My two cents.

I’m FINALLY starting to put together plans for this summer’s Camp Mom 2017 and have the first set of internal flights booked. I got 4 $533 tickets from Santiago to Iguazu Falls for 12.5K Skymiles and $30 each. I’m pretty happy with a Skymiles value of 4 cents/mile. (Side note: Joe is right: Delta partner award space is out there waiting to be booked!).

That’s Great: What’s this about a Bonnie Rule?

You guys know I keep it real around here and track how much my adventures cost to share with you at the end. The Bonnie Rule, named after a reader who questioned my math, stipulates that I not only track out of pocket expenses but lost opportunity costs. It’s a really valuable tool to remind me that travel is NOT free.

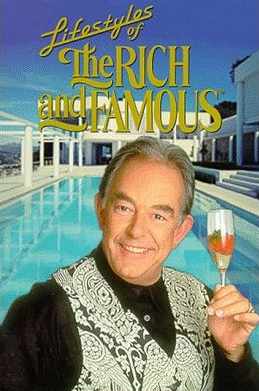

Champagne Wishes and Caviar Dreams

Of the myths surrounding travel hacking I’ve always considered “travel is free” the most dangerous. Vendoming is fun to mock (and engage in from time to time). But I think most people spot pretentious behavior (at least in others) fairly easily and know when to say when.

However selling credit cards while also selling “travel is free” is like selling a bag of tools to a customer who doesn’t understand basic construction. It’s just like ACME selling TNT to Wile E Coyote. You just stand by and wait: eventually he’s gonna blow himself up.

Which credit card should I get next?

Amending the Bonnie Rule

In the original version of the Bonnie Rule I valued the missed opportunity cost of most points at a penny each. I did so because it was what Chase or AMEX would give you if you used them to pay your bill.

However, with Cash Back Being the New Black a penny isn’t a fair value anymore. Cards like the Citi Double Cash, Barclay’s Arrival, US Bank’s Flexperks and others give you a minimum of two cents per dollar in cash equalivent for everyday spend. Therefore the missed opportunity cost has doubled.

A real life example

Let’s return to the tickets I got last night: the cash cost was $533 and the miles cost was 12.5K and $30.

Travel is FREE math: “My $533 tickets were only $30 or 94% off!”

Old Bonnie Rule math: “My $533 tickets were only $155 or 71% off.

New Bonnie Rule math: “My $533 tickets were only $280 or 47% off.

Bonnie Rule math is a lot less sexy, but a lot more real.

And you won’t blow yourself up doing it.

The Deal Mommy is a proud member of the Saverocity network.

Sure, travel isn’t totally “free”, but I like to think of my travel budget as “investing in my happiness”. My kids were impressed with our last Hyatt stay, and my daughter asked me, “Are we rich?” Hardly rich, just had two free hotel nights from a cc sign-up. My family travels at a fraction of the cost for 5-6 vacations a year that most people spend on one. The money could be saved, but I’d much rather spend my time and dollars on experiences my family will always remember.

I understand the new Bonnie rule math but you have to assume you would do as much “activity” (MS n such) on a 2% card as you would a travel rewards card. I know from experience I just wouldn’t because my motivation is MUCH higher when the focus is to build up miles/points that will take my family to places we otherwise wouldn’t go and stay more comfortably than we otherwise would. So for me, the opportunity costs has to be compared to a number less than 2%. Before miles/points I used cash to travel. I had a cash back card but rarely used it.

For others, the 2% guideline is probably 100% true.

Great point. Its remembering that points values are subjective and variable that matters.

Thanks for this post. It alerted me to the possibility of a Delta award to Iguazzu, something that had not occurred to me. Great use of Delta miles.

I find low level partner awards easier to find than actual Delta metal.