This is perhaps a rhetorical question. After all, miles and points are currencies, but they are very finicky currencies. Meaning, their value can change at the whim of an airline or bank. In fact, some currencies, such as the transferable Ultimate Rewards Points, Membership Rewards, Thank-You Points, and even Starwood Preferred Guest, are all at risk from being “devalued” by an airline or hotel chain, that they effectively have no control over.

Why now?

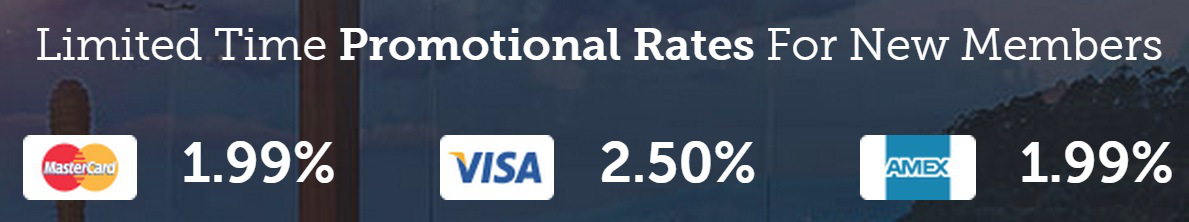

Plastiq Limited Time Offer Rate (Courtesy of (I hope!) View From the Wing).

There are a handful of ways you could value points, to keep things simple, here are the ones I’m considering for this post:

- Cost of Acquisition

- Redemption value

- Fair Trading Price (Courtesy of Frequent Miler)

- Flat rate

- Voodoo Math

Cost of Acquisition

This is easy, and does not incorporate the opportunity cost of assuming 2% as the base. It is as simple as taking your cost of acquisition, divided by the number of miles that you are accumulating. Example, you spend $206.95 for a Visa Gift Card from Staples with your Ink Plus, and load $200 onto your RedBird, then you’ve paid $6.95 for 1,000 UR points, or $0.00695 per point.

The skeptics of you may highlight the fact that I wrote about this in the past.

Redemption Value

Flat Rate

Voodoo Math

I call this Voodoo Math, because it includes a variety of factors, and I’m not entirely certain that I even know all of them. For example, One Mile at a Time’s Points Valuations don’t really include any notes, so its hard to figure out how he comes to these numbers. The Points Guy offers his valuations monthly (and for once, I agree with him, because these things do change quickly). Gary perhaps offers the most clear justification and background discussion of points values, but nonetheless offers his own. I wish I could find others, but the fact is, when I read valuations like this, I think a couple things:

- These generally incorporate logical benefits like SPG’s 25% benefit when transferring to other programs (like American Airlines)

- These can be further bolstered to justify annual fees, or otherwise market credit cards.

- These can also incorporate personal biases, e.g. I really want to fly Korean Air First so Ultimate Rewards points are more valuable now.

Now I realize my second point is harsh, but why else would you attribute a value to points, other than perhaps a Fair Trading Price? Because you want to show that one particular credit card is better than another, and it is worth a hard pull. Don’t get me wrong, I apply for a bunch of credit cards each year, however I just have to be skeptical, and would advise others to be skeptical. Let’s circle back to Gary’s post:

As long as you’re using the Everyday Preferred card at least 30 times a month for purchases, it’ll earn at least 1.5 points per dollar on all of your spend. And I value Membership Rewards points at 1.8 cents apiece. So each dollar spent on the card, earning 1.5 points, gets you a 2.7% rate of return.. and a cost through this service of 1.99%. Profit. – Excerpt from View from the Wing

Here’s my concern: Gary is attributing a value, a value of 1.8 cents per Membership Rewards point, and thus asserting that even paying 1.99% you can generate a profit. In all fairness, he offers his logic in the underlined section, but I still have difficulty with the word profit, given how quickly miles and points can change in value.

I too even use Voodoo Math for my personal valuations when I make the quick determination of which card to use for a particular transaction, although that’s more because of that third bullet, based on which particular award I see myself doing next.

The biggest challenge I see with the voodoo math approach is the fact that today I might think UR points are more valuable than say Membership Rewards, however, tomorrow Korean Air or United might devalue their program, leading me to have accumulated all of these UR points for a goal line that has effectively moved another 10 yards, or to another zip code (e.g. United increasing awards by nearly 2x in some cases…there’s a multiplier that I don’t like).

Wrapping Up

There are tons of ways to value your points. Is one way better than another? I can’t say, but, the real point is, to be conscious of how others value their points, and how you value your points, so that everyone can speak the same language.

How do you value your miles and points?

I don’t buy points at all, but I do have an idea of what they’re worth which I use to evaluate redemption options and which credit card I’ll use for spending. I actually agree with The Points Guy’s valuations for the most part. However, I wouldn’t pay my mortgage through Plastiq using my SPG card just because I “value” them at 2.4cpp.

Great points. I find that I’ll buy points to top off an award (e.g. buying Alaska miles for an Emirates award), but yeah, the idea of paying a mortgage and incurring that kind’ve cost seems counter productive.

Then I would argue you don’t actually value them at 2.4cpp

If you truly value them at 2.4 cents, you should be thrilled to pay 2 cents to acquire them. That’s getting them for 16% off.

That’s not entirely true though. How many things are you passing up every day at a 16% discount. If you have an award to book that day, he might be super happy to pay 16% off, but speculatively buying them for some unknown redemption sometime in the future is an entirely different thing. No one has tried to explicitely put a value on the risk incurred.

So true! Regardless of your valuation of points, your present circumstances clearly impact your decision.

Buy AGC when they’re 2.25% back, then use that to pay mortgage. Earn pts on the initial card.

Pingback: How I Value a Mile (or a Point) | Points are King

Pingback: Electronics Ban, 2.5% Cashback is the new floor, Farewell to Virgin America - Tagging Miles