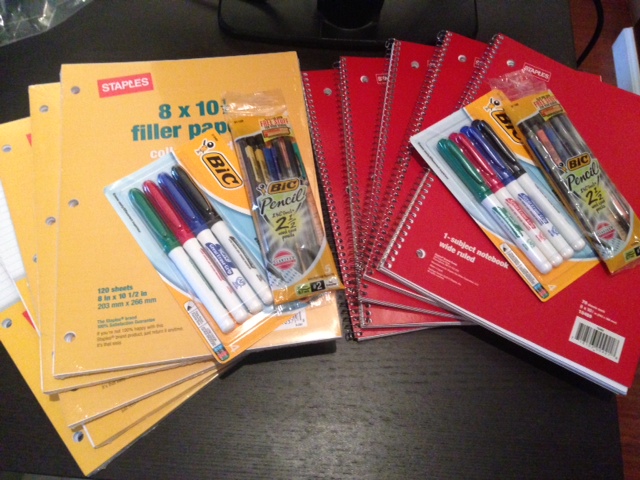

Here is my first installment of items from Staples that you could purchase for a ridiculously low price, and use to build up a collection of useful items that can be donated to the Charity of your choice. As a frequent traveler I do particularly like Pack for a Purpose, but please feel free to consider these items for your local Charities too.

Staples – In store Only, limits apply (you could buy more if you are willing to make multiple transactions, by visiting other stores or on different days. Here are some ideas for this week.

BIC® .7 mm mechanical pencils, 5/pack

Item: 380036 Model: 91188 (2x max per person) 25 Cents Each = $0.50

Staples® filler paper, 8″ x 10.5″, 120 sheets

Item: 772966 Model: 37427F-CC (5x max per person) 1cent each with a $5 purchase = $0.05

Staples® poly cover composition book or 1-subject notebook, 8″ x 10.5″, 70 sheets

Item and Model Various by color. (5x max per person) 75 cents each = $3.75

BIC® Great Erase dry-erase markers, fine tip, assorted, 4/pack

Item: 650249 Model: 31940/GDEP41AST (2 max per person) $1 Each = $2

Total spend = $6:30

The above are valid prices for instore only purchases, and will be there until 8/10. Don’t forget to use the Staples Rewards card to earn 5% back on that, and if you have it, the Ink Bold for 5x Ultimate Rewards too.Let me know if there are any other bargains out there and I will add them to the list.

Note that a lot of credit card offers these days give you 0% on purchases for the first x months–this option can be used as a fee-free BT where you just make your usual credit card purchases but only pay the minimum payment for the promo period. You can then use the freed-up cash to pay down the principal on a loan. Obviously, this carries the same sort of risks as the BT scenario.

So, one caveat I would add is this (and it comes from experience) – once you make a balance transfer to the card (e.g. Chase Slate), Don’t spend another dime on it. Put it in a safe, freeze it in ice, do whatever you need to not to use it. Otherwise you could incur unwanted interest charges as you no longer get the 20+ days of interest free charging b/w charge date and statement closing date.

Great point Trevor – NEVER use the card that has a balance transfer on it, they will stick you for the interest.

Manufacture a 0% loan by paying off last month’s CC bill with this month’s manufactured spend. Requires enough credit line to cover but this is what I do. I have a 4% HELOC but figured why pay 4% interest when I can pay 0% and get the best of both worlds from manufactured spend?

Great stuff! Takes a little skill and plenty of discipline but the benefits are huge if you do this. Thanks for stopping by, I appreciate your comment.

This was easier when Chase was handing out a free $2.5K loan every month on my 4 Chase cards. Still, I do at least 30K of MS each month. Of course, this is very risky without a HELOC to cover since MS options may die and money could get tied up with FR, adverse action, etc.