I made a public service announcement about in branch offers being better than online on Twitter, and many folks don’t seem to fully grasp that fact. Yes, I love doing things online and at home just like many people, but you need to go to the branch and speak to a banker to see what’s available. Despite some of the news you may see online, like Chase laying off 5,000 people from the branches, which targets mostly tellers as ATMs are now so sophisticated it does many of the functions the tellers do like dispensing change! Speaking of Chase, last time I mentioned the in branch offers, it was for the National Small Business week where Chase was upping the bonus AND waiving the annual fee if you signed up.

This time, we are looking at Bank of America and you must apply in branch.

The Offer:

Let’s start with the crappy offer.

The online offer says if you open either of the two small business checking accounts above and you will receive $100. Not very interesting.

In Branch

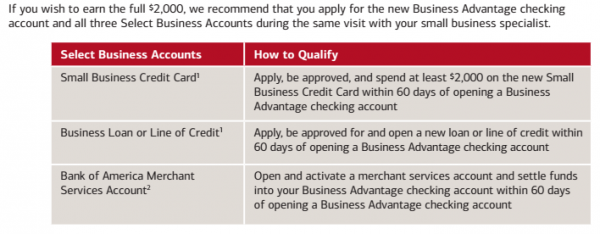

If you visit your local branch and speak with the Small Business Banker they will tell you about this amazing offer that’s up to 20 times higher than the online offer. Below with their emphasis

Here’s how

- Open a Business Advantage checking account by 10/30/2015 AND be approved for one of the following Select Business Accounts listed below within 60 days of opening the Business Advantage checking account to earn $1,000, provided you meet the related qualifier as defined below.

- For each additional Select Business Account you are approved for within 60 days of opening a Business Advantage checking account, you will earn an additional $500, provided you meet the related qualifier(s) as defined below.

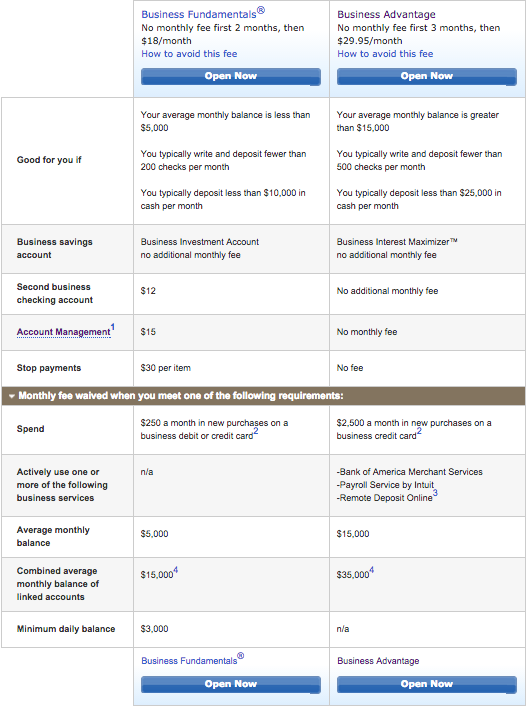

The “problem” is you must open a Business Advantage account. I use “problem” loosely as you will see why it’s really not an issue. There’s a monthly minimum balance if that was a route you were planning to take to avoid the monthly service fee.

But that’s OK! Because Bank of America has a very unique way to build relationship banking, you can spend your way to waive the fee.

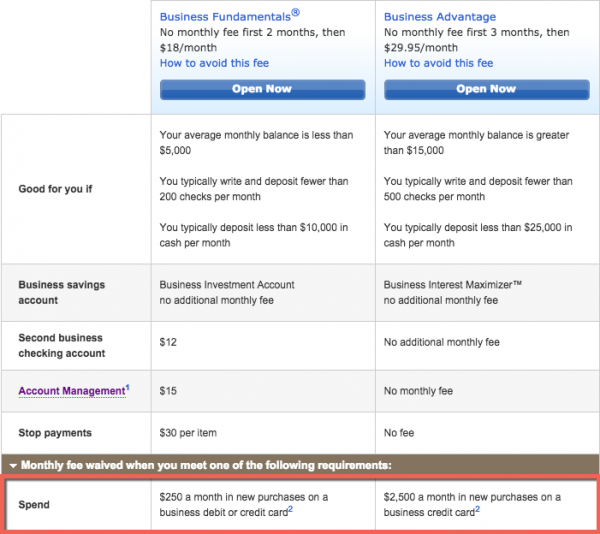

Did you miss it in the first screenshot? No circles and arrows, but a red box will do the trick

Yes, that’s right, it ties into the bonus very well, spend $2500/month on your credit card and all the checking account fees will be waived. Add in the this checking account type with the Business Preferred credit card, you will now receive a free credit card and a free checking account and $100 a year.

