I don’t have any hot new deals today, but I do have an unusual news item. “Elaborate credit card scheme busted at Chatham County Jail”, says the headline: [Read more…]

How to make six figures with Airbnb! And how to make $1.25 (plus points) with Staples

HOW TO MAKE SIX FIGURES WITH AIRBNB: Some clever entrepreneurs are making good money with Airbnb.com:

Airbnb insists it’s not a hotel. Even while admitting that its hosts should be responsible for hotel taxes. While defending itself in New York City–where the attorney general demanded user data on 15,000 hosts in order to crack down on “illegal hotels”–the company pointed press to a survey showing, at least by its own measure, that 87% of Airbnb hosts are the primary residents in the homes they rent out to guests. In San Francisco, it’s 90%, according to another survey.

But among the other 10% are people like Bradley, who very much sees being an Airbnb host as a business. “With trading, you look for arbitrage opportunities, where you have an opportunity to buy things for cheaper and sell them for more,” he says. “In the same way, I was like, I can rent apartments for $2,000 a month, but if I were to rent them on Airbnb, I get $150 a night.”

At 90% occupancy, Bradley can make about $4,000 per apartment on Airbnb. He pays about $2,000 of that in rent and utilities. That comes out to about $2,000 profit per apartment per month, or $24,000 each year. With six apartments, he could make up to $144,000 in a year.

It’s a good read–the full article’s here.

WHO LIKES FREE MONEY AND POINTS?: Frequent Miler reminds us that there’s still money to be had at Staples:

- Register credit card with Plink. Add Staples to your Plink Wallet.

- Go to Staples.com via uPromise.

- Buy a single $100 Visa gift card for $106.95.

If all goes well, you’ll earn $5.35 cash back from uPromise and $3 worth of gift cards from Plink. Let’s value the gift cards at 95% face value so that we get a rebate of: $5.35 + $2.85 = $8.20. That’s pretty cool since the combined fees for the Visa gift card came to only $6.95. So, you earn $1.25 profit plus 5 points per dollar.

Why worry about your cost per point when you can actually get paid to take points off peoples’ hands?

UNITED GETS MEDIEVAL ON “MISTAKE” FARE USERS, SORT OF: Some folks on Flyertalk found and exploited a glitch with United’s website to book themselves $80 tickets to Hawaii, and United has responded by shutting down the frequent flyer accounts of the guilty parties. It seems as though only new accounts set up for the purpose of exploiting this software flaw with United’s site were shut down, so I’d say that’s fair.

TIMESHARE VACATION OFFERS: If any brave souls want two nights in Vegas (or three in Orlando) plus 10,000 HHilton HHonors Ppoints and a $200 certificate, all for just $199, here you go. This requires sitting through a timeshare presentation, so don’t go unless you’re fully prepared.

WHO LIKES BANK DATA?: Nate Tobik, who runs the interesting and well-written stock blog Oddball Stocks, has launched a new service focusing on bank investing. The site is called CompleteBankData.com and you can get a free 30-day trial here.

12 UNUSUALLY PLACED SPORTS VENUES: Cool pics, bro!

MONEY-SAVING TIP: Cooking at home is a great way to save money! If you don’t know how to cook, here’s an easy recipe to get you started: How To Make Ice.

What can I say, it’s Friday… enjoy the weekend!

$200 from Citizens! $200 from Target! And good news for people who pay off their credit card balances!

AN EASY $200 FROM CITIZENS BANK: If you open a checking account by November $15, Citizens Bank will gladly pay you $200. As per the offer page, all you have to do to claim the bonus is “make any deposit (excluding opening deposit) or have five qualifying debit card payments or purchases post to and clear your new account by January 31, 2014.”

The downside: as per the rep I chatted with, “It is currently required to reside within our business area to not only qualify but also open an account with us.” Citizens operates in Connecticut, Delaware, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island and Vermont. Hopefully that covers a non-trivial percentage of my readership.

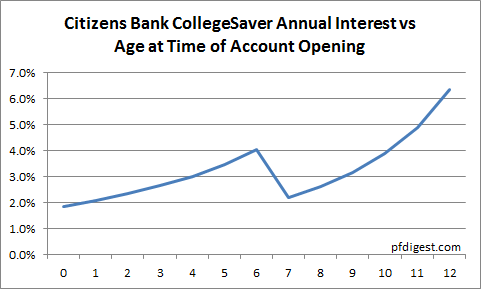

Incidentally, Citizens boasts one of my favorite weirdly fascinating financial products: the CollegeSaver savings account. What makes it interesting is how complicated it is. I go into more detail here, but in a nutshell the effective interest rate depends on how old your child is when you open the account. The net result is that you can get anywhere from 2% to 6.4% depending on your child’s age:

So if you have a kid who’s about to turn 12, this is a like a 6-year CD paying over 6%. But if he’s a newborn or has just turned 6, you get 2%.

A NOT-QUITE-AS-EASY $200 FROM TARGET: Via FatWallet, you can trade in an old iPad for a $200 Target gift card with the Target electronics trade-in program. As this FWF thread points out, you can get first generation iPads for less than that on eBay and Craigslist. As per the Fatwallet thread:

The $200 will be issued as a “Target Electronics Trade-In” gift card. This is not a regular Target GC but can be used in store or online. It is branded MasterCard and some report it can be used as a regular card once it is registered, etc. YMMV.

And also:

Trade ins are only done at a store with a Target Mobile. Check to make sure this service is available.

GOOD NEWS FOR TRANSACTORS: One of the more frustrating things about credit bureau reports is that they do not say whether or not you’re paying off your balance every month. So from a risk standpoint, somebody who’s chasing promos and buying a bunch of Vanilla Reloads looks a lot like somebody who’s leveraged up on credit card debt.

