Noah found this great nearly 7% CD through NRL Federal Credit Union. You might even be able to fund it with a credit card.

Its awesome. Don’t get me wrong. If I had infinite float, it’d be a no brainer. In fact, if I had the time to MS (which can thus turn into infinite float), I’d be jumping in. However, I’m not sure that I will jump on ths.

So the details, pulling from Noah are pretty simple:

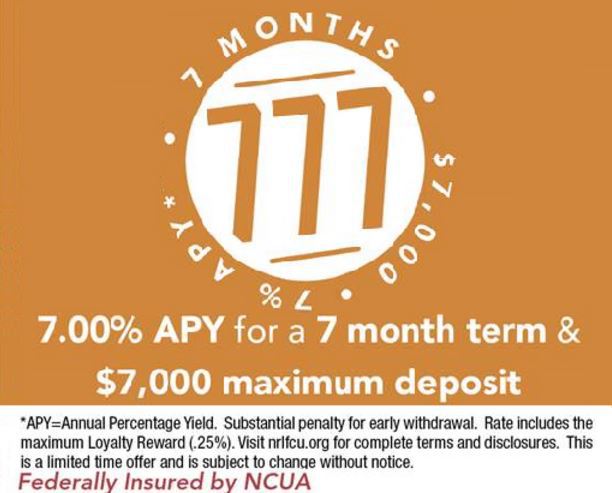

NRL 7%, 7 Month, $7k CD offer

As an #avgeek I love this! why? Because: 777! Ok, that aside. Noah does a great breakdown on this deal. In fact, he estimates the rough return for tying up $7,000 for 7 months as $281.

If I’m doing my math right (and I’m writing this on a Saturday night, after pulling a redeye home from Las Vegas), that’s roughly a 4% ROI. When I resell, 4% wouldn’t even factor in. I suppose you could look at this CD as 4% ROI without any risk.

Factoring in Opportunity Cost

Normally when I resell, I’m looking for a floor of 25% ROI. So rough calculations (again, jetlagged math), seems to tell me that the opportunity cost is roughly 21%. I could be further off, because I’m just looking at 4% guaranteed ROI, vs. 25% ROI as a “goal” from reselling. In reality, I could do worse, or I could do better. But, lets just calculate that in real dollars, as far as what that opportunity cost could be based on a one time event: 21% of $7,000 = $1,470.

As Emeril Lagasse likes to say – lets kick it up a notch. My normal “velocity of sales” is better than 7 months. When I’m really good with product choice, its less than a month, but a month is a nice even number. So, now, I have $7,000 that I could put into a CD at $281, or, if I’m really good with my product selection, I could in theory convert that $7,000 into product and sell – rinse and repeat 7 times. Now from a reselling standpoint, I’m looking at roughly $10,290, if I’m really on my game.

Wrapping Up

So, if I understand this promotion correctly, its $281 for the CD, and somewhere north of $10,000 if I invest that money into reselling. Now, in theory, if you have infinite resources, or, at least have more float then you have the ability to procure products for resell, this could be an ok deal, but it commits you for 7 months, when there might be something better. Don’t get me wrong, a 7% risk free return is great. If I could put the entirety of my Roth IRA into that for the next 7 months (especially considering the election), I totally would, but, at a max of $7,000, the possible return is so limited that, I would argue, you must consider alternative options. I’ll offer one final counter point: While reselling could generate ~36x the return, there is a greater time commitment. That $7,000 in a CD is pretty much passive income, so you’re saving a lot more time. I still think, 36x is pretty impressive… it even exceeds the best cashback or miles/points return from eBags (which has historically had some high multipliers!).

So, are you sold on the 7% CD? Or will you utilize $7,000 of float (assuming you have that) differently? If so, how?

Given that it’s a CD and therefore about saving and investing, I will be looking into this as a resting place for part of my emergency fund. Or maybe not, since I just ravaged it to deal with replacing 70% of my floors due to mold.

@MMKate – Fair point, could be a different pot of money focused on saving rather than miles/points/reselling focused. Sorry to hear about the floors!