You are already reading this blog, so you will know how to manufacture spend and $2500/month should be easy peasy.

Here are additional terms and conditions, emphasis theirs again:

Eligibility: Offer only available to customers who receive this offer via a direct communication from a Bank of America small business specialist. New Business Advantage checking account must be opened by 10/30/2015, and the qualifiers of all Select Business Accounts selected must be met within 60 days of opening your Business Advantage checking account. Bank of America may change or terminate this offer before this date without notice. To be eligible for this limited-time offer, you must not currently have a business checking account with Bank of America. You are not eligible for this offer if you were a signer on or owner of a business checking account within the last six (6) months. Bank of America associates are not eligible for this offer.

To Earn the Initial $1000: You will qualify to receive the initial $1000 cash bonus after verification of the Business Advantage checking account opening by 10/30/2015 AND verification of completing at least one (1) of the following Select Business Account requirements: 1) apply and be approved for a new small business credit card and spend at least $2,000 in net new purchases on that card within 60 days of the opening of your new Business Advantage checking account; 2) apply, be approved, and open a small business loan or line of credit within 60 days of the opening of your new Business Advantage checking account; 3) open and activate a Bank of America Merchant Services account (for the purposes of this offer, the application is deemed to be a referral to a merchant services associate by a Bank of America small business specialist) and settle funds into your new Business Advantage checking account within 60 days of the opening of your new Business Advantage checking account. Activation is defined as the submission of a batch greater than $20 of any card type. Bank of America Merchant Services account must settle funds into customer’s new Business Advantage checking account. You must not be an owner or signer on a Bank of America Merchant Services account that is open or that was closed within the last six (6) months.

To Earn up to an Additional $1000: Earn $500 for each additional Select Business Account when you: 1) apply and are approved for that Select Business Account AND 2) complete the related qualifiers on that Select Business Account within 60 days of the opening of your new Business Advantage Checking account.

Taking It To Another Level

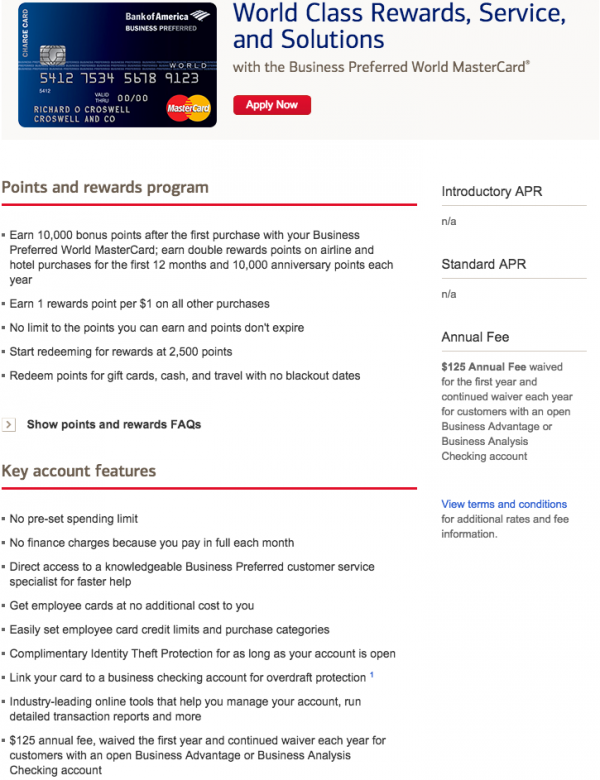

Bank of America hits the mark with relationship bonuses with credit cards and checking accounts. If you want to take this offer another level you should consider the Bank of America Business Preferred credit card. Yes, it has a $125 annual fee, but it will be waived when you open the Business Advantage checking account! Get this, at the end of your anniversary year, you will receive 10,000 points! That’s free checking and a free credit card AND free money to pay for it all. I mean it doesn’t get any better than this.

The points earned from the Business Preferred card are the WorldPoints. The only wild card is if they will allow you to consolidate to your personal Fidelity Amex so you can withdraw for cash back or leverage Milenomic’s method and supercharge the Fidelity AMEX.

Other Credit Cards:

To receive the $1000 or more bonus the easiest way is obviously opening a credit card, so you will need to figure out what’s the best credit card for your portfolio and manufacture spend $2500 per month. For folks looking for Alaska Airline miles this could be an easy way to earn some miles and get a nice cash bonus.

Closing It Out

If you’re serious about this offer, go to your local Bank of America branch and apply for the checking account and credit card. While you’re at at it, make some friends with the local bankers so you can be notified of these great offers. Thanks to my friend, I hear about many lucrative bank offers.

https://saverocity.com/chasingthepoints/wp-content/uploads/sites/12/2015/07/BAC_small_business_2000.png

Continue reading...