That, fortunately, will change:

The three major credit bureaus have started adding new details about credit card payments to credit reports that reveal whether a cardholder is a “revolver” — someone who carries a balance each month, racking up interest charges — or a “transactor” — someone who makes purchases but typically pays off the balance in full.

Credit bureaus say the additional information will help card issuers better target their products to customer needs and better identify people who are the best credit risks. Customers who pose the least risk generally are offered cards with the best rates and terms.

Transactors are “absolutely” less likely to default on debt than revolvers, said Ezra Becker, vice president of research and consulting at the Chicago-based national credit bureau TransUnion.

The last time I saw my FICO my biggest negative factor was “balances on too many cards”, so this is a change I’m happy to see, and presumably some of you out there will benefit as well.

22 DEPRESSING PHOTOS THAT SHOW HOW KMART IS DYING: That’s the headline of the article, and I can’t top that, so here you go. Of possible interest to those who may have bought a Sears/Kmart gift card or two:

Even Kmart’s registers are outdated. “Pictured is one of the most outdated point of sale terminals I have seen in recent memory. It sits off in the electronics section. Oh, and all of those wires are exposed to the paying consumer,” Sozzi writes.

Kmart doesn’t have a store within 30 minutes of me, so I haven’t been to one in a couple of years. I do recall that my last visit was slightly depressing though. Does anybody remember when Eddie Lampert was supposed to be the next Warren Buffet?

Santander Bank wants to pay you $240! And how to live on $5,000 per year

$240 PER YEAR FROM SANTANDER BANK: (Thanks FWF!) Boston-based Sovereign Bank was recently acquired by Spain-based Santander Group, and consequently the bank has changed its name to Santander Bank. The makeover may or may not be related to the fact that Santander is generously offering to give you $20 per month, and all they ask for in return is a $1,500 direct deposit and two bills paid via online billpay.

I’ve yet to do this deal myself, but this FWF poster says they do credit card funding of accounts up to $500, and this one says it’s a soft credit pull, not a hard one. I guess the big question is whether an ACH counts as a direct deposit? If you have a lot of family members, this could be a nice little promotion.

$200 FREE GROCERIES FROM HARRIS TEETER: For those of you in the right areas, Harris Teeter would like you to patronize their pharmacy, so they’re willing to give you $20 of groceries for every prescription you fill, up to $200.

INFORMATIVE P2P LENDING SITE: I’ve yet to venture into P2P lending, and at this point it looks to me like there’s too much money chasing too few quality P2P loans (thank you very much, Federal Reserve), but for those of you currently in the game or thinking about it Nickel Steamroller has some interesting stuff.

ALLY BANK CHANGES CD TERMS: Once upon a time, Ally Bank had an extremely consumer-friendly policy on CDs where they would only charge you 60 days of interest as an early withdrawal penalty regardless of the CD’s term. This made Ally CDs a pretty good investment relative to other options, such as the atrocious Duke Energy PremierNotes.

Those days, alas, are now behind us, sort of. While the policy for CDs of two years or less remains unchanged, Ally has increased the penalties for CDs above three years as follows:

- 3 year CD: 90 days’ loss of interest

- 4 year CD: 120 days’ loss of interest

- 5 year CD: 150 days’ loss of interest

Which is not unreasonable, of course–it’s just not a great deal like it was before.

HOW TO LIVE ON $5,000 PER YEAR: Our latest example of extreme frugality:

More than two decades ago, then-33-year-old Dan Price had a wife, two small children, a high-interest mortgage, and a stressful job as a photojournalist in Kentucky. He worried daily about money and the workaday grind.

“I told myself, ‘buck up and pay the bills,’” said Price. “This is just the way normal life is.”

Then he learned about what he calls “the simple life.” Price read Payne Hollow, a 1974 book about author Harlan Hubbard’s rejection of modernity and his primitive home on the shore of the Ohio River. Price’s marriage dissolved soon after, and the whole family moved to Oregon, where he grew up. Price opted to move alone into a tiny cabin in the woods, then a flophouse, then a teepee, and finally into an underground “Hobbit hole” on a horse pasture near a river, where he still lives. During the winter, he decamps to Hawaii to surf and avoid the harsh weather.

Price’s version of the simple life costs $5,000 a year, which he earns from publishing a wilderness zine and doing odd jobs around Joseph, his eastern Oregon town. “I like being able to do what I want to do,” said Price, who pays $100 a year for his land. “I don’t believe in houses or mortgages. Who in their right mind would spend their lifetime paying for a building they never get to spend time in because they are always working?”

My Money Blog had a good comment on this:

I like being presented with people who make different “opt-out” decisions, even if they are extreme. The article uses terms like “intentional poor” and “voluntary poverty”. Why not just “conscious simplicity”?

…which is a good point. Sometimes we get caught up thinking a certain way and I think stories like this are helpful in realizing that there are other ways to think about things–even if you don’t want to live in a “hobbit hole” for five grand per year.

INTERESTING MAP: I’m pretty good with geography, but I just didn’t know Africa was this big. And speaking of Africa, for a harrowing travelogue I recommend Blood River: The Terrifying Journey Through the World’s Most Dangerous Country, which recounts the author’s brave and probably foolhardy trip down the civil war-ravaged Congo River. It is quite fascinating, though discouraging as well.

(Thanks to TTMYGH and Mediaite for the map.)

- « Previous Page

- 1

- …

- 14

- 15

- 16

- 17

- 18

- …

- 28

- Next Page »

Recent Comments