I think we’re comparing apples and oranges here, active vs. passive gains, reselling float vs. an emergency fund, etc.

Don’t you have some kind of cash buffer or emergency fund that you specifically choose not to invest in your reselling? That’s the kind of money that I would use for risk-free ~7% gains because it would otherwise be sitting in a lower yielding account. This CD promotion is a good alternative for the same people that get excited about 3-5% savings accounts, not for those entrepreneurial-types that are seeking to maximize returns in a more active way.

I agree it doesn’t make sense to pull money out of an active business for ~7% APY if you’re getting a lot better return than that.

@Noah – not apples and oranges when that 7 months includes Q4… Its the time when most folks even take out loans to maximize. There’s a reason they call it Black Friday for retailers (aka when retailers make it into the Black — ironically, 11 months in). That said, resellers should be in the black far earlier. But with so much opportunity, you want to have everything possible liquid. At least that’s my argument.

That said – my argument was if you have $7,000 – no color of money, no distinction.

I may have underestimated how close to the edge resellers are going with their capital, especially to the point of taking out loans to afford more merchandise. At some point you have to run out of reselling opportunities or time and have excess cash right?

With your 25% ROI goal and the 1 month average turnaround from the post, you should be doubling your business’s money every ~3.1 months, but let’s round up to 4 to be conservative. That means you should end any given year with 8x the amount of money you started with. Even starting with a measly $1,000, you should have a multi-million dollar reselling business within 4 years!!! (assuming all profits are reinvested in the business)

Unless that describes the track you’re on, there has to be a bottle-neck somewhere. I would guess either the amount of profitable items available or your personal velocity limit given how much time you have to invest in reselling. Both of which should cause excess cash availability that should only grow over time. At that point, you can either attempt to ramp up the reselling by outsourcing some of the effort in various ways or look for alternative places to put that excess cash such as index funds or this 7% CD.

Given the opportunity cost you laid out in the post (7% APY vs. 245% APY), something doesn’t seem to be adding up here. If you’re really generating that kind of ROI consistently AND running into cash-flow problems, myself and I’m sure a bunch of others would be happy to invest in your growing business for a small cut.

@Noah – Time is finite, as I’ve spoken about before. Besides, working for investors on a side gig seems like it’d be more stress than fun.

That’s my point.

You laid out two options in your post:

1. Invest $7k in a ~7% CD for 7 months and profit $281

OR

2. Start/Expand a reselling business, flip $49,000 worth of merchandise in 7 months, and profit over $10k

I don’t think these two choices are even in the same ballpark for the majority of people. A successful reseller like yourself is already at a velocity limit because “Time is finite”, so reselling another $7k per month on top isn’t a realistic option. Someone who has never been a reseller probably can’t flip anywhere near that volume or get that return just starting out. Who does this choice apply to other than a small subset who are just starting reselling and are cash-flow limited at the moment?

I digress though, I’m just not sure who the target audience was for the point you made. Just for fun, to exaggerate your premise a bit:

“Instead of signing up for another credit card and earning a measly 50k miles, why not spend your time becoming the next Elon Musk and starting hugely successful businesses? The profits are way better!”

Have a couple of kids guys and parking 7K at 7% will look amazing

@Joe – Then by all means! Enjoy that cool $281! Besides, you don’t resell, so your opportunity cost may be less.

Reselling is my day job and I’m thrilled to learn about a CD like this. No different than free money or a ” high interest” bank account. Sure, it’s tempting to see the returns you get reselling and think about reinvesting all the profits. You need to be able to separate investments from speculations. Reselling is a fickle business and past performance is no guarantee of future returns! You have a Roth IRA, why don’t you want a CD? Investment money should be different than seed money. Each has a purpose and there is a risk/reward trade off.

If you only have float to invest in either one or the other, you’re taking a big risk with reselling. If you meant a limited amount of capital or seed money, it still pays to keep powder dry.

Borrowing from a HELOC would be a good way to raise the ROI, yes?

@Nick – Could be – I’m not a huge fan of that idea though.. Could just be my lack of comfort with HELOCs, could be the experience of going through the 2007 Bubble/Burst.