Many credit cards offer opportunities to earn miles and points from signups and putting spend on your credit card. So you put your regular—or organic—purchases on your miles and points earning credit card, but if you’re like me, you find that the miles just don’t add up quickly enough for that next planned trip! So what other options do you have? More credit card applications? Paying cash—the terror! Or, you could add non-organic or manufactured spending to your credit card.

What is Manufactured Spending?

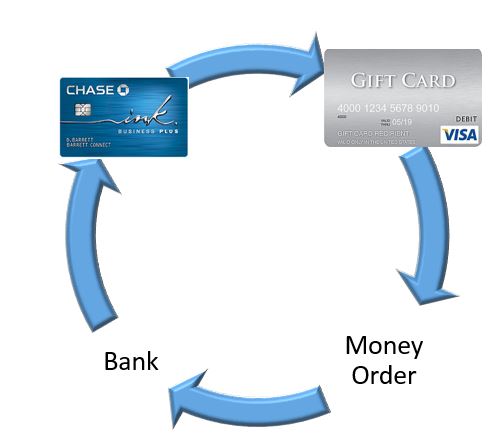

By its very definition, manufactured spending is creating spending, generally on a miles or points earning card for the purposes of generating miles and points at little or no cost.

Manufactured spending has taken on many forms over the past decade or so. In the beginning it meant buying $1 coins from the US Mint, where you bought them at face value, but the US Mint picked up the shipping. Since you were literally buying money, it was as simple as depositing those pristine $1 coins at your bank of choice. Now this wasn’t the US Mint’s intent with offering free shipping, and ultimately the Mint decided to discontinue that practice, thus killing the opportunity.

Since the US Mint, manufactured spending has taken on many forms. The method that propelled Frequent Miler to worldwide fame were with prepaid debit cards. You see we had this trifecta of Birds—well, two birds and a Serve—which history tells us, was a failed attempt of American Express to expand into a new market. First there was Bluebird, a partnership with Walmart, whereby one could load their Bluebird prepaid debit card at any Walmart cashier, or, in some cases, at a Kiosk at the Entrance (otherwise known as Kate). Many miles and point folks loved Kate. You might say that Kate was the girlfriend that helped us turn left when we boarded the plane, to settle into our comfy Lufthansa First Class seat with a nice glass of Champagne.

Thanks Kate!

Then there came Serve, to lesser fanfare, but still very lucrative as you could load Serve online. That’s right, you didn’t need to go to Walmart!. That helped. There were other benefits of Serve too.

Finally, the trifecta of the “Birds,” The Target Redbird. If Greg the Frequent Miler was not a household name before, this certainly changed that. You see, the Target Redbird was everything anyone could have ever wanted in a prepaid card. You could load it at Target with first a Credit Card, then a prepaid Visa Gift Card. It gave you a 5% discount if you used it to purchase things at Target—including Starbucks! You could transfer the balance to a bank account or directly pay a credit card! There were even some other cool, yet shorter lived features. This was the pinnacle of easy, low hanging fruit manufactured spending. Yes you were limited to $5,000 per month per card, but you were only limited by your imagination as to how many redbirds you could get!

Then, one day, Redbird died. I opined that there was still life in Manufactured Spending (read: Redbird is Dead, Back to Basics), which unfortunately is where we are now.

You can still generate many thousands of miles and points by purchasing Visa Gift Cards and other similar instruments. You just have to work harder in liquidating or converting those Visa Gift Cards into cold hard cash. The costs to achieving that liquidation have also increased over and above the prepaid Redbird cost.

Is it still achievable? Of course, but it takes time, patience, and in some cases, a lot of experimenting and trial and error.

A word of warning with Manufactured Spending

While manufactured spending is completely legal, there are some aspects that can put you in the gray area. One area in specific is how you deposit those money orders into your bank account. Structuring those deposits to avoid federal reporting requirements, should be avoided at all costs. Structuring is the practice of intentionally depositing less than $10,000 in monetary instruments or cash, in a reporting period or single transaction. There are varying interpretations of what constitutes structuring. Some will argue that depositing Money Orders doesn’t result in required federal reporting. I won’t argue the point, I will just say this: Don’t Structure.

Wrapping Up

Manufactured Spending is a great way to increase your miles and points balances. It takes work, don’t think that it doesn’t. Is it worth the time? I tend to think so. Consider it this way, miles and points are essentially a discount. They still have a cost. Visa Gift Cards have an activation fee cost (e.g. $6.95), Money Orders have a cost, your time has a cost. So consider all of those factors, and decide for yourself if its worth it. Often times, if you are traveling in premium cabins, that cost is worthwhile. Why? Because the marginal cost between an premium cabin cost on miles as compared to paying outright for that premium cabin ticket can often be very significant.

So blue arrows instead of red arrows… coolio.

Cheers,

PedroNY

@Pedro – have to switch it up every so often!

I am somewhat confused now…”Structuring is the practice of intentionally depositing less than $10,000 in monetary instruments or cash, in a reporting period”…I am only doing between $7000-$1000 a month, so that’s what I deposit in a “reported period” (a month). How could this constitute structuring??

@T – the perception is that you might be trying to avoid reporting requirements. My recommendation is that if you are only doing ~$10k a month – maybe consider rolling it? e.g. instead of depositing ever 4 weeks, accumulate over $10k and deposit every 5 weeks. or something like that.

If you’re not doing it so as to avoid triggering a bank report, it’s not structuring. However, if you consistently deposit amounts slightly under $10K it can create an appearance of structuring, even if you’re doing absolutely nothing wrong, and the feds can seize your assets. For example:

http://www.huffingtonpost.com/entry/irs-structuring-civil-asset-forfeiture_us_573b908de4b0aee7b8e83ae3

After some negative coverage of this sort of thing the IRS loosened up its policy a bit:

https://www.irs.gov/uac/newsroom/new-irs-special-procedure-to-allow-property-owners-to-request-return-of-property-funds-in-specific-structuring-cases

Unfortunately, I don’t think there’s s great answer on how to handle this from an MS perspective. The odds of anything happening are pretty low, it seems. I’ve never heard of anybody getting caught up in this for MSing, but that doesn’t mean it’s never happened / never will happen.

I thought it was April 1st for a second.

Pingback: Introduction to Today's Manufactured Spend: at Sea Edition - Saverocity Travel

FWIW, the first time I deposited $10K at my bank, I made sure to do it in person, inside. The best way to avoid being suspected of structuring is to go out of your way to be open about your deposits.

Good article.. thanks!

Re:Money Orders

Would it be best to use them as payments on your credit card bills…

rather than just depositing into your bank account?

I where can I obtain money orders that are purchased via Debit Gift Cards?

Thanks!

@Michael, I spoke at a high level in the post, but really it varies based on your level; Walmart is the most prevalent, but please, don’t ask if you can use Debit gift cards; really you just want to be able to use PIN enabled debit cards.

Pingback: Priority Pass cards, United Devaluation, Wrong Journalists, 5/24 Rule - Tagging Miles

Why would you post this drivel?

Banks closed my accounts for this exact activity.

@HoG, Interesting, what kind of numbers were you doing, if you don’t mind my asking? Each bank seems to be different, too, which I also find interesting as data points.

Pingback: Reselling, the next frontier for Manufactured Spending - Tagging Miles

You could see the typical response time, the proportion of unsuccessful queries, and more. This service is very worthwhile, despite the cost. https://jokersstash.net/

You’ve provided some great information and how-to’s on how to run a blog, rescator forum.