I don’t care what anybody says or how much money affiliate bloggers are making from it, I think the new Citi Double Cash is great for credit card consumers.

Recently Drew at Travel Is Free lambasted this card as well as some others. I love Travel Is Free, I think it’s one of the best blogs out there, but Drew was (and remains) completely wrong about this card. Let’s go through the virtues:

- It’s 2% cash back

- There is no annual fee

And that’s it! Do you know how many major issuers (JCB Marukai doesn’t count) have 2% cash back cards with no annual fee? One! I’m talking about the Fidelity Amex, of course, but you know that already. It’s been praised by many bloggers, myself included, as one of the best cards out there.

But there’s no pleasing everybody. Travel Is Free writes, “This card sucks. Why are we even discussing it?” Let’s go through TIF’s points one by one and explain why this is a good card:

It doesn’t even have a sign up bonus.

So what? You know what other card didn’t have a sign-up bonus? The Best Buy credit card, and that thing was freakin’ awesome for a while.

The Barclay Arrival Plus comes with $400 via 40,000 points and you earn more value per dollar.

It also has an annual fee, and you have to use the money on travel. Some of us value 2% cash more than 2.2% that has to be used on travel.

I can’t imagine a universe where I would get this card, and I can’t even imagine a scenario where I would ever use it.

How about a universe where the Fido Amex and Arrival Plus are discontinued and where retailers tighten up on letting you buy stuff with a 5% bonus card?

And no other blogger is getting it (unless they are doing very very highe dollars with, no cat bonus, and don’t already have a 2% back card)

Lots of bloggers are getting it, myself included. Citi informs me I’ll be able to convert an existing card on September 7. And I’m not doing very high dollars with no category bonus, and I already do have a 2% cash back card.

This is the Cap1 Venture card with no bonus.

Wrong on two counts. The Venture card has a $59 annual fee, and the rewards are not cash, they are “miles”.

Here’s why it really sucks: If I’m MSing, I’ll 5x that sucker at any grocery, office, gas station, etc… If I’m buying travel, I could at least 3x it and maybe more with that airline or hotel’s particular card.

Yes, that’s why it really sucks… for Drew. But there are plenty of us who don’t do the 5X everywhere game. Drew is committing what’s known as the Christopher Elliott fallacy, where one falsely concludes that because something is wrong for him, it is wrong for everybody else.

Doctor of Credit has a pretty good write-up on the card, where he points out that it may be worth waiting to see if a bonus is offered. Good point! I’ll be doing a conversion from an existing Citi card since I doubt that there will be much of a sign-up bonus, but to each his own.

If you have an unused Citi card in your sock drawer, you might want to think about converting it to the Double Cash. 2% cards don’t grow on trees and they tend to get discontinued periodically (e.g. the Priceline Visa), so it’s good to get in before the plug gets pulled. I don’t think Citi would pull the plug on this any time soon, so there’s no rush.

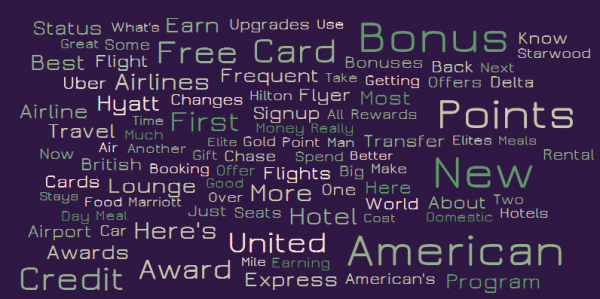

BOARDINGAREA.COM WORD CLOUDS: Recently Travel Blogger Buzz linked to a Flyertalk kerfuffle between him and Wandering Aramean. The friendly, cordial discussion is more of an inside baseball type of thing, but what was interesting was Seth posted article titles from the past three months for both View From The Wing and One Mile At A Time. I decided to create word clouds from the results just for the heck of it. Here’s VFTW:

What can we conclude from this? My conclusion is that word clouds are cool, and I wish somebody would post all the titles to my posts in one place so I could make my own.

What can we conclude from this? My conclusion is that word clouds are cool, and I wish somebody would post all the titles to my posts in one place so I could make my own.

If you read the T&C here (https://www.accountonline.com/ACQ/DisplayTerms?sc=4T5Z4484815D111111W&app=UNSOL&siteId=CB&langId=EN&BUS_TYP_CD=CONSUMER&DOWNSELL_LEVEL=2&BALCON_SC=&B=M&DOWNSELL_BRANDS=M,M,&DownsellSourceCode1=4T5Z5494815D111111W&B1=M&DownsellSourceCode2=4T5Z64A4815D111111W&B2=M&t=t&d=&uc=D8H), the card is not that great.

If you’re using the card for MS, you notice that they they have this line: You will also earn 1% cash back on payments you make that appear on your current month’s billing statement as long as the amount paid is at least the Minimum Payment Due that is printed on your billing statement and there is a balance in the Purchase Tracker. The balance in the Purchase Tracker is reduced by eligible payments you make. When the Purchase Tracker reaches $0, you won’t earn cash back on payments until more eligible purchases are made.

So if you MS the card and pay the balance off before the due date, you won’t earn that second 1%.

Fine print seems to say it is only 1% back if you do not run a balance.

Your blog is great, thanks Nick.

As to the new Citi card, my understanding is it’s not yet been determined whether you can obtain points on intra-statement balances (i.e., balances cleared before the card posts at the end of the month). That could be a problem.

That’s what I thought too. This card is definitely not fro MS. In fact, it’s design for non MS purpose. Only good for PC from other fees-based CCC.

I’m staying away because I don’t need to be dealing with the fine print on the 1% at purchase + 1% at payment. I don’t want to play games with balances posting in a “purchase tracker” before I can pay them for the 2nd half of the bonus. I’d be right there with you if the Fidelity Amex was no longer available, but while it lasts I really don’t need both.

I don’t even remember the last time I made a non-category bonus purchase where Amex wasn’t accepted. Maybe my car registration? I can put that on a gift card though. I mean, my daughter’s day care takes Amex and it’s a non-profit.

I get that it’s not a one or the other proposition, but I also don’t need another card just because it exists.

You have to be extremely disciplined if you want to maximize the MS opportunities with this one. It’s never easy to change behaviour and keep track of everything. Still, it’s better than a hole in the head. I’m cautiously “thrilled”

???

Drew is correct for the vast majority of people who read his (and your) blog (ie, people interested in traveling).

The Arrival’s sign up bonus and higher earn rate make it significantly better card than the Citi.

As for the ridiculous “advantage” of not having an annual fee, it’s a red herring argument as Barclays is very liberal in waiving AF as a retention bonus (as you should know).

I will likely convert one of my Citi TY cards to the 2% (assuming I can do that), but I’d never waste a hard pull on such a card.

Most people can do much better than 2% for everyday spend by playing the 5% everywhere game. And if you’re too lazy/stupid to do that, then the no-bonus Citi 2% is perfect for you as you are clueless …

I think sign-up bonuses matter, and I think you have to reckon with Matt’s take on the potential pitfalls of the card.

On bonuses mattering:

1. The Arrival’s bonus means that Citi only beats it after three/four years.

2. If I’m looking to add another Citi card, there are extra AA miles and Hilton/TY points that I can get, and then discard the card. That sign-up bonus (admittedly with a hard pull) will pay more than 1%, which I can combine with a 1.25%-1.5% cash back card for non-bonused spending.

3. If I’m looking to keep a Citi card alive, I can get my annual fee waived as a retention offer. (Citi does this the moment you call in and sneeze over the phone.) Or I can transfer to a Citi Dividend Pref, and go hog-wild on MS in a special category (up to $6K spend) in only one out of the four quarters (or divided across quarters).

On a separate note from the new Citi card, @PF Digest, you’ve found all these online altercations and they’re quite entertaining to follow!

Probably should’ve made in clearer in my original post, but I think most peoples best bet is to downgrade an existing Citi card rather than wait for a sign up bonus to come along. I was just saying that it might be worth waiting for a sign up bonus for those thinking about applying for the card directly.

If you’re doing a large amount of MS, then chances are this isn’t going to be extremely useful for you. How useful it is is going to depend on how the purchase tracker works, I’ve seen it interpreted in two different ways so far and there is endless debate on which one is correct. I’m personally happy to just wait a few weeks to see what actually happens in the real world.

If an esteemed expert such as yourself admits to the many caveats associated with this card, and is taking a “wait and see” approach, why on earth would you criticize Drew for saying this card sucks for both newbies and seasoned players? Yeah, it might be good for a downgrade play on an existing citi card at AF time, but how many newbies are facing that situation?

And lets not get into a foolish debate about the definition of “sucks!”

If you’re a newbie, there’s a good chance this card is going to be better for you than whatever you’re currently using.

That’s a “lesser of two evils” kind of response. Lame, IMHO. I would think that a blogger whose mission is to educate folks on making good personal financial decisions would advise a newbie to go with a tried and true cb card like Fidelity or Arrival over one with unclear, perhaps deceptive T&Cs.

No offence, but you obviously didn’t bother to read my post or my comments on Drew’s post. I was critical of Drew not mentioning it as a downgrade option, because frankly it is a good downgrade option for people with Citi cards.

I also stated that I was going to be sticking to my AmEx fidelity because I liked the flexibility of using the points for travel rather than cashback (they are BoA worldpoints).

There is absolutely nothing wrong with taking a wait and see approach with a new product, in fact I see very little reason NOT to do so unless it’s a product you think will be taken away (which makes little sense when it comes to credit cards).

I don’t think any of the cards Drew listed sucked, I think most of them have very limited appeal and I’ve said as much when I’ve blogged about them. If you want to see cards that really suck, you should spend a little more time looking at some of the secured products currently on the market.

Seems the Citi reps aren’t being allowed to convert annual fee cards to this yet, despite many calls from customers to do this, according to the rep I talked to.

Completely agree. a 2% card with no annual fee is just unheard of (non Amex) these days. So this can be great for people who don’t want to carry around prepaid cards for all expenses.

They told me it would be possible September 7, and I think Doctor of Credit heard the same thing.

Okay, so I’m going to enter this debate with a Cashback card I haven’t seen anyone mention.

I was targeted, applied for, and received a Capital One Spark Card for Business which includes 2% across the board (no minimum to cash out), a $500 Cash bonus after $4500 in minimum spend, and NO ANNUAL FEE.

Yes, that is right, I am claiming that I received a targeted version of a card that doesn’t just have a bigger bonus, but has in fact a different annual fee structure – $0 versus $59.

So someone please tell me if there is a better non category cashback card out there. In my mind, this one beats all of those mentioned: Amex Fidelity, Citi, and Barclays hands down…

So you’re saying the fee isn’t just waived the first year, it’s $0 forever, or at least until COF changes the T&Cs? If so, that’s a great offer! The current offer is $0 the first year, $59 thereafter, with a $250 bonus plus $50 for an AU.

Yes, that is exactly what I’m saying. I had to check and recheck, but all the documentation I’ve received just says $0 Annual Fee.