I’d like for you to contrast and compare two things. The first is an excerpt from Freequent Flyer’s review of the Charlotte mile madness festivities:

You are not playing against any other member of the community when you manufacture spend, book tickets, or sign up for credit cards. You are only playing against yourself (and the referees).

When people hear about the levels of manufactured spend being reached by others, their first, natural reaction is envy: why aren’t I earning as much as they are?

And the answer is simple: they have a different credit history, different credit limits, different risk tolerance, different geographical restrictions, different ethical boundaries, and different knowledge.

And that’s totally fine. It would be deeply weird (and not a little suspicious) if we all had exactly the same spend patterns, at the same merchants, all year every year. Instead, we’re all different, and that’s one of the things that makes it hard to pin any one of us down (our relatively small numbers help, too).

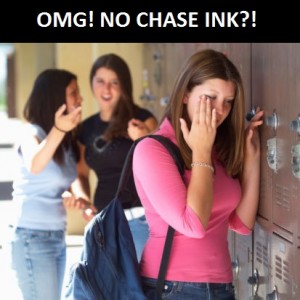

Contrast that passage with the headline of a recent post from another blogger:

WOW – Only 24% of readers have an INK card!

“Only”? Left unsaid is what the appropriate percentage of readers with an Ink card should be. I can only wonder what number would be satisfactory for the post’s author–50%? 75%? 100%?

Online Travel Review just posted a nice rant against this sort of thinking:

After reading the 372nd blog post about someone getting points through credit card signups and now they fly business class and if you don’t fly business class you a loser, I was feeling just a bit beaten down. 275 ways to use 60,000 Ultimate Rewards points. If you miss this added bonus you a loser. It’s exhausting.

And I liked this:

You can probably get 8-10 cards per churn. But you are not a loser if you’re only comfortable getting 1 or 2 cards a year. The Internet makes it easy for people who take things to the extreme to make it seem like they are normal and you are a loser for not taking part. Sleeping comfortably and not worrying about credit cards and manufacturing spend makes you sane, not a loser.

Freequent Flyer phrases it well: “You are only playing against yourself”. One thing I liked about this past weekend’s points-n-miles meet-up was the laid-back nature. There was a lot of “here’s how this system works” and “here’s an interesting trick” but nary a soul asked me to sign up for a credit card.

And everybody there was doing different things with their credit cards. Some people were doing hard-core manufactured spending at ridiculous levels. Some people were relatively new and working their way up the learning curve.

You don’t need an Ink card, and you won’t be missing out on a life-changing experience if you don’t get one. My wife and I each have one. We only got them last year because there was a good sign-up bonus (60K, same as now) AND because we saw an opportunity to bring her family here from Central America for a visit, a trip which would otherwise be difficult to afford. So yes, it worked out well for us… but not everybody has large numbers of in-laws in foreign countries.

A question often asked by people who lack knowledge of this stuff is, “What’s the best credit card?” And the answer is always, “It depends.” What are your goals, if any? Most people are best off with something like the Fidelity Amex, a straightforward 2% cashback card. Somebody like me is best off with a whole bunch of different credit cards since I know how to work them and I have a weird obsession with figuring out credit card deals. Somebody like you is best off with your own arrangement.

The nature of that arrangement is up to you, so figure out what you want (it will probably involve some combination of cash, travel, and simplicity / peace of mind) and then figure out how to do it. There are lot of forums for doing this–I like Fatwallet Financial and Flyertalk–and of course there are tons of blogs with helpful bloggers and helpful commenters. Most folks are happy to help you out just so long as you’re civil, appreciative, and you make a sincere effort to learn.

But you’re not missing out if you lack any buzzed-about card. To make you feel better about whatever you’re doing, here are some confessions from me:

- My wife and I both lack a Chase Sapphire Preferred. Good card? Sure, it has a nice sign-up bonus and UR points are awesome. But I never really needed it for anything in particular. Given that we have a bunch of small kids we’re not doing a ton of travel since it’s exhausting just keeping up with them at home, to say nothing of traveling with them. Maybe we’ll get those bonuses someday, or maybe not. I’m not losing sleep over it, though.

- My wife and I both lack a Barclaycard Arrival. Good card? Sure, it has a nice sign-up bonus and 2.2% travel rewards are awesome. But again: we haven’t really needed it. We actually tried to get this for Mrs. PFD in the last app-o-rama as a way to work the Big Win promo, but Barclaycard said no. Big deal–we’ve had plenty of credit card fun to keep us busy anyway.

- The Citi Executive Aadvantage: Nope, not much use for one of those right now, much less two, three, or four.

Whew! Felt good to get that off my chest. Feel free to add your own confessions of points-n-miles inadequacy below.

CHARLOTTE WRAP-UP: I hope you’re not getting sick of hearing about last weekend, but here are a few more bloggers’ summations and pronouncements:

If you wanted to go to this one but missed it, there’s talk of another one. It would make sense to have it on the west coast, and Portland seems to be the early front-runner.

