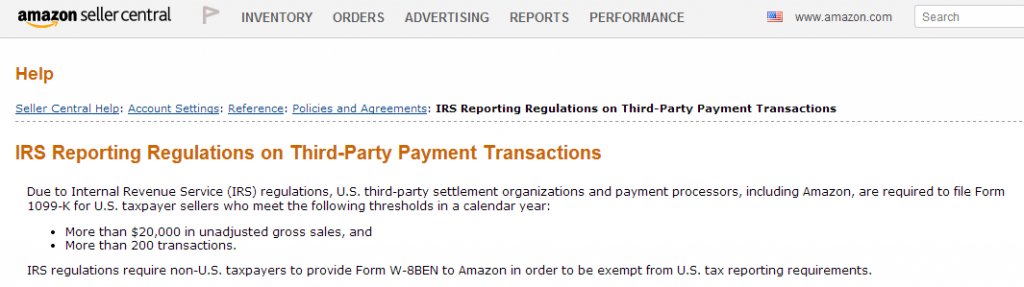

Update: In my haste to post this before I boarded a plane, I mis-typed; the 1099 is generated from $20,000 AND 200 transactions.

Amazon.com for lack of a better way to describe it, is a veritable powerhouse for manufactured spending. Some of Amazon’s services are very far out there in the blogosphere, with many of the nitty-gritty details, right down to your circles and arrows. Others aren’t. Here are the services that I either use or find to be useful for MS.

This topic has been hammered, so I’ll be short here: You can send up to $1,000 per month as an Amazon Payment – always select “goods/services” and avoid Citi Cards which can result in a cash advance fee. There are other aspects to be concerned about, such as the potential of getting shut down. If you do this, first, use Amazon Payments for legitimate reasons (e.g. paying a friend for purchasing an airline ticket for you, or your rent, etc.), or, make sure that both accounts aren’t linked to the same bank accounts. Avoid A-B-A type circuits, or operating two accounts from the same IP address. You can–and should–research more on Amazon Payments on FlyerTalk.

Also see below the risks, as all components roll-up to the tax liability/1099-K risk.

Finally, I’ve gone through a couple of Amazon’s Annual Reports / 10-K’s, and can’t identify how it is that Amazon accounts for the fees from Amazon Payments. It looks like this falls under “Services” or “Cost of Sales.” The services component’s revenue continues to grow a few percentage points a year. Cost of Sales varies, but also includes things like Shipping, Payment Processing, etc. Either way, it looks like even though this may be a “loss” or “expense” for them, they are covering it by providing payment processing to businesses.

This is where I spend most of my non-pure Manufactured Spending efforts. The simple premise with selling on Amazon is that you can sell products on Amazon just like eBay, however if you pay a little more (e.g. earn a little lower margin) you can ship your products to one of Amazon’s fulfillment centers, and when your product sells, they do all the work. I really quite like the set up. I really enjoy getting e-mails from Amazon saying that they’ve shipped another product.

FrequentMiler has a slightly dated “intro” to FBA. I’m currently working on a more detailed post outlining some of the pitfalls. For example, I’m hearing more and more that we might soon need to move to collecting sales taxes at least in the states that products reside (e.g. the fulfillment centers that we send products to). I’m not a tax professional, but I am working with a tax professional and hope to have more on that by early or mid-October.

Amazon Local Register is Amazon’s latest tool out there for processing spending. Ostensibly, it is Amazon’s attempt to get into brick and mortar stores, however it could, in theory be used to generate miles and points at a 1.75 cent cost per point. Scott talks more about it as a potential manufactured spend tool. Note, this service includes a 1.75% (which is how it comes out to be a 1.75 cent cost per point) transaction fee, so you’re already looking at a mitigated return.

The Risks

It’s well documented that if you have more than 200 transactions or $20,000 received (it doesn’t appear you get dinged for sending money via Amazon Payments for example), with Amazon Payments you will receive a 1099-K. If you generate more than $20,000 in revenue and have 200 transactions with FBA, you will receive a 1099-K.

Fat Wallet Forums has a bunch of information on this as well. It all rolls up to, so far as I can tell, a combined 200 transactions, and $20,000 revenue / received funds via Amazon will get you an unwanted tax form to fill out. If you are going to push it, I highly recommend that your tax filings are air tight, such that you can endure the additional scrutiny. Note: I am not a tax professional.

Pulling it all together

The greatest benefits of using Amazon’s services is that most can be done from the comfort of your own home. If you simply leverage these services (sans Fulfillment by Amazon) shy of the $20,000 / 200 transaction combined–across Amazon Payments, Amazon Local Register and Fulfillment by Amazon–threshold, they you can still do well enough to meet most minimum spend targets, if you’re judicious in your use of other manufactured techniques. All told, Amazon’s upside is great, but while it may seem limitless, the headaches can increase as you scale.

Seems like the Fulfillment by Amazon screenie, the Amazon Payments help files (though I 404ed a lot there), and most importantly the IRS documentation itself, are all pretty clear that it is 200+ transactions AND $20,000+, not OR.

This makes a big difference.

@Miles and @Paul – Yes, you are correct, I have updated the post.

@Miles, I was wondering why Tagging Miles continually changed AND to OR. I hope they do not know something the rest of us do not. In all the documentation I have seen from Amazon, it is an AND statement.

Do you know if your Amazon Local Register and Amazon Payments account are accrued in the IRS filing? I read that Amazon does not combine them, but that source was not from Amazon.

My read is that ALR and AP are both through the AP account, so accrued as one. At least, that is how I interpret this: http://localregister.amazon.com/help/201551330/tax-information

My read is that ALR and AP are both through the AP account, so accrued as one. At least, that is how I interpret this: http://localregister.amazon.com/help/201551330/tax-information

Trevor – you need to have a better grasp of the details before you write these posts.

@P – I’ve updated the post.

As an aside, it is worth noting that regardless of 1099, if you make profit from a business, which would include reselling on Amazon/eBay etc then you need to declare that as income.

@Matt, Agreed. My point was more that, if you’re trying to use AP and ALR for manufactured spend, you might have additional explaining to do. A legitimate business is understood to have to be declared. Point though though, about FBA, is that there is more stirrings of needing to charge sales tax where one has nexus (e.g. the fulfillment centers one sends products too). I’m still exploring this, but it has the potential to become a headache for sure.

@Trevor, that piece of information from Amazon is interesting. Based on that, I am now wondering why I did not receive a 1099 from Amazon last year.

@Paul, Hmm, how much did you “earn”?

I had around 22K in sales last year on FBA. It is a little work as you need to keep a file of what you paid for items and what you profited lets all hope I did it right.

Is it 200 sales or 200 transactions? Do transactions include things like the costs you pay Amazon (shipping, referrals, packing, prep)?

@Ted – Hi Ted – thanks for your comment! Its 200 sales. The Amazon fees don’t count against getting the tax form, so far as I can tell on my form.

You’ve just given me the info I was searching for. Has anyone ever wondered how to fill out forms online? I have, and found a simple service. BTW, there is an online service through which you can fill out a DS-2003, the fillable blank is here

https://goo.gl/PyB2UX.