthlong exceptions over the years. If you missed it, Matt has a great post on how this remains viable here. From the United card with 1.4X on the first $25K each year to AMEX Everyday Preferred at 1.5X MR to the various 2% (or a little better) cashback cards out there, it’s a lot easier to fly under the radar if you can split up your MS activities between 5 or 6 cards issued by several banks. Needless to say, this approach also makes any obstacle that might pop up a lot smaller as spending can simply be shifted from one ~2% product to another.

Our strategy, then, is to pick up as many AMEX gift cards as possible using lots of different 2X+ cards as well as signup bonus spending, earning ~2% from the portal as well as anywhere from 1.4 to 12X from the card. Unfortunately, the 2.5X-12X that we earn is generally only on new accounts as we work towards signup bonuses. Fortunately there is no shortage of offers, some of which remain churnable against all odds.

The catch:

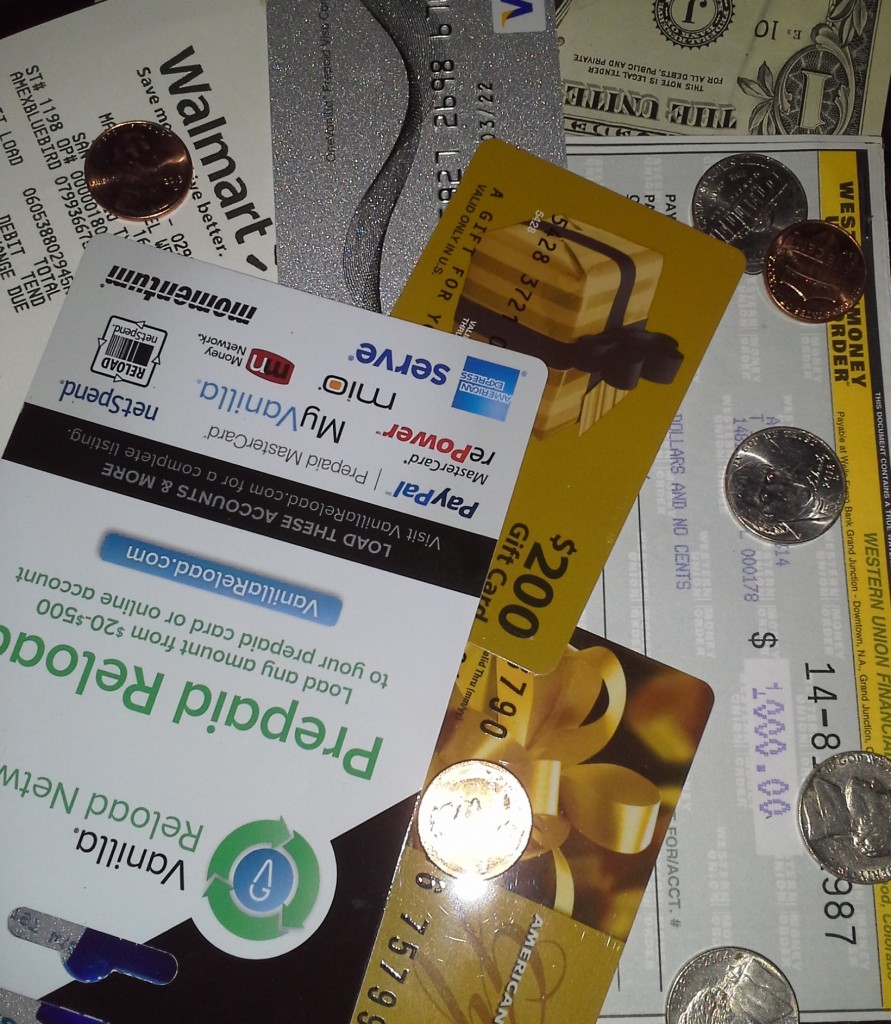

To go down this road and avoid the slash-and-burn approach, there is one obstacle: liquidating AMEX gift cards. As always, MS is local. If you’re looking for ideas on that anywhere but Central Texas, you’ll be a lot better off working with a few local friends than asking me for ideas on that. But if Chasing the Points and The Miles Professor could find a way to win with MS in New York City, I think it can be done just about anywhere in the U.S.

I’m not saying you have to quit 5X (or even better) cold turkey – there are still some awesome short-term and limited offers out there! I still hate myself for missing out on the unlimited-5X-for-a-year Citi Preferred offer. When the honeymoon ends, though, I think you’ll find a more sustainable path makes sense in the long run. Or maybe you’ll just get off the hamster wheel, but we’re definitely not at that point yet!

Sound approach.

Is that an HEB money order I’m seeing? Those are becoming a rarity in $1k increments, as multiple swipes start to generate more and more GC nazi responses.

I can’t be 100% sure whether that one was the result of a split payment – it may have earned Delta miles instead. Things are a little better here where the MSer to store ratio is much lower with a location on every corner.

Hah, yes some of the smaller towns up and down 35 have stores with relatively lax oversight, especially atWallyworld.

It’s cashing out those AGC that’s the stone cold bitch.

WM hereabouts won’t sell Sunnies on CC. Grocery stores are matching CC to ID. CVS cashiers are trained not to sell a GC on a GC. WAG is hardcoded to not sell GC on CC. Simon won’t have anything to do with AGC. RB dragged AFT under with it.

The sky has fallen.

That’s a tough environment you’ve got!

Speaking of The Miles Professor, we haven’t heard from her in a while. I hope she’s okay.