To manufacture for this latest trip has been tiring. I am going to take a little break while continuing to feed the birds and let all the bills settle out from the trip. Reset the financial compass with a diversion plan for more hyper savings. Then get back in the game for fall. The trip has been amazing for the last year and I am glad I started on the journey. It certainly has been rewarding to be able to travel on the cheap.

Would LOVE to go to the next one. NYC-based.

Sweet post. Love it. Very well written. When you set people are hard core manufacture spending , what kind of numbers are they doing?

Say, mid five figures in spending per week.

I’ld say NEVER in NYC. Most of the country won’t be able to get a ticket and you’re stuck with a bunch of locals. You could readily set up your own NYC DO and find a good number of participants.

Great post. As always this game is not paint-by-number or one size fits all. However you might want to revisit the Executive card, since you can get about $1100 in hotel stays at nearly any hotel in any room(s) or suite (not just standard rooms in hotel programs designed around two travelers) for each one. Of course that is not the highest apparent retail value for 110K AA but for a family it works a lot better than branded hotel cards. And if you can MS 10K before the first statement posts, you also get the $200 credit and the fee is completely optional.

Thanks Kenny, really appreciate it! I had no idea about the hotel thing–how’s that work? Do you just book hotels w/ American mile? I’m not familiar with this at all.

I disagree with the quote (paraphrasing) “you are not competing against others in the community”

Remember the bloggers pimping the Chase Ink and Sapphire cards night and day? What did that do to Star Allliance premium seats inventory? There was very little of it even 6-9 months out because too many bozos had Chase UR cards and were transferring their points to United because it was too easy to book seats.

Now with the United devaluation, go take a look at the inventory starting January 2015, it’s all freaking green! I don’t think this is a coincidence.

“Most of the country won’t be able to get a ticket”

Seriously? Come on, now. Just say you don’t like the city. We’ll understand. 🙂

Browse for availability of rooms at useaamiles.com without signing in, and multiply the required number of miles by 0.6 to see approximately how many would be required if you have status or an Executive card. IME the ‘price’ drops about 2-3 weeks after getting an Exec card, and has stayed there as I have churned and cancelled cards. At this point it makes sense for me to keep one at all times, and I’ve already gotten more in credits than the fee I will have to pay if/when churning gets shut down. I don’t think I would do car rentals but they are also a possibility. Some hotels have more room choices than others, but there’s lots of variety available.

The real cost of AA Executive card is $750 if you count lost cashback opportunities, so I kind of can see why it gives you a pause. Then again, I wouldn’t be a travel junkie if I didn’t believe that it’s still amazing value (CX in J to Asia?). Wouldn’t use it on a hotel.

Hadn’t thought of it like that, but now that I do that’s actually a good point.

Thanks for that. I know that everything you said is true, but since some bloggers are more concerned about their own income from CC signups than they are about the well being of their readers, one can get inundated by that sort of “why are you such a loser?” talk.

We were lucky enough to be able to spend time with daughter and family when our first grandchild was born last year in Italy, d/t sign up bonus and points earning activities outside of CCs with both Delta and Alaska. Flying roundtrip to Italy at our age is much more able to be handled when one can sleep on the plane in business, so thank you Delta and AK Air for that!

As for another get together. YES, PLEASE. The west coast sounds lovely. But please, not on Mother’s Day (or Father’s Day, for that matter) weekend, OK?

Try the math again. Spend 10K, get $200 statement credit and 110K miles. Apply again after a month, get another, then cancel the previous one. No fee. If these miles are ‘wasted’ on hotels, that adds up to 13 cents per dollar. 13X is also better than 1X. Of course you can get CX J or whatever but that’s only useful if you have time and they have seats. For me (travel opportunities are basically limited to long weekends with 4 pax around school holidays), any AA mileage balance over 500K is miles I can’t use within the next year or two, so I will gladly use them to take the lodging cost for 4 out of the equation, in the exact non-chain hotels in little towns that I want to be in.

If we believe the general advice that says that one should never manufacture more points than can be reasonably used in a year then doing basic churning is good enough. I’m happy for those like Marathon Man who have essentially turned MS into a full time job, and there are a few on FW Finance who have done the same thing with heavy hitting. But that’s what it is – a full time job. One with very flexible hours, but especially the ramp-up will require the same level of effort as starting up a business (in terms of research, making contacts, etc.) And like a business you have to constantly guard against competitors and so you will scream bloody murder when things like HIGC get exposed to the general public. I’m more content with this being a part time job that I can dive into as time permits. I get enough free trips and rooms, but I’m not constantly jetsetting to Europe or flying around the world, because I don’t need to in order to validate my existence, nor do I hate my day job enough.

“not on Mother’s Day” –> you listening, Matt? 🙂