FREE NIGHT WITH AIRBNB!: Here you go! Up to a $300 value. Mr. Pickles has an idea you may or may not find interesting. [Read more…]

A hearty welcome to Chasing The Points and Big Habitat!

The Saverocity family continues to expand… please check out Chasing The Points and Big Habitat if you haven’t already done so!

A Staples mystery! And the trouble(s) with money orders

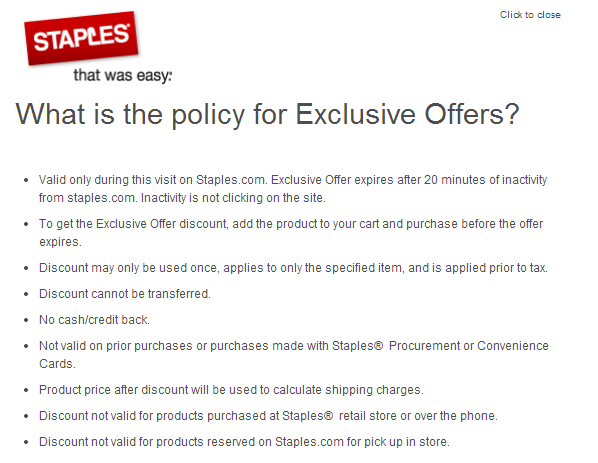

A STAPLES MYSTERY: Chasing The Points reports on a mysterious event that happened while perusing the Staples website: he brought up a Nordstrom gift card, let that tab alone for 15 minutes, and when he came back a message had popped up offering him 5% off that gift card if he bought it in the next 20 minutes. He can’t figure out how (or if) he did something to trigger it, and neither can I. My effort consisted of starting an anonymous browsing session in Chrome, pulling up the gift card, and waiting… but no luck.

INTERESTING ODDBALL STOCK PICK: CIBL, a discounted pile of cash with high optionality. If that title doesn’t grab you, then I don’t know what to say. Nate Tobik, as always, gives us a good read.

EDDIE LAMPERT EMPIRE CRACKING?: My curiosity about the financial health of the Sears empire was piqued several weeks ago when they began offering ridiculously generous bonuses for buying their stuff. Like this one, for example. Or this one, or this one, or this one. I wrote at the time:

I’m starting to suspect Sears’ managers–under pressure from incompetent CEO Eddie Lampert–are making a desperate and ultimately counterproductive attempt to meet their numbers with giveaways, so by all means get in on the action before the inevitable bankruptcy.

Which brings us to a CBS News article today:

Now, a group of clients that came over through Goldman Sachs (GS) have asked Lampert to return the roughly $3.5 million they invested with him in 2007, The Journal reports.

But instead of giving those investors cash back, Lampert is paying them partly with Sears stock. He’s returned some 7.4 million shares to them, in fact. As a result, ESL now only owns 48.4 percent of Sears’ shares, down from 55 percent from as early as October, Bloomberg reports.

So were investors happy to get paid in Sears stock? The answer can be seen in the company’s plummeting share price last week. The stock started a week ago in the $64 range — the day before Lampert disclosed the fund redemptions — and closed Friday at $48. And lurking behind that 25 percent drop is a harsh reality: Many of the investors who get paid in Sears shares will turn around and sell.

So… any other retailers getting a little too generous with their promotions?

MS 101: MilesAbound has an intro to buying money orders with a debit card. It’s quite clear and well-written, and it elicited some good discussion in the comments. World-famous Flyertalk personality Marathon Man writes:

The subject as a whole is not really one, in the opinion of me and many others, that can just be lightly put out there for discussion. There are oh so many things people may or may not know or have seen, and things that I personally would have to include if I ever were to actually write a piece about this subject. But my piece, if I were to write one, and I wont, would be hugely long and drawn out, and so that is one reason to actually avoid the subject.What things, you ask?

For example…

- Ever seen one where the numbers on the tear off recibo do not exactly match the check numbers across the bottom? What would you do with it if you did?

- Do you/others know the process, time and cost to recoup problematic MOs from Moneygram?

- IF–no, rather, WHEN the printer jams or breaks, what’s the standard length of waiting time one must endure to actually walk out of there with their MOs? AND what do you do if your bank actually fails to charge you for the ones you just got?

- What 3 forms do walmarts often make customers get booked in even if we know they shouldn’t and where is this book usually kept?

- Where does your ID info go when they enter it into the system on making you a +$3k purchase?

- What’s the most one single MO transaction can be and what will happen if you go a penny over?

- When the power goes out in the WMT, what is the procedure for recouping MOs that happened to be in process at that exact moment?

- If they try to reverse out a debit charge on a GC vs a debit card?

- WHY do banks really shut you down when you deposit MOs?

- Should you ever mail one? And when?

- Which major bank ATMs take them and which ones do not?

All good questions, and all have something to do with why I don’t bother with some of the more esoteric personal finance practices–it’s a pain. As always, YMMV.

DO YOU HAVE TOO MUCH MONEY?: No worries! Bargaineering has you covered with “Sock of the month club a cool new way to squander money, dignity.” What’s shocking here is not that not just one but a dozen companies offer sock subscriptions. Socks! Since the NYT is now covering this trend, I suppose the hipsters have already cancelled their sock subscriptions and moved on to some other whimsical thing while the huddled masses are getting out their wallets in order to sign up for overpriced socks. I guess we have to buy something different now that cupcakes are old hat, right?

Hot deal: 50% off everything at Neiman Marcus!

I don’t shop at Neiman-Marcus, but I know some of you do and this seemed like a great deal to pass along. If you’re interested, move quickly since it expires around lunch tomorrow. [Read more…]

- « Previous Page

- 1

- …

- 13

- 14

- 15

- 16

- 17

- …

- 28

- Next Page »

Recent Comments