A couple of months ago, I had a quick post about why it’s important to build a relationship with your banker. My friend told me about this offer that he was researching and was very exciting to hear about: Earn 50% more on all of your spend, but the promotion had to be applied to your account only by your small business specialist.

Travel Rewards:

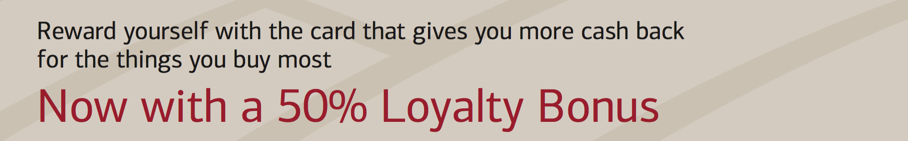

Here’s a screenshot of a flier for the Bank of America Business Travel Rewards card. If you are able to sign up with your business banker, you will earn 50% and receive 5,000 points on the first purchase. In total, you will be earning 2.25% for every $1 you spend with the promotion.

For those that signed up for the Bank of America promotion and haven’t closed their account yet, if you sign up for a new Travel Rewards card you could earn an extra 10,000 WorldPoints after spending $500:

Card bonus rewards — If you have an open Business Advantage or Business Fundamentals® checking account, you’ll receive 10,000 bonus points when you open and spend $500 on a new Travel Rewards Visa Signature® Business Credit Card within 60 days (applies only to first-time business credit card customers)4

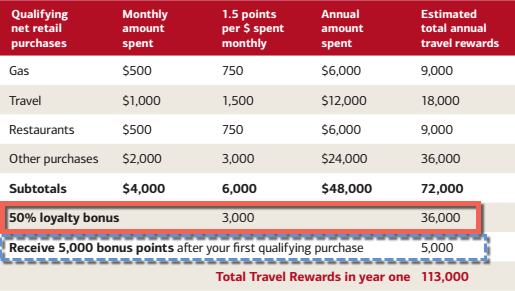

The Bank of America Business Cash Rewards is an interesting card. Their marketing material:

Earn 1% cash back on purchases, 2% on purchases at restaurants and 3% on purchases at gas stations and office supply stores (up to $250,000 in gas station and office supply store purchases annually, 1% after that)

If you dig deeper into the terms and conditions into the card it says with my emphasis:

Earn Cash Rewards of 1% of new Net Purchase transactions charged to the card. Net Purchases exclude any transaction fees, returns and adjustments. For each qualifying purchase you will receive 2% cash back of the Net Purchase at participating Restaurants, which are: restaurants and quick service restaurants (fast food), bars, taverns, lounges and discos, but do not include merchants that are bakeries, coffee shops, grocery stores, and other miscellaneous food stores that may operate a restaurant inside their premises. The 2% cash back consists of your base rate of 1% of Net Purchases plus a bonus of 1%. For each qualifying retail purchase you will receive 3% cash back of the Net Purchase at participating Gas Stations that primarily sell fuel for consumer use and may or may not have a convenience store, car wash, or automotive repair shop on the premises, and include merchants that process credit card transactions by requiring customers to present the card to an attendant and sign a sales draft or enabling cardholders to purchase fuel by completing the transaction at the pump; Office Supply Stores, wholesale distributors of stationery, office supplies, and printing and writing paper, but do not include variety, department, discount warehouse, or drug stores that may sell office supplies, and do not include merchants that sell large or high-priced office equipment such as computers or desk units. The 3% cash back consists of your base rate of 1% of Net Purchases plus a bonus of 2%.

With that out of the way, the 50% promotion is only applied on the 1% of the Net Purchases. So the max you could earn is 3.5% instead of a cool 4.5% on office supply purchases.

Like the Travel Rewards card, if you sign up for a new Cash Rewards card you can receive a sign up bonus since there typically isn’t a sign up bonus.

Card bonus rewards — If you have an open Business Advantage or Business Fundamentals® checking account, link a new Cash Rewards for Business credit card account and spend $500 on purchases within 60 days to receive a $100 cash back bonus on the card (applies only to first-time business credit card customers)6

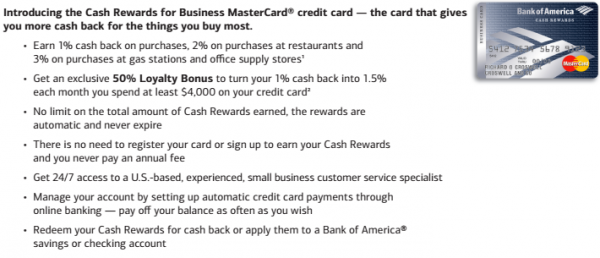

By now, you must be wondering if the other business Bank of America cards offer the 50% bonus. Unfortunately, they do not. Only these 2 cards have the extra 50%. Even the other WorldPoints earning cards like the American Bar Association is not eligible for the extra bonus

Bottom line, for all those that took advantage of the Alaska Airlines credit card with the checking account promotion you will not be eligible for the 50%.

Continue